UNITED STATES

Document a loan to a borrower with these customizable Loan Transaction Forms for US lenders.

Q. Why do I need to do paperwork for a loan to a family member or a friend?

A. No matter who you're lending money to, you need to document the loan and charge simple interest on the principal amount. If you don't document the loan, you may end up paying gift taxes on the proceeds. And if you don't set an interest rate, the tax department will do it for you and they will charge income tax on interest income you never received.

Q. What interest rate should I charge?

A. Each state has its own legal lending rate, being the highest rate of interest that can be charged on personal loans. They may also have a usury limit, which is a statutory maximum rate of interest. Anything in excess of this rate is deemed to be usury. In states that do not have a usury limit, the federal government may still impose a limit on the interest rate. Late fees or other charges may also be counted as interest.

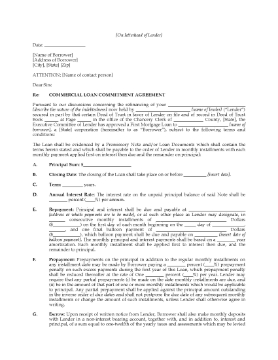

Commercial Loan Commitment Letter | USA

USA lenders, prepare a Commercial Loan Commitment Letter with this fully customizable template which sets out the terms of the loan and how it is to be repaid.

- The commitment letter template includes:

- monthly payments to be made into escrow for property taxes and hazard insurance,

- documents and other instruments to be given by the borrower as security,

- form and amounts of title insurance and hazard insurance required by the lender,

- payment of closing costs by the borrower,

- protection, preservation and maintenance of the property used as security,

- other standard provisions.

- This is a customizable template that can be used throughout the United States.

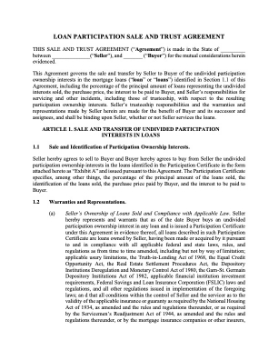

Loan Participation Sale and Trust Agreement | USA

Under this Agreement, a lead lender (Seller) participates in one or more loans by transferring an undivided participation ownership interest in the loan to another lender (Buyer).

- The Buyer receives a percentage yield on its interest, plus a pro rata participation in any interest collected.

- The Seller is entitled to the remainder of the interest plus any default penalties, late charges, etc.

- The Seller will act as trustee with fiduciary duties to hold the participation ownership and legal title to the loans and receipts, and to make the required remittances.

- The Seller, as trustee, will retain all loan documents, mortgage notes, and related items.

- The Seller will continue to service the loans in the same manner as it services loans for its own account.

- Available as a fully editable MS Word template.

- Intended to be used only in the United States.

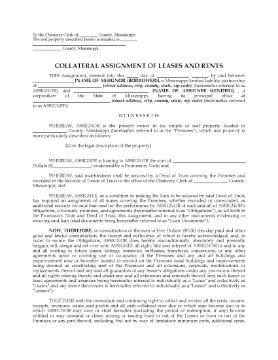

Mississippi Assignment of Leases and Rents

Mississippi lenders, prepare a Collateral Assignment of Leases and Rents for execution by a corporate borrower, with this fully editable template.

- The borrower assigns to the lender all of its interest in the leases and rents payable in respect of property owned by the borrower, to secure repayment of a commercial business loan.

- The lender also has the right to collect all revenues from the leases, including parking fees, taxes and insurance contributions, and liquidated damages after default.

- The borrower indemnifies and holds the lender harmless from any liability, loss or damage.

- The borrower will not amend any lease, or terminate or accept surrender of any lease without the lender's consent.

- All rentals collected from the premises are to be applied firstly to repayment of the debt.

