Accounts Receivable and Credit Forms

Manage your accounts receivable and credit accounts with these convenient forms for credit managers, AR departments, controllers and collections agencies.

- Collections forms, demand letters for arrears, and notices of pending legal action.

- Customer forms to extend credit to new accounts and manage your current credit accounts.

- Legal documents for settling overdue accounts.

- Agreements for factoring and brokering receivables to increase cash flow and enhance your operating capital.

Sort by

Display per page

Alberta Purchase Money Security Agreement

Secure payment for inventory sold on credit to a customer with this Purchase Money Security Agreement for the Province of Alberta.

- The customer (debtor) grants the supplier (secured party) a purchase money security interest in the secured goods and proceeds from the sale of the goods.

- The debtor must keep the collateral free of any other liens or security interests ranking equal to or in priority to the secured party's interest.

- The debtor can only sell the secured goods in the ordinary course of business.

- If the debtor defaults in payment, the secured party has the right (among other remedies) to appoint a receiver-manager over the collateral.

- This legal contract is prepared in accordance with the Personal Property Security Act.

- Available in MS Word format.

- Intended to be used only in the Province of Alberta, Canada.

$19.99

Assignment of Accounts Receivable Forms

Factor the receivables of a business with this package of Assignment of Accounts Receivable forms which contains two templates:

- Assignment with Recourse. The assignee has recourse to re-transfer back any customer account which is not paid in full within a specified time period, and the assignor will buy them back for the amount of the unpaid balance.

- Assignment Without Recourse. The assignor does not have the option to take back the accounts if they remain unpaid. The right to collect the unpaid accounts remains with the assignee.

An assignment of your accounts receivable is a quick way to increase cash flow during slow periods. These are downloadable forms that you can use again and again.

$12.99

British Columbia Authority to Do Credit Check

Before you run a credit check on that new customer, have them sign this British Columbia Authority to Do Credit Check form.

- The authorization is required by the B.C. Credit Reporting Act.

- The applicant authorizes the supplier to run a credit check on the applicant before extending credit.

- This form a free download provided in MS Word format.

- Intended to be used only in the Province of British Columbia, Canada.

$0.00

Broker Agreement for Factoring | USA

Hire a broker to locate potential factoring clients for you with this USA Broker Agreement for Factoring.

- The factoring agency is under no obligation to purchase accounts from any client referred from the Broker.

- The Broker's only compensation will be a commission, calculated as a commission of the monthly gross factoring fees, including late charges, for each of the clients referred by Broker and accepted by the agency.

- The parties agree to waive trial by jury in the event of any action arising out of the Agreement.

- This USA Broker Agreement for Factoring template is provided in MS Word format, and is fully editable to fit your particular circumstances.

$12.49

California Customer Account Agreement and Terms of Sale

California businesses can create credit accounts for new customers with this downloadable Customer Account Agreement.

- The agreement includes:

- terms of sale, due dates for payment, interest rate on outstanding account balances,

- the seller's limited warranty,

- limitation on the seller's liability,

- delivery of goods to the customer,

- use of purchase orders.

- You can easily customize the Customer Account Agreement and Terms of Sale to reflect the unique character of your business.

- Available in MS Word format.

- Intended for use in the State of California.

$12.49 $8.99

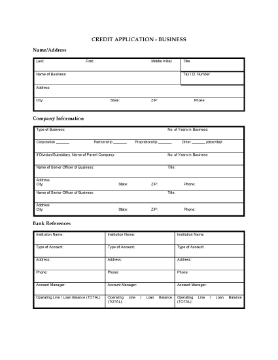

Credit Application Package for Corporate Customers

Your corporate customers can apply for a credit account with your company by filling out these Credit Application forms.

The package includes:

- Credit Application Form for Business;

- Credit Check form, for obtaining information from the trade and banking references supplied by the customer;

- template letter of refusal, to notify the customer if the application for credit has been denied due to the results of the credit check.

This Credit Application Forms Package for Corporate Customers is a downloadable MS Word file which can be filled in by hand or computer.

$4.99

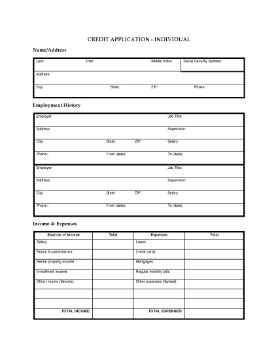

Credit Application Package for Personal Accounts

Extend credit to individuals with this Credit Application Package for personal accounts.

- The package includes:

- Credit Application for Individual, to be completed by the customer;

- Credit Check, to gather information from employment and banking references supplied by the customer;

- Letter of Refusal, to notify the customer if the application for credit has been denied due to the results of the credit check.

- The Credit Application forms package for personal accounts is easy to download and use. You can customize it to reflect your unique business image.

$4.99

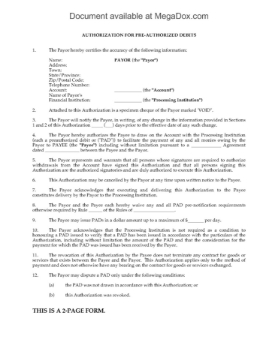

Debit Pre-Authorization Form | Canada

Set up pre-authorized payments by direct debit from a customer's bank account with this Authorization Form, for Canadian merchants and financial institutions.

- The payments will be processed in accordance with the Rules of the Canadian Payments Association.

- This form can be used for regular payments on a mortgage or loan, insurance premiums, investments, pension plan contributions, or payments on a customer's account.

- The authorization can be revoked at any time, but the revocation does not alter the customer's obligations to make payments.

- Includes instructions for the procedure by which the customer can dispute a payment that has been improperly withdrawn.

Payments by pre-authorized debit are easier for both the customer and the creditor. Download the Authorization Form template for your customers.

$6.29

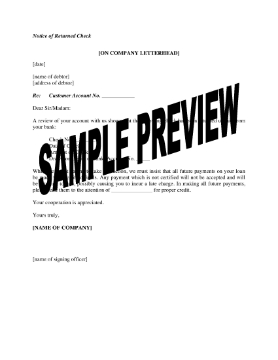

Demand for Payment Letters

Have you got customers that won't pay? Demand payment with one of these 8 customizable demand letter templates.

- Notice of Returned Check

- Reminder Letter and Request to Contact Credit Manager

- Notice of Declined Credit Card

- Notice to Preferred Customer of Overdue Account

- Notice that Account Will Be Referred to Collection Agency

- Final Demand for Payment

- Final Notice Before Legal Action

- Notice of Intention to Commence Legal Proceedings.

Don't allow non-paying customers to drain your cash flow. Download these Demand for Payment Letters and start collecting today.

$9.99

Factoring and Security Agreement with Full Recourse | Canada

Purchase the accounts receivable of a Canadian business with this Factoring and Accounts Receivable Security Agreement with Full Recourse.

- Under this Agreement (also called a debt purchase contract), a company needing cash for operations sells its accounts receivable to a factor (buyer) for an immediate cash injection, at a discounted rate off the face value of the accounts.

- The buyer has full recourse against the seller for the full amount of any receivable which is not paid or disputed by a customer, together with interest on unpaid accounts.

- The template is provided in MS Word format and is fully editable to meet your needs.

- This is a Canadian legal form which can be used in most provinces and territories.

$29.99

- 1

- 2