Real Estate Forms

Are you buying or selling real estate? When you purchase one of our template Real Estate Forms, you get a convenient ready-made product that saves you money on costly legal fees.

- Standardized forms for residential or commercial real estate property.

- Downloadable, customizable, fill-in-the-blank templates.

- Country, state, and province specific legal forms.

- Offers, real estate purchase and sale contracts, For Sale by Owner packages.

- Title deeds and conveyancing forms.

- Realtor and broker listing contracts.

- Forms updated regularly to comply with changes to laws and regulations.

Sort by

Display

per page

Pennsylvania Warranty Deed for Joint Ownership

Transfer ownership of a PA real estate property from two sellers to two buyers with this Pennsylvania Warranty Deed for joint ownership.

The buyers will own the property as joint tenants with rights of survivorship. This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.The sellers (grantors) covenant to the buyers (grantees) that:

- the grantors have good and marketable title to the property,

- the grantors have the legal right and power to transfer the title, and

- that they will forever defend the grantees' right to possession of the property.

$6.29

Pennsylvania Warranty Deed Form

Transfer title to a Pennsylvania real estate property from a seller to a buyer with this easy-to-use Pennsylvania Warranty Deed form.

The seller (the grantor) gives the buyer (the grantee) the following covenants:- that the grantor has good and marketable title to the property,

- that the grantor has the legal right and authority to transfer the title to the buyer, and

- that the grantor will forever defend the right of the grantee to possess the property.

$6.29

Project Development Agreement for Commercial Retail Building

Prepare a Project Development Agreement for a Commercial Retail Project with this ready-made template.

- The agreement is between the owner of the project lands and the developer, with respect to construction and development of a commercial and retail project on the lands.

- The developer is named as construction and development manager of the project.

- The manager's duties include negotiating architectural, engineering and construction contracts and sub-contracts.

- The manager is responsible for obtaining all necessary insurance, permits and licenses, and arranging financing.

- The manager will also manage construction and leasing, coordinate advertising, receive all revenues from the project and pay all liabilities.

- This template is available as a fully editable MS Word download.

$39.99

Protect Your Family From Lead in Your Home Pamphlet | USA

Protect Your Family from Lead in Your Home is a 14-page booklet published by the U.S. Federal Government to protect consumers from lead paint poisoning.

- The brochure outlines the risks to your family's health from lead-based paint, which was in use prior to 1978.

- If you are buying or renting an older home, this information could be vital to you and your loved ones.

- The brochure must be provided by a landlord to all tenants that are renting any property that was built before 1978.

- This is a joint publication of the US Environmental Protection Agency, the Consumer Product Safety Commission, and the Department of Housing and Urban Development.

- Available as a free PDF download.

$0.00

Purchase Contract for Land for Subdivision | Canada

Canadian land developers, purchase land for a residential subdivision with this template Agreement to Purchase Land.

- The agreement is unilaterally conditional upon the vendor (seller) being able to obtain subdivision approval from the municipality.

- Conditions subsequent to the transaction include the provision of an easement across adjacent lands to allow the purchaser access to a water retention pond.

- The vendor is responsible for upgrading the access roadway.

- The vendor will have control over architectural plans and specifications of the subdivision development.

- This legal form template is provided in MS Word format and is fully editable to meet your specific needs.

- Intended for use only in Canada. The form may require additional provisions to comply with provincial or territorial laws.

$29.99

Purchaser's GST Warranty and Indemnity | Canada

Prepare a GST Warranty and Indemnity for the purchase of real estate or a bulk sale of goods in Canada with this downloadable template.

- The Warranty and Indemnity is supplied by the purchaser to the vendor as part of the documentation required for the transaction.

- The purchaser warrants that it is a GST registrant and indemnifies the vendor against any liability incurred by the vendor with respect to the collection and remittance of Goods and Services Tax in connection with the purchase and sale transaction.

- The form is a downloadable MS Word document.

- For use only in Canada.

$2.29

Quebec Declaration of Family Residence (English)

Protect your occupation of your home if you separate from your partner by registering a Declaration of Family Residence.

- If you are married or in a civil union and you have registered a Declaration of Family Residence, your occupation of your home is protected if you separate. Your former spouse will not be able to sell, lease or mortgage your home.

- The same rule applies if you rent your home and have added a statement to your lease declaring that it is your family residence. In this case, your former spouse will not be able to transfer the lease without your written consent.

- The family residence forms part of the family patrimony of a couple who are married or in a civil union, regardless of which spouse actually owns it.

- The form is a free Microsoft Word download. English language version.

- Intended to be used only in the Province of Quebec, Canada.

$0.00

Quebec Promise to Purchase Real Estate (English)

Make an offer to purchase a real estate property in Quebec with this Promise to Purchase template (English language version).

- Buyer's Promise. The buyer promises to purchase the property after the buyer has examined the property and has declared itself satisfied with the property.

- Mortgage Condition. The buyer's offer is conditional upon the buyer being able to obtain a new mortgage.

- Other Offers. The seller is still at liberty to offer the property for sale, but if the seller receives an acceptable offer from another party, it must notify the buyer, who will then have a period of time to either cancel its condition on the purchase, or cancel its offer. If the offer is cancelled, the buyer's deposit will be returned and neither party will take any further action.

- Building Inspection. The offer is also conditional upon the buyer obtaining a satisfactory building inspection.

- Encumbrances. The seller must provide good title to the property, and must warrant to the buyer for any violations that encumber the property.

- Rentals. This template can also be used for a rental building and includes provisions for notifying tenants and transferring current leases.

The English-language Promise to Purchase Real Estate template is available in Microsoft Word format and is fully editable. Intended to be used only in the Province of Quebec, Canada.

$24.99

Quebec Real Estate Sale Contract (English version)

Sell immovable property in Quebec with this Real Estate Sale Contract (English language version).

- Legal Warranty. The sale is made with legal warranty. The contract contains all the standard declarations and warranties of the vendor regarding the condition of the immovable.

- Rentals and Condominiums. The Sale Contract also contains optional provisions to be used if the immovable is a rental property, a new construction or a condominium.

