Investor Forms

Raise venture capital, manage investor relations and keep investors informed with these contracts, notices and legal forms.

If your company has outside shareholders and investors, you should delegate someone to handle investor relations. This person should be fluent in the language of finance, and have good communication and marketing skills. He or she must also keep current on all securities laws and regulations that apply to your company, and knowledgeable in the areas of compliance, reporting and fiduciary duty.

Most securities commissions provide information and seminars, and there are national organizations in many countries which hold training courses and ongoing informational sessions for investor relations officers.

Sort by

Display per page

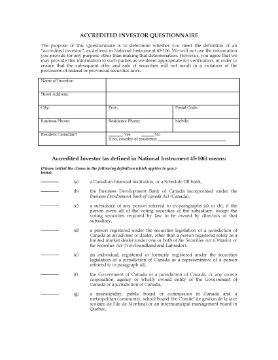

Accredited Investors Checklist and Representation Letter | Canada

Prepare an Accredited Investors Checklist and Representation Letter for a private offering of securities with this downloadable template for Canadian securities.

- The checklist sets out all of the classifications of investors which are defined as accredited investors by National Instrument 45-106.

- Any person, corporation or entity subscribing for the securities must complete the form and return it to the issuer.

- The subscriber must also make certain representations to the issuer regarding whether they are a Canadian resident, and on what basis they are purchasing the securities.

- This template is available in MS Word format and can be easily edited to meet your needs.

- Intended for use only in Canada.

$17.99

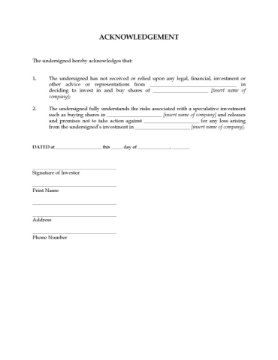

Acknowledgement by Investor of No Advice Given

Prepare an Acknowledgement to be signed by an investor to acknowledge that no advice has been given to the investor with respect to an investment.

- This is a generic form which can be used anywhere.

- Click the Download button to download a copy of the form.

- Available in MS Word format.

$0.00

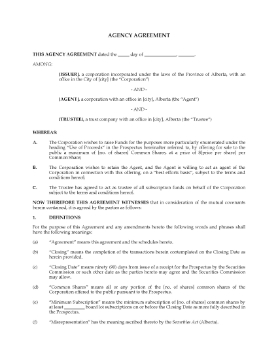

Alberta Agency and Trustee Agreement

Retain a sales agent and a trustee in connection with a public offering of shares under a prospectus with this Agency and Trustee Agreement for Alberta issuers.

- The issuer (offering corporation) retains the Agent to sell the securities on a 'best efforts' basis.

- The Trustee will hold all subscription funds on behalf of the issuer.

- The Agent may enter into arrangements with other investment dealers registered to sell securities in Alberta, at no additional cost to the issuer.

- The Trustee will keep the subscription funds in a daily-interest escrow account or in short-term interest-bearing securities.

- The issuer indemnifies the Trustee against claims or losses, and against its costs incurred in the performance of its duties.

- The issuer also indemnifies the Agent against claims or losses, costs or expenses (except loss of profits).

- Available in MS Word format.

- Intended to be used in the Province of Alberta, Canada.

$29.99

Alberta Co-Owner Certificate for Syndicated Mortgage Transaction

Prepare a Co-Owner's Certificate for each investor in a syndicated land mortgage in Alberta with this template form.

- The Certificates are issued to the investors (co-owners) by a company which is acting as bare trustee of the land on behalf of the co-owners.

- The Certificate represents the investor's undivided interest in the mortgage and as a co-owner of the land.

- This template is available in MS Word format and is fully editable.

- Intended for use only for lands located in the Province of Alberta.

$2.29

Alberta Co-Owner Certificate for Units in Syndicated Mortgage

Issue Co-Owner Certificates to investors for units in a syndicated mortgage with this template form for Alberta.

- Each of the investors who have purchased an undivided interest in the syndicated mortgage will be issued a certificate evidencing their tenancy-in-common share in the mortgage.

- Interest will be calculated annually and paid quarterly.

- All percentage ownerships rank pari passu (that is, equally on a proportionate basis).

- The certificates are subject to redemption by prepayment or repayment of the mortgage.

- This form is a downloadable MS Word template.

- Intended for use only in the Province of Alberta, Canada.

$6.29

Alberta Co-Owner Power of Attorney re Syndicated Mortgage

Prepare a Power of Attorney from a co-owner (investor) in a syndicated mortgage investment with this fully editable template form for Alberta transactions.

- The co-owner appoints the issuer of the investment (developer) as his/her attorney with respect to executing, filing and registering any documents necessary to document and protect the co-owner's interest in the mortgaged lands.

- This legal form template is available as a downloadable MS Word template.

- Intended for use only in the Province of Alberta, Canada.

$6.29

Alberta Directors Resolutions Authorizing Warrant Indenture

Prepare a Resolution of the Directors authorizing a Warrant Indenture with this downloadable template for Alberta corporations.

- The Board of Directors authorizes the corporation to issue a warrant indenture and share warrants for common shares.

- The warrants are issued to investors as part of a private placement of securities, in order to raise capital for the corporation.

- Each warrant entitles the holder to one common share.

- The form is easy to download, fill in and print. Available in MS Word format.

- Intended for use by corporations formed in the Province of Alberta, Canada.

$6.29

Alberta Employee Statutory Declaration re Purchase of Syndicated Mortgage Units

Prepare Statutory Declarations to allow employees of a company which is party to a syndicated mortgage transaction to purchase mortgage units with this easy form for Alberta.

- The employee must provide the issuer with the Statutory Declaration in compliance with Securities Act regulations.

- The Declaration states that the employee is not required to purchase the units as a term of his/her employment, and that s/he has read the offering memorandum for the syndicated mortgage offering.

- This legal form template is available in MS Word format.

- Intended for use in the Province of Alberta, Canada.

$2.29

Alberta Forms for Meeting of Development Co-Owners

Prepare the forms needed for an annual meeting of the co-owners / investors in a land development project with this downloadable package of templates for Alberta.

- Each of the co-owners is a registered owner and holds an undivided interest in the land comprising the development.

- This package of forms contains:

- Form of Proxy which allows a co-owner to appoint a proxy to vote at the meeting if he/she is unable to attend,

- Notice of Meeting of Co-Owners, setting out the business to be conducted at the meeting,

- Information Circular / Annual Report prepared by the agent for the co-owners.

- Available in MS Word format.

- Intended to be used only in the Province of Alberta, Canada.

$17.99

Alberta Offering Memorandum Checklist

Put together the necessary information and resources you need to issue an offering memorandum for securities with this handy Alberta Offering Memorandum Checklist, which covers:

- Determination of the risk factors

- Details of the offering

- Objectives of the offering

- Use of the proceeds

- Corporate structure and history of the issuer

- Directors, officers, promoters, principal holders of securities

- Description of the offered securities

- Minimum and maximum number of securities offered

- Information about the seller

- Financial statements and material contracts

- Tax consequences

- Exemptions.

Simplify the private placement process - get this Alberta Offering Memorandum Checklist.

$12.49