Product tags

Related products

Saskatchewan GST Exemption Certificate for Sale of Real Property

When you resell a residential property in Saskatchewan, you must complete this GST Exemption Certificate and provide it to the purchaser.

- The seller certifies that the real estate in question is a residential property being resold within the meaning of the Excise Tax Act and that the seller has not claimed an input tax credit.

- This form is for resales only and cannot be used for new construction.

$0.00

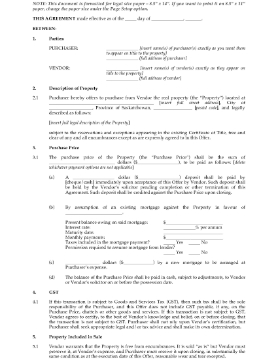

Saskatchewan Offer to Purchase Residential Real Estate

Make an offer to buy a residential property in Saskatchewan with this Offer to Purchase Residential Real Estate.

- GST. The purchaser is responsible for paying any GST payable on the purchase of the property.

- Conditions Precedent. The offer is conditional upon the purchaser obtaining mortgage financing and a satisfactory home inspection report.

- Condominiums. If the property is a condominium, the seller must provide the purchaser with condominium documents (estoppel certificate, bylaws, etc).

- Binding on Acceptance. Upon acceptance by the seller, the offer will form a legally binding contract between the parties for the purchase and sale of the real estate property.

- The form includes a Property Disclosure Statement to be completed by the seller, as required by provincial law.

- Available as a Microsoft Word file, and is fully editable to fit your circumstances.

- Intended to be used only in the Province of Saskatchewan, Canada.

$17.99