- Taxes and Costs. The purchaser's obligations include payment of the property taxes from the adjustment date, paying the costs of publication and copies of the sale contract, and paying condo fees and assessments (if the immovable is a condominium).

- This English-language template is available as a Microsoft Word template and is fully editable.

- Intended to be used only in the Province of Quebec, Canada.

$29.99

Queensland PAMD Form 30c Contract Warning

Download this free Contract Warning Statement for Queensland, pursuant to the Property Agents and Motor Dealers Act 2000 (Form 30c).

- This warning must be attached to the front of a contract for sale of a residential property whether vacant land or land and an already existing residence.

- The document is for the benefit of a potential buyer of residential property and suggests matters the purchaser should investigate prior to purchase.

$0.00

Real Estate Contract Between Natural Persons | Mexico

Buy and sell real estate property in Mexico with this template Real Estate Purchase & Sale Agreement Between Natural Persons.

- Parties. The land in question is owned by an individual and is being sold to another individual, in accordance with Mexican laws.

- Purchase Price. The purchase price is payable in US dollars. The buyer pays a 10% deposit at the time of signing the Purchase & Sale Agreement, with the balance due on closing.

- Rescission. If the buyer rescinds due to a breach by the seller, the buyer is entitled to a penalty fee of 10% of the purchase price. If the seller terminates due to a breach by the buyer, the seller is entitled to keep the deposit as the penalty fee.

- Expenses. The buyer is responsible for paying all expenses relating to the transfer of the property, except for capital gains and value-added taxes.

- This template is provided in MS Word format and is fully editable to fit your circumstances. English-language version only at this time.

- Intended to be used only for properties being bought and sold in Mexico.

$15.99

Real Estate Purchase and Sale Agreement | USA

Sell a real estate property in the United States with this template USA Real Estate Purchase and Sale Agreement.

- Fixtures. The property is being sold with all the attached fixtures, including window coverings.

- Encumbrances. The property will be free of any encumbrances on title except for existing zoning laws, party wall agreements, easements, and the like.

- Title Defects. If the seller is unable to perfect title or make the property conform to all building and zoning laws within the time agreed to by the parties, all payments made by the buyer will be refunded and the agreement will be void. However, the buyer has the option to elect to accept the property even if the title has not been perfected.

- Adjustments. All rents, taxes, mortgage interest and other charges with respect to the property will be adjusted as of the closing date.

- Default by Buyer. If the buyer defaults in fulfilling any of its obligations, the seller may keep any amounts paid as liquidated damages.

- Financing Condition. The sale is conditioned upon the buyer obtaining mortgage financing.

- Lead Disclosure. The agreement includes the required Lead Paint Disclosure form.

- This form is available in MS Word format and is fully editable.

- This is not a State-specific form. Some States may have certain requirements regarding the type of forms used. Check your State laws to be sure.

$19.99

Real Estate Sale Contract from Corporation to Natural Person | Mexico

Buy and sell real estate property in Mexico with this template Real Estate Purchase & Sale Agreement Between Mexican Corporation as Seller and Natural Person as Buyer.

- Parties. The land in question is owned by a corporation incorporated under Mexican law, and is being sold to one or more individuals.

- Payment of Purchase Price. The purchase price is payable in US dollars. The buyer pays a 10% deposit at the time of signing the Purchase & Sale Agreement, with the balance due on closing.

- Rescission. If the buyer rescinds due to a breach by the seller, the buyer is entitled to a penalty fee of 10% of the purchase price. If the seller terminates due to a breach by the buyer, the seller is entitled to keep the deposit as the penalty fee.

- Expenses. The buyer is responsible for paying all expenses relating to the transfer of the property, except for capital gains and value-added taxes.

- This template is provided in MS Word format, and is totally editable to meet your exact needs.

- English language version only at this time.

- Intended to be used only for properties situated in Mexico.

$17.99

Receipt for Non-Refundable Deposit | USA

Issue a receipt for a non-refundable deposit to a property buyer with this free downloadable form for U.S. real estate transactions.

- The deposit will be applied toward the purchase of the property.

- The seller agrees to remove the property from the market until the balance of the purchase price is paid.

- The buyer acknowledges that the deposit is non-refundable and will be retained by the seller as damages if the buyer cannot complete the transaction.

- Available in MS Word format.

- Intended to be used only within the United States.

$0.00

Restrictive Covenant for Trees and Shrubs | Canada

Register a Restrictive Covenant for the planting of trees and shrubs in a residential subdivision with this customizable template for Canadian land developers.

- The Restrictive Covenant sets out the restrictions governing the height, appearance, pruning and removal of trees and shrubs in the subdivision being developed on the land.

- The restrictions run with the land, and the rights of the developer under the covenant will transfer to the new owners of the lots as they are developed and sold.

- This form is a downloadable MS Word template and can be easily edited to fit your circumstances.

- Intended for use only in Canada.

$6.29

Restrictive Covenant on Subdivision Lots | Canada

Draw up a Restrictive Covenant governing the use, development and appearance of lots in a residential subdivision with this customizable template for Canadian developers.

- The Restrictive Covenant will be registered on the title for all residential lots in the subdivision.

- Development is restricted to one detached single family dwelling on each lot, and accessory buildings such as garages, sheds, etc.

- Mobile homes and modular structures are not allowed.

- No building may be moved onto a lot, and all buildings must be constructed on site, from new materials.

- The developer must give approval for all buildings, fences, and other structures.

- The restrictive covenant runs with the land, and the rights of the developer under the covenant will transfer to the new owners of the subdivision lots as they are developed and sold.

- This legal document template is available in MS Word format and can be easily edited to fit your circumstances.

- Intended to be used only in Canada.

$17.99

Rhode Island Quitclaim Deed

Transfer your interest in a real estate property in Rhode Island with this easy-to-use Quitclaim Deed.