Mississippi Certificate of Corporate Borrower

This Mississippi Certificate of Corporate Borrower is part of the paperwork documenting and securing a commercial loan. An officer of the corporation makes certifications regarding:

- the borrower's corporate status, its legal and valid authority to enter into the agreement,

- the financial situation of the borrower,

- the title and status of the property being mortgaged by the borrower as security for the loan,

- the presence of any hazardous substances on the property,

- the existence of any legal actions against the borrower or with respect to the property.

Mississippi Commercial Deed of Trust and Security Agreement

Use a commercial property as security for a loan with this Deed of Trust and Security Agreement for Mississippi.

- Title to the property is transferred to the lender who will act as trustee and hold the title as security for the borrower's repayment of a commercial business loan.

- If the borrower defaults in making its loan payments, the entire balance immediately becomes due and payable and the lender may foreclose on the property.

- The borrower is responsible for paying all taxes, assessments, liens and other charges against the property.

- This is a customizable legal form that is easy to use and can be re-used as often as you like.

If you make business loans in Mississippi, you need a copy of the Commercial Deed of Trust and Security Agreement. Buy and download it for your document library.

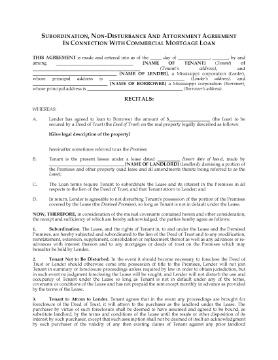

Mississippi Subordination, Non-Disturbance and Attornment Agreement

- The Agreement is between the lender, the borrower, and a tenant who has leased all or part of the mortgaged premises.

- The tenant agrees to subordinate the lease and its leasehold rights to the lender's lien in connection with the mortgage loan.

- If the lender forecloses on the property, the lender agrees not to disturb the tenant's use of the leased premises so long as the tenant is not in default under the lease.

- If the property is foreclosed and sold, the tenant agrees to attorn to the purchaser as the landlord under the lease.

Notice of Intention to Sell Property | USA

USA lenders, serve a debtor with this Notice of Intention to Sell Property before the sale, in accordance with applicable laws in your State.

- The property was pledged as collateral security for a loan from the lender to the debtor.

- The lender (secured party) prepares and serves the Notice to advise the debtor that the property will be sold either through private sale or at public auction, to cover all or part of the outstanding debt, following default by the debtor in making payment.

- The form includes a Certificate of Service, to record how the Notice was served on the debtor.

- This Notice form is available as a MS Word template document which is downloadable and easy to use.

- The form can be used in States that do not have a statutory form.

Notice of Right to Rescission | USA

Prepare a Notice of Right to Rescission for your customers with this template form for the United States.

- This notice is required by law to be given to a customer in relation to a loan, lease, purchase or other transaction which could result in a lien or security interest being placed on the customer's home.

- The notice sets out the customer's right to cancel (rescind) the contract within three business days of the transaction date, and details the procedure for canceling.

- This is a reusable legal form. Pay for the document once, download it, then use it as often as you require.

- Intended to be used only within the United States.

Promissory Note Secured by Real Estate | USA

USA lenders, use this easy template form to prepare a Promissory Note Secured by Real Estate.

- The Note allows the borrower to pay the principal and interest in monthly payments until paid.

- The total loan amount can be prepaid at any time without penalty.

- The Note is secured by a Deed of Trust on real estate property owned by the borrower.

- The form is fully editable and is easy to download, fill in and print.

- Available in MS Word format.

- Intended to be used only in the United States.

Revolving Loan Agreement | USA

Provide revolving credit facilities to a corporate borrower under the terms of this Revolving Loan Agreement.

- This is a digital template for lenders in the United States.

- The Loan Agreement allows the borrower to borrow and reborrow funds up to a specified maximum amount.

- The borrower grants the lender a security interest in all of the borrower's assets and proceeds.

- Interest is computed daily and is payable monthly on the last day of the month.

- The loan may be paid out in whole or in part at any time without penalty.

- Available as a downloadable and fully editable MS Word document.

- 1

- 2