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This Rhode Island Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This Rhode Island Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

$6.29

Rhode Island Quitclaim Deed for Joint Ownership

Transfer the interest in a real estate property in Rhode Island from a husband and wife to another husband and wife with this Quitclaim Deed for Joint Ownership with rights of survivorship.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This Rhode Island Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This Rhode Island Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

$6.29

Rhode Island Quitclaim Deed from Husband and Wife to Individual

Transfer title to a real estate property in Rhode Island from two spouses to one person with this easy-to-use Quitclaim Deed from Husband and Wife to Individual.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Rhode Island Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Rhode Island Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

$6.29

Rhode Island Special Warranty Deed

Transfer ownership of a RI real estate property with this easy-to-use Rhode Island Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.This Rhode Island Special Warranty Deed form is a downloadable legal document in MS Word format.

$6.29

Rhode Island Warranty Deed for Joint Ownership

Transfer ownership of a RI real estate property from two sellers to two buyers with this Rhode Island Warranty Deed for joint ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the survivor.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

$6.29

Rhode Island Warranty Deed Form

Transfer title to a Rhode Island real estate property from a seller to a buyer with this easy-to-use Rhode Island Warranty Deed form.

The seller (the grantor) gives the buyer (the grantee) the following covenants:- that the grantor has good and marketable title to the property,

- that the grantor has the legal right and authority to transfer the title to the buyer, and

- that the grantor will forever defend the right of the grantee to possess the property.

$6.29

Right of First Refusal to Purchase Property | Canada

Prepare a Right of First Refusal to purchase a real estate property with this ready-made template for Canada.

- The owner of the real estate (the grantor) grants another party (the grantee) an irrevocable right of first refusal to purchase the property.

- The right cannot be revoked and will not expire until the grantee exercises the right to purchase or, alternatively, decides to waive its rights.

- This downloadable legal form is available in MS Word format and is fully editable.

- Governed by the laws of Canada.

$17.99

Saskatchewan Declaration of Residency

Download this free Saskatchewan Declaration of Residency forms for real estate sales in Saskatchewan.

- If you are the vendor of the real estate property, you will need to provide the purchaser with the Declaration of Residency in order to fulfill the residency requirement of the Income Tax Act (Canada).

- This is a free form provided in MS Word format.

- For use in the Province of Saskatchewan, Canada.

$0.00

Saskatchewan GST Exemption Certificate for Sale of Real Property

When you resell a residential property in Saskatchewan, you must complete this GST Exemption Certificate and provide it to the purchaser.

- The seller certifies that the real estate in question is a residential property being resold within the meaning of the Excise Tax Act and that the seller has not claimed an input tax credit.

- This form is for resales only and cannot be used for new construction.

$0.00

Saskatchewan Offer to Purchase Residential Real Estate

Make an offer to buy a residential property in Saskatchewan with this Offer to Purchase Residential Real Estate.

- GST. The purchaser is responsible for paying any GST payable on the purchase of the property.

- Conditions Precedent. The offer is conditional upon the purchaser obtaining mortgage financing and a satisfactory home inspection report.

- Condominiums. If the property is a condominium, the seller must provide the purchaser with condominium documents (estoppel certificate, bylaws, etc).

- Binding on Acceptance. Upon acceptance by the seller, the offer will form a legally binding contract between the parties for the purchase and sale of the real estate property.

- The form includes a Property Disclosure Statement to be completed by the seller, as required by provincial law.

- Available as a Microsoft Word file, and is fully editable to fit your circumstances.

- Intended to be used only in the Province of Saskatchewan, Canada.

$17.99

South Carolina Limited (Special) Warranty Deed

Transfer ownership of a real estate property in the State of South Carolina with this Limited (Special) Warranty Deed form.

- Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property, but not against title defects existing before that time.

- The form includes an Affidavit for Taxable or Exempt Transfers.

$6.29

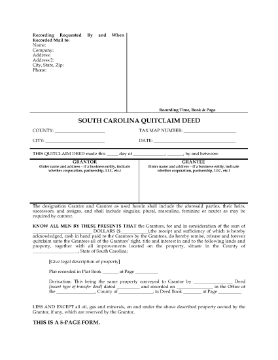

South Carolina Quitclaim Deed

Transfer your interest in a real estate property in South Carolina with this easy-to-use Quitclaim Deed.

- Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property.

- This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

- The form includes the required Affidavit for Taxable or Exempt Transfers, and information explaining the contents of the Affidavit.

$6.29

South Carolina Quitclaim Deed for Joint Ownership

Transfer title to a property in South Carolina from one couple to another couple with this Quitclaim Deed for Joint Ownership with rights of survivorship.

- The transferors convey their interest in the real estate to the transferees, but do not provide any warranties regarding the property.

- The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

- The form includes the required Affidavit for Taxable or Exempt Transfers, and information explaining the contents of the Affidavit.

- Provided in MS Word format, easy to download, fill in and print.

- Intended to be used only in the State of South Carolina.

$12.49

South Carolina Quitclaim Deed from Husband and Wife to Individual

Transfer title to a real estate property in South Carolina from two spouses to one person with this easy-to-use Quitclaim Deed from Husband and Wife to Individual.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This South Carolina Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This South Carolina Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

$6.29

South Carolina Warranty Deed for Joint Ownership

Transfer ownership of a SC real estate property from two sellers to two buyers with this South Carolina Warranty Deed for joint ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the survivor.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

- The form includes an Affidavit for Taxable or Exempt Transfers.

$6.29

South Carolina Warranty Deed Form

Transfer title to a South Carolina real estate property from a seller to a buyer with this easy-to-use South Carolina Warranty Deed form.

The seller (the grantor) gives the buyer (the grantee) the following covenants:- that the grantor has good and marketable title to the property,

- that the grantor has the legal right and authority to transfer the title to the buyer, and

- that the grantor will forever defend the right of the grantee to possess the property.

$6.29

South Dakota Quitclaim Deed

Transfer your interest in a real estate property in South Dakota with this easy-to-use Quitclaim Deed.

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This South Dakota Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This South Dakota Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

$6.29

South Dakota Quitclaim Deed for Joint Ownership

Transfer the interest in a real estate property in South Dakota from a husband and wife to another husband and wife with this Quitclaim Deed for Joint Ownership with rights of survivorship.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This South Dakota Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This South Dakota Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

$6.29

South Dakota Quitclaim Deed from Husband and Wife to Individual

Transfer title to a real estate property in South Dakota from two spouses to one person with this easy-to-use Quitclaim Deed from Husband and Wife to Individual.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This South Dakota Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This South Dakota Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

$6.29

South Dakota Special Warranty Deed

Transfer ownership of a SD real estate property with this easy-to-use South Dakota Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.This South Dakota Special Warranty Deed form is a downloadable legal document in MS Word format.

$6.29

South Dakota Warranty Deed for Joint Ownership

Transfer title of a South Dakota real estate property from two sellers to two buyers with this South Dakota Warranty Deed for joint ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the survivor.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

$6.29

South Dakota Warranty Deed Form

Transfer title to a South Dakota real estate property from a seller to a buyer with this easy-to-use Warranty Deed form.

- The seller (the grantor) gives the buyer (the grantee) the following covenants:

- that the grantor has good and marketable title to the property,

- that the grantor has the legal right and authority to transfer the title to the buyer, and

- that the grantor will forever defend the right of the grantee to possess the property.

- This form is a downloadable legal document in MS Word format.

- Intended for use only in the State of South Dakota

$6.29

Special Power of Attorney to Buy Property | India

Appoint an agent as your attorney to handle the purchase of real estate in India for you during your absence with this Special Power of Attorney to Buy Property.

- This Special Power of Attorney form gives your attorney the power to:

- execute and file necessary transfer and mortgage documents to complete the purchase,

- pay out money in your name,

- arrange for utility accounts and insurance,

- pay taxes, charges and legal fees with respect to the transaction,

- and to do all other things necessary to complete the purchase and take possession of the property on your behalf.

- The form is available as a fully editable MS Word template and is easy to download and use.

- Instructions are included for proper execution and notarization, for both Indian residents and expatriates.

$11.99

Special Power of Attorney to Sell Property | India

Appoint an agent to handle the sale of property in India for you during your absence with this Special Power of Attorney to Sell Real Estate Property.

This Special Power of Attorney form gives your attorney the power to:

- execute and file necessary documents for the sale,

- receive and pay out money in your name,

- hand over possession of the property,

- pay taxes, charges and legal fees with respect to the sale of the property.

This Indian Special Power of Attorney to Sell Real Estate Property is provided in MS Word format, and contains instructions for completing and validating the form, for Indian residents and ex-patriates.

$12.49

Temporary Shoring Indemnity Agreement

Prepare a Temporary Shoring Indemnity Agreement between a land developer and a municipal corporation (city) with this easy-to-use template.

- The city is issuing the developer a development permit for the construction and development of a commercial and retail project.

- The developer must put temporary supports for the walls of the excavation on the adjacent municipal property.

- The developer must install and remove the shoring supports strictly in accordance with the City Engineer's specifications.

- The developer must indemnify the city and the owner of each utility running onto the property, and must carry sufficient public liability insurance.

- The template is available as a downloadable and fully editable MS Word document.

- This is a generic legal form template which does not contain references to the laws of any specific country or region.

$27.99

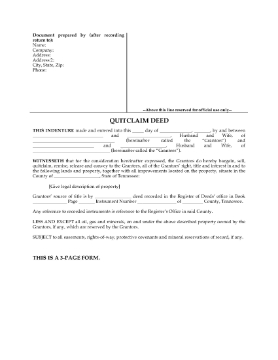

Tennessee Quitclaim Deed

Transfer your interest in a real estate property in Tennessee with this easy-to-use Quitclaim Deed.

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This Tennessee Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This Tennessee Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

$6.29

Tennessee Quitclaim Deed for Joint Ownership

Transfer title to a Tennessee real estate property from a husband and wife to another husband and wife with this Quitclaim Deed for Joint Ownership with rights of survivorship.

- The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property.

- The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

$6.29

Tennessee Quitclaim Deed from Husband and Wife to Individual

Transfer title to a real estate property in Tennessee from two spouses to one person with this easy-to-use Quitclaim Deed from Husband and Wife to Individual.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Tennessee Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Tennessee Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

$6.29

Tennessee Special Warranty Deed

Transfer ownership of a Tennessee real estate property with this easy-to-use Special Warranty Deed form.

- Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.

- This Warranty Deed form is a downloadable legal document in MS Word format.

- Intended for use only in the State of Tennessee.

$6.29

Tennessee Warranty Deed for Joint Ownership

Transfer title of a Tennessee real estate property from two sellers to two buyers with this Tennessee Warranty Deed for joint ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

$6.29

Tennessee Warranty Deed Form

Transfer a Tennessee real estate property from a seller to a buyer with this easy-to-use Tennessee Warranty Deed form.

The seller (the grantor) gives the buyer (the grantee) the following covenants:- that the grantor has good and marketable title to the property,

- that the grantor has the legal right and authority to transfer the title to the buyer, and

- that the grantor will forever defend the right of the grantee to possess the property.

$6.29

Texas Amendment to Real Estate Contract

Amend a signed real estate contract for Texas property with this free Amendment to Contract Form from the Texas Real Estate Commission.

- Provisions include changes for:

- sale price,

- property repairs,

- contract dates,

- additional fees and other amounts paid by seller or buyer.

- This free PDF form can be downloaded directly from the TREC website, or filled in online.

- TREC Form ID 39-8.

$0.00

Texas Application for Residence Homestead Exemption

TX home owners, apply for a reduction in your property taxes with this Application for Residence Homestead Exemption Form 50-114.

- The form must be completed and submitted to your local appraisal district office.

- If you are over 65, disabled, or a disabled veteran, your exemption level is higher than the general amount available to other residents.

- The exemption application form can be used for a single family dwelling, or a mobile or manufactured home, provided that you live in the home. You must provide proof of residence.

- Instructions for completing the form are included.

- The form is available from the website of the Texas Comptroller of Public Accounts. Click the link to download the PDF.

$0.00

Texas Application to Amend a Timeshare

Apply to make an amendment to a timeshare property registration with this free form provided by the Texas Real Estate Commission (TREC).

- The form includes instructions for completing it.

- The individual completing the form must sign an oath stating the information provided in the amendment is true and correct, in accordance with The Timeshare Act.

- Download the free PDF form directly from the TREC website, or fill it in online.

- TREC Form ID TSR 2-6.

$0.00

Texas Application to Register Time Share Property

Download a free Texas Application to Register Time Share Property, prepared by the Texas Real Estate Commission.

- The form discloses all pertinent information regarding the property and the owners of the property, pursuant to The Timeshare Act.

- Available as a PDF download directly from the Texas Real Estate Commission (TREC) website.

- TREC Form ID TSR-16.

$0.00

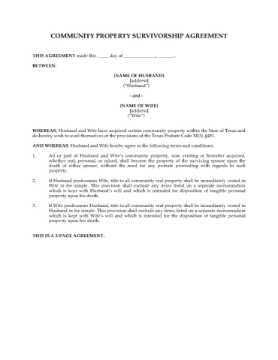

Texas Community Property Survivorship Agreement

TX property owners, avoid probate proceedings with respect to your community property with this Texas Community Property Survivorship Agreement.

- The agreement is between two spouses, pursuant to the Texas Probate Code XI(3), section 451.

- Upon the death of a spouse, title to all community property held by the spouses will immediately vest in the surviving spouse.

- The agreement automatically terminates if the marriage ends.

- As long as both spouses are alive, the property remains community property.

- The agreement revokes all prior community property agreements.

- The agreement must be filed in the county records in order to take effect.

- This legal document template is provided in MS Word format and is easy to edit and print.

- Intended for use only in the State of Texas.

$6.29

Texas Easement and Maintenance Agreement

Allow a neighbor to have access over your land with this Ingress and Egress Easement and Maintenance Agreement for Texas land owners.

- This form can be used to create an easement for a road to one party's house that runs across adjoining land belonging to a neighbor.

- The landowner (the grantor) grants, sells and conveys to the other party (the grantee) a perpetual, free, continuous and uninterrupted easement to use the easement.

- Neither party will erect any improvements that impair the flow of traffic over the easement.

- The grantee is responsible for maintaining the easement in an all-weather road surface condition.

- The easement is granted solely for the purpose of entering and leaving (ingress and egress), access and maintenance to and from the grantee's property.

- Available in MS Word format.

- Intended to be used only in the State of Texas.

$12.49

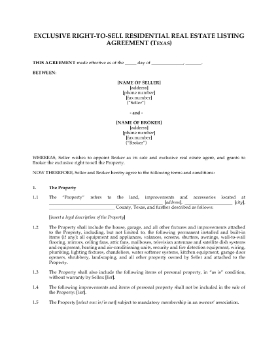

Texas Exclusive Right-to-Sell Real Estate Agreement

Texas realty brokers, prepare an Exclusive Right-to-Sell Residential Real Estate Agreement with this easy-to-use template.

- The property seller gives the broker the exclusive right to sell the property. In exchange, the broker will list the property and promote it with potential buyers.

- In addition to the broker's fees, the seller is responsible for paying all closing costs.

- The seller agrees to pay the broker's fee if the seller fails or refuses to sell the property to a qualified buyer identified by the broker, or if the seller breaches the agreement.

- The broker's fee is not payable if the sale cannot be completed through no fault of the seller.

- Any earnest money forfeited by a buyer will be distributed equally between the seller and the broker, provided that the broker's portion does not exceed the agreed commission.

- If the broker shows the property to a buyer represented by the broker, the broker may not disclose confidential information about one party to the other, including how much the party is willing to pay or to accept for the property.

- The seller agrees to refer any inquiries about the sale of the property to the broker.

$29.99

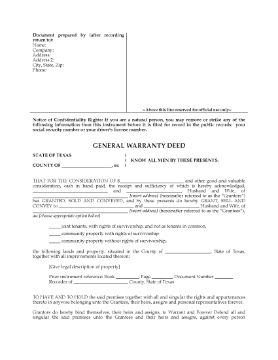

Texas General Warranty Deed for Joint Ownership

Transfer title of a real estate property in Texas from two sellers to two buyers with this Texas General Warranty Deed for joint ownership with rights of survivorship.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

- The buyers can take title either as:

- joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant, or

- community property with rights of survivorship, or

- community property without rights of survivorship.

- The Warranty Deed includes a Community Property Agreement to be signed by the buyers, if applicable.

- Intended for use only in the State of Texas.

$6.29

Texas General Warranty Deed Form

Transfer a Texas real estate property from a seller to a buyer with this easy-to-use Texas General Warranty Deed form.

- A General Warranty Deed provides the buyer with the broadest protection of any form of title deed. The seller (the grantor) gives the buyer (the grantee) the following covenants:

- that the grantor has good and marketable title to the property,

- that the grantor has the legal right and authority to transfer the title to the buyer, and

- that the grantor will forever defend the right of the grantee to possess the property.

- This form is a downloadable legal document in MS Word format.

- Intended to be used only in the State of Texas.

$6.29

Texas Notice of Real Estate Contract Termination

Cancel a real estate purchase contract with this Notice of Real Estate Contract Termination form for Texas properties.

- The contract can only be terminated for a valid reason (for instance, if you are unable to obtain a mortgage loan).

- The Notice must set out the reason(s) that the contract is being canceled.

- The form includes a Certificate of Delivery so that you can record how the Notice was served on the seller of the property.

- The form is available in MS Word format and is easy to fill in and print.

- Intended for use only in the State of Texas.

$2.29

Texas One to Four Residential Real Estate Contract (Resale)

Sell a Texas residential property with this One to Four Residential Real Estate Contract (Resale) from the Texas Real Estate Commission.

- This form of contract is used for the resale of residential properties that are either a single family home, a duplex, a tri-plex or a four-plex.

- It is not to be used for condominium transactions, new homes being sold by a builder, or farm and ranch properties.

- Download the form directly from the TREC website, or fill it in online.

- TREC Form 20-16.

$0.00

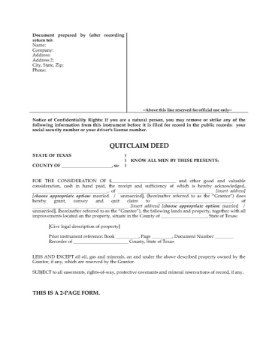

Texas Quitclaim Deed

Convey your interest in a Texas real estate property with this easy-to-use Quitclaim Deed.

- Under a Quitclaim Deed, the seller / transferor transfers all of its interest in the property to the transferee but does not provide any warranties regarding the property.

- This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

- This is a downloadable legal form which can be re-used as often as you require.

- This is a downloadable legal form in MS Word template which is easy to fill in and print.

- Intended for use only in the State of Texas.

$6.29

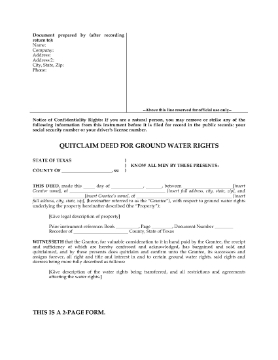

Texas Quitclaim Deed for Ground Water Rights

Transfer ownership of ground water rights underlying a property in the State of Texas with this Quitclaim Deed for Ground Water Rights.

- The ground water rights run with the property and must be transferred whenever the property is transferred, and cannot be sold, liened or encumbered separately from the property.

- The grantor does not warrant the quality or quantity of ground water available.

- This form is provided in MS Word format and is easy to download, fill in and print.

- Intended to be used only in the State of Texas.

$5.99

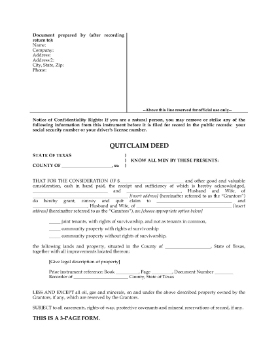

Texas Quitclaim Deed for Joint Ownership

Transfer the interest in a real estate property in Texas from a husband and wife to another husband and wife with this Quitclaim Deed for Joint Ownership.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees can take title either as:

This Texas Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees can take title either as:

- joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant, or

- community property with rights of survivorship, or

- community property without rights of survivorship.

This Texas Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

$6.29

Texas Quitclaim Deed from Husband and Wife to Individual

Transfer title to a real estate property in Texas from two spouses to one person with this easy-to-use Quitclaim Deed from Husband and Wife to Individual.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Texas Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Texas Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

$6.29

Texas Realtor Complaint Form

File a complaint against your realtor with this free form from the Texas Real Estate Commission.

- This form can be used for complaints against:

- real estate agents,

- inspectors,

- developers,

- registered easement or right-of-way agents,

- education providers, or

- residential service companies,

- regarding the sale or purchase of a property. Information on the complaint process is provided in both English and Spanish.

- Download the free PDF form directly from the TREC website.

$0.00

Texas Release of Vendor's Lien

Discharge a vendor's lien against a real estate property in Texas with this Release of Lien form.

- The Release of Lien must be recorded with the County Recorder's Office to release a vendor's lien against the property.

- The Release would be filed after (i) the purchaser has paid the balance of the purchase price and (ii) the promissory notes securing the balance have been canceled by the vendor (seller).

- Available in MS Word format.

- Intended to be used only in the State of Texas.

$6.29

Texas Seller's Disclosure Notice

If you are selling a real estate property in Texas, you must provide the buyer with this Seller's Disclosure Notice, in accordance with Section 5.008 of the Texas Property Code.

The form must be completed by the seller and given to the purchaser prior to completing the sale transaction. The condition of the property, including land, utilities, appliances, gas lines, water supply, structural elements, etc, must be disclosed in full.

This Texas Seller's Disclosure Notice form is available as a MS Word download, and can be easily filled in with your specific information.

The form must be completed by the seller and given to the purchaser prior to completing the sale transaction. The condition of the property, including land, utilities, appliances, gas lines, water supply, structural elements, etc, must be disclosed in full.

This Texas Seller's Disclosure Notice form is available as a MS Word download, and can be easily filled in with your specific information.

$6.29

Texas Special Warranty Deed

Transfer your interest in a piece of real estate with this easy-to-use Texas Special Warranty Deed form.

- Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.

- This is a downloadable legal form that can be re-used as often as you like.

- Available in MS Word format.

- Intended to be used only in the State of Texas.

$6.29

Texas Third Party Financing Addendum

Is your real estate purchase conditioned on financing from a third party? Attach this Third Party Financing Addendum to the purchase contract for properties in Texas.

- This form includes provisions for:

- conventional financing,

- FHA insured financing,

- VA guaranteed financing,

- Texas Housing Assistance Program loan.

- Download the free PDF form directly from the Texas Real Estate Commission (TREC) website.

- TREC Form ID 40-9.

$0.00

Texas Warranty Deed with Vendor's Lien

Transfer ownership of a real estate property in Texas from a seller to a buyer with this Warranty Deed with Vendor's Lien.

- The Warranty Deed gives the seller (the vendor) a lien over the property under a promissory note signed by the buyer and held by the vendor.

- The vendor can assign the vendor's lien to a mortgage lender after the promissory note is paid out of the proceeds of a new mortgage.

- The lender, who holds the promissory note and deed of trust, will retain superior title to the property until the loan is paid by the buyer.

- The form can also be used to place a lien by a third party lender.

- Available in MS Word format.

- Intended to be used only in the State of Texas.

$6.49

UK Anti-Gazumping Agreement

Are you buying a real estate property in the UK? Prevent the seller from dealing with other prospective buyers with this UK Anti-Gazumping Agreement.

- Exclusivity. The Agreement creates an exclusivity period during which the seller agrees not to continue to seek purchasers or allow others to do so (such as estate agents), provide information to other persons or allow them access to the property (except for persons acting on your behalf), or to commit to sell the property to anyone else.

- No Obligation to Complete. The Agreement does not bind either party to complete the purchase and sale of the property. After the exclusivity period expires the seller is free to deal with other prospective purchasers.

- The template also includes a Withdrawal Notice and an Offer Letter form, which can be used by either party.

$17.99

UK Extension of Option to Purchase Property

Prepare an Extension of Option to Purchase Property in the UK with this ready-made template.

This agreement extends the option period and sets back the date by which the option must be exercised, upon payment by the optionee of a fee for extending the time.

This United Kingdom Extension of Option to Purchase Property form is provided in MS Word format, and is fully editable to meet your needs.

This agreement extends the option period and sets back the date by which the option must be exercised, upon payment by the optionee of a fee for extending the time.

This United Kingdom Extension of Option to Purchase Property form is provided in MS Word format, and is fully editable to meet your needs.

$2.29

USA Affidavit of Non-Foreign Status

If your company is selling land located in the USA, you are required to provide this Affidavit of Non-Foreign Status to the buyer.

- An officer of the corporation must attest that the corporation is not a foreign corporation.

- The form is required by the IRS for tax purposes.

- Buy the form once, use as often as desired.

$6.29

USA Agreement for Sale of Real Property by Auction

Document the terms of sale for a real estate property sold at auction with this USA Agreement for Sale of Real Property by Auction.

- The buyer agrees to pay any existing special assessments levied against the property.

- The buyer has no financing contingencies or inspection rights. The buyer agrees that prior to making the bid, the buyer examined the property and determined that it met all of the buyer's requirements.

- The seller is not obligated to make any repairs or changes to the property in connection with the sale.

- Possession will be provided at closing, subject to any existing leases.

$17.99

USA Closing Correction Agreement

The Closing Correction Agreement protects both the buyer and the seller in the event any of the closing documents in a real estate transaction are lost, misplaced, or inaccurate.

- The buyer and the seller agree to correct or replace any closing document that contains an error or which has been lost or destroyed.

- If the original loan note is replaced, the seller and the lender will indemnify the buyer against any loss.

- If there was an error resulting in the wrong amount of funds being transferred between the parties, the parties agree to supply or refund any amount necessary to adjust for the error.

- The agreement does not address any errors in consumer disclosure documentation given to the buyer in connection with a mortgage loan.

- This form can be used throughout the United States.

If your real estate sale or purchase is relying on lost or incorrect documents, you need this USA Closing Correction Agreement. Buy and download the form now.

$6.29

USA Confidentiality and Noncircumvention Agreement for Real Estate Sale

USA brokers, prepare a Confidentiality and Noncircumvention Agreement for a seller with this customizable template.

- This type of Agreement is generally used when property is being transferred as part of a sale of business assets.

- The broker agrees to use the seller's confidential information only in connection with evaluating the property on behalf of its client.

- The broker will not disclose any of the confidential information, and will ensure that its employees, agents and third parties involved with the transaction agree to be bound by the agreement.

- The seller agrees not to circumvent the broker by contacting any potential purchaser introduced by the broker. If the seller breaches this provision, the seller must still pay the broker's fees and commissions with respect to the sale.

$17.99

USA Earnest Money Escrow Agreement

Prepare an Earnest Money Escrow Agreement with this template form for a real estate purchase and sale transaction the USA.

- The purchaser will deposit the earnest money with the escrow agent, who will invest it according to the purchaser's instructions.

- If the purchaser breaches the Purchase & Sale Contract, the money will be paid to the seller as liquidated damages.

- Upon written instruction from the parties, the escrow agent will disburse the funds after the transaction closes.

- The escrow agent is to be held harmless from liability in the performance of his duties.

$12.49

USA Letter of Intent to Purchase Fixture

Clarify the terms of a purchase and sale of a fixture between a buyer and a seller with this easy-to-use USA Letter of Intent to Purchase Fixture.

- The Letter of Intent summarizes the discussions between the parties prior to signing a written contract with respect to the sale of a fixture, outbuilding or other fixed immovable property which is NOT part of the real estate, even though it is permanently fixed to the underlying property.

- The Letter of Intent itself is not a legally binding contract, but rather it is a confirmation of both parties' intentions to complete the transaction.

$12.49

USA Real Estate Purchase and Sale Agreement for Ranch or Farm

Sell a ranch or farm property in the United States with this USA Real Estate Purchase and Sale Agreement for Ranch or Farm.

- The sale is to include all buildings, livestock and crops on the property.

- The seller has the right to harvest crops until the purchaser takes possession.

- The seller must deliver fee simple insurable title by way of warranty deed.

- A property land survey is to be performed, and the parties may agree to adjust the purchase price based on the land survey results.

- The agreement includes optional clauses for cash, assumption of existing mortgage loan, conventional financing, FHA insured or VA loan.

- The seller must provide a title insurance policy insuring the transaction for the total purchase price.

- Also included is a lead paint disclosure.

$29.99

USA Seller's Closing Affidavit

Mortgage brokers in the U.S. can use this easy template to prepare an Owner's (Seller's) Closing Affidavit for a real estate transaction.

The Affidavit is required to obtain title insurance. It contains statements sworn by the seller of the property with respect to:- the seller's ownership of the property and marital status,

- any liens against the property,

- improvements ordered or contracted for within the last 60 days,

- local improvements done or to be done in the neighborhood by municipal or government authorities,

- structural defects,

- location of utilities,

- violations of any restrictions affecting the property, or any disputes with neighboring owners,

- any lawsuits pending against the seller,

- any bankruptcy or insolvency proceedings against the seller,

- the seller's acknowledgement that the statements will be relied upon by the mortgagee and the title insurance company.

If you don't have a Closing Affidavit template in your digital documents, you should. Download your copy now. This form can be used anywhere in the United States.

$12.49

USA Seller's Net Sheet for Real Estate Sale

Selling your home? Figure out how much you'll have left after closing with this free Seller's Net Sheet for a Residential Real Estate Sale.

- The worksheet will help you determine what your net sale proceeds will be after paying the closing costs and any remaining loan balance.

- The worksheet contains a section for estimating your closing costs and refunds (e.g. any unused insurance and the balance in escrow).

- Easy to download, fill in and print.

$0.00

Utah Declaration of Covenants, Conditions and Restrictions (residential)

Utah property developers can use this ready-made template to easily prepare a Declaration of Covenants, Conditions and Restrictions for a residential subdivision.

- The Declaration (also called a CC&R) contains covenants, easements, terms and conditions to govern the use and development of the lots, such as:

- completion of construction prior to occupancy,

- location of buildings and proximity of buildings, fences, etc. to property lines,

- types of construction materials and methods allowed in the subdivision,

- restrictions on parking, noise, commercial use, and other activities which could become a nuisance or be disruptive to other residents,

- trash removal and sewage disposal,

- installation and maintenance of utility easements,

- powers and authority of the Architectural Review Committee.

- The CC&R must be filed with the County Records Office upon completion.

- This form is a MS Word document template that you can customize to fit your specific circumstances.

- Intended to be used only in the State of Utah.

$29.99

Utah Declaration of Homestead (Permanent Structure)

Protect your home against sale or seizure to satisfy your creditors by filing this Declaration of Homestead for the State of Utah.

- Utah Code §78B-5-503 entitles you to a homestead exemption of up to $20,000 of the value of your primary personal residence. That increases to $40,000 if the property is jointly owned.

- Even if your property is sold by a bankruptcy trustee or a creditor, you will be entitled to receive a certain amount of the sale proceeds.

- This form is for a dwelling that is a permanent structure on the land, and can be applied to the land surrounding it up to a maximum of one acre.

- You must live in the property in order to claim it as a homestead.

- A homestead exemption can also be claimed on property that is not the principal residence of the owner, but only to a maximum of $5,000. For jointly owned properties, the total exemption cannot exceed $10,000.

- After the document is signed, it must be filed with the County Recorder's Office for the county in which the home is located.

- The exemption does not apply to tax debts, any mortgages or charges already registered on the property, child support judgments, or consensual liens (such as mortgages or deeds of trust).

- Intended to be used only in the State of Utah.

$6.29

Utah Declaration of Homestead for Mobile Home

Claim the mobile home you live in as your homestead by filing this Utah Declaration of Homestead (Mobile Home) form.

- Utah law allows you to protect the equity you have built up in your home up to $20,000 (or $40,000 if the property is jointly owned).

- Even if your property is sold by a bankruptcy trustee or a creditor, you will be entitled to receive a certain amount of the sale proceeds.

- This form is for mobile homes. You must live in the home in order to claim it as a homestead.

- After the document is signed, it must be filed with the County Recorder's Office for the county in which the home is located.

- Intended for use only in the State of Utah.

$2.29

Utah Quitclaim Deed

Transfer your interest in a real estate property in Utah with this easy-to-use Quitclaim Deed.

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This Utah Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This Utah Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

$6.29

Utah Quitclaim Deed for Joint Ownership

Transfer the interest in a real estate property in Utah from a husband and wife to another husband and wife with this Quitclaim Deed for Joint Ownership with rights of survivorship.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This Utah Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This Utah Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

$6.29

Utah Quitclaim Deed from Husband and Wife to Individual

Transfer title to a real estate property in Utah from two spouses to one person with this easy-to-use Quitclaim Deed from Husband and Wife to Individual.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Utah Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Utah Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

$6.29

Utah Special Warranty Deed

Transfer ownership of a real estate property in the State of Utah with this Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property, but not against any title defects existing before that time.

This Utah Special Warranty Deed form is available as a downloadable MS Word document, and is easy to fill in with the details of your transaction.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property, but not against any title defects existing before that time.

This Utah Special Warranty Deed form is available as a downloadable MS Word document, and is easy to fill in with the details of your transaction.

$6.29

Utah Warranty Deed for Joint Ownership

Transfer ownership of a real estate property in Utah from two sellers to two buyers with this Utah Warranty Deed for joint ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the survivor.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

$6.29

Utah Warranty Deed Form

Transfer a real estate property in Utah from a seller to a buyer with this easy-to-use Utah Warranty Deed form.

- The seller (the grantor) gives the buyer (the grantee) the following covenants:

- that the grantor has good and marketable title to the property,

- that the grantor has the legal right and authority to transfer the title to the buyer, and

- that the grantor will forever defend the right of the grantee to possess the property.

- This form is a downloadable legal document in MS Word format.

- Intended for use only in the State of Utah.

$6.29

$5.99

Vendor's GST / HST Warranty and Indemnity | Canada

Use this downloadable template to get a GST / HST Warranty and Indemnity from the vendor of real estate or bulk goods in Canada.

- The vendor (seller) warrants that it is a GST (or HST) registrant.

- The vendor indemnifies the purchaser against any liability incurred by the purchaser with respect to the collection and remittance of Goods and Services Tax (or in Ontario, Harmonized Sales Tax) in connection with the purchase and sale transaction, up to the closing date.

- This form can be used anywhere in Canada.

- This is a printable blank legal form which is easy to use.

$2.29

Vermont Quitclaim Deed

Transfer your interest in a real estate property in Vermont with this easy-to-use Quitclaim Deed.

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This Vermont Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This Vermont Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

$6.29

Vermont Quitclaim Deed for Joint Ownership

Transfer the interest in a real estate property in Vermont from a husband and wife to another husband and wife with this Quitclaim Deed for Joint Ownership with rights of survivorship.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This Vermont Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This Vermont Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

$6.29

Vermont Quitclaim Deed from Husband and Wife to Individual

Transfer title to a real estate property in Vermont from two spouses to one person with this easy-to-use Quitclaim Deed from Husband and Wife to Individual.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Vermont Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Vermont Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

$6.29

Vermont Special Warranty Deed

Transfer ownership of a real estate property in Vermont with this easy-to-use Vermont Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.This Vermont Special Warranty Deed form is a downloadable legal document in MS Word format.

$6.29

Vermont Warranty Deed for Joint Ownership

Transfer title of a real estate property in Vermont from two sellers to two buyers with this Vermont Warranty Deed for joint ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the survivor.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

$6.29

Vermont Warranty Deed Form

Transfer a Vermont real estate property from a seller to a buyer with this easy-to-use Vermont Warranty Deed form.

The seller (the grantor) gives the buyer (the grantee) the following covenants:- that the grantor has good and marketable title to the property,

- that the grantor has the legal right and authority to transfer the title to the buyer, and

- that the grantor will forever defend the right of the grantee to possess the property.

$6.29

Virginia Quitclaim Deed

Transfer your interest in a real estate property in Virginia with this easy-to-use Quitclaim Deed.

- Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property.

- This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

- The form is provided in MS Word format and is easy to download, fill in and print.

- Intended to be used only in the Commonwealth of Virginia.

$5.99

Virginia Quitclaim Deed for Joint Ownership