UNITED STATES

Create an incentive plan for your company's employees, directors, and consultants with these template Stock and Incentive Plan Forms.

- The templates are intended for use by companies incorporated in the United States.

- These forms are not State-specific. Check your State laws to make sure there are no additional provisions required by legislation.

- All templates are fully editable and can be easily customized to fit your exact needs.

Sort by

Display per page

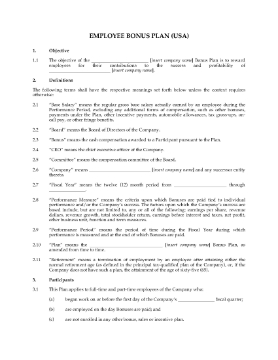

Employee Bonus Plan | USA

Reward your employees for their contributions to your company's success with this Employee Bonus Plan for U.S. businesses.

- All full-time and part-time staff who are not enrolled in any other type of incentive plan with the company are eligible to take part.

- The committee administering the plan will have full authority to set the performance criteria upon which bonuses are determined, and the bonus amounts to be paid out.

- The members of the committee, board of directors, and employees involved in administering the Plan are not liable to any person for any good faith action or determination made with respect to the Plan.

- A bonus pool will be established for each period during which performance measurements are evaluated. The bonus pool will be allocated among the eligible participants as determined by the committee.

- Available as a fully editable MS Word download.

- Intended for use in the United States.

$29.99

Restricted Stock Award Plan | USA

With this easy template, you can set up a Restricted Stock Award Plan for your company, under current United States securities legislation.

- Under this type of Plan, a company can provide incentives to its key personnel through awards of restricted shares of common stock.

- The company will reimburse the employee for any amounts he/she has to pay as a consequence of any such award (such as income tax).

- Stock subject to an award is forfeited if the participant ceases to work for the company or retires within a specified time after the date of the award.

- If a participant dies, his or her estate retains the stock.

- Incentives like this Restricted Stock Award Plan help attract and retain top flight talent. Download the template for your business.

- Intended to be used only in the United States.

$17.99

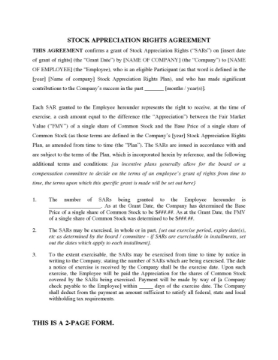

Stock Appreciation Rights Agreement | USA

Grant Stock Appreciation Rights to key personnel in your company under the terms of this template Agreement.

- The Agreement is between the company and one of its key personnel, pursuant to a Stock Appreciation Rights (SAR) Plan.

- The employee is being granted a number of SARs with respect to common shares issued to the employee as compensation for performance.

- Upon being exercised, the SARs will give the employee the right to receive a cash payment of the difference between the between the Fair Market Value (FMV) and the Base Price of a single share of common stock in the company.

- The Agreement sets out the number of SARs being granted, how they are to be exercised, the term of the exercise period, and other conditions relating to the employee's rights and obligations under the SAR Plan.

- The Agreement is governed by the securities laws of the United States.

$12.49

Stock Appreciation Rights Plan for Employees and Officers | USA

Set up a phantom stock program for employees and officers of a U.S. company under this Stock Appreciation Rights (SAR) Plan.

- SAR Rights will be awarded as a reward for significant contributions, and as a means of attracting and retaining quality personnel.

- The Plan includes provisions for exercise of Rights within a specified time following termination of employment, retirement, death or disability of a participant.

- If the share capital is subdivided or reorganized, the number of SARs under the Plan will be adjusted proportionally.

- SARs are not transferrable except under a will or by law of descent.

- The digital template also contains a Stock Appreciation Rights Agreement to be signed by the participant receiving the SARs.

- This is a digital download that is fully editable and can be easily customized to fit your requirements.

- Intended to be used only in the United States.

$29.99

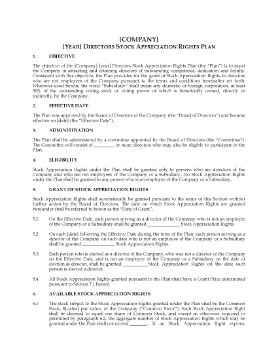

Stock Appreciation Rights Plan for Non-Employee Directors | USA

Establish a Stock Appreciation Rights (SAR) Plan for non-employee directors of a USA company under the terms of this downloadable template.

- The longer the participant has contributed services to the company, the more SAR Rights are vested.

- Rights become fully vested upon the death, disability or retirement of a participant, or upon a merger, consolidation or disposition of substantially all of the company's assets.

- Upon any subdivision or reorganization of the share capital of the company, the number of SARs under the Plan will be adjusted proportionally.

- Rights under the Plan are not transferrable.

- Available in MS Word format and fully customizable.

- Intended to be used only in the United States.

$19.99

USA Deferred Compensation Plan for Outside Directors

Set up a Deferred Compensation Plan for outside directors with this downloadable template for USA companies.

- The plan is only for directors who are not employees of the company or any of its subsidiaries.

- The Plan allows the non-employee directors to defer receipt of all compensation which would otherwise be paid to them for acting as a director, for income tax purposes.

- A participant in the Plan can elect to have the deferred compensation invested in shares of the company's common stock or let it accumulate and earn interest.

You can customize this Deferred Compensation Plan to fit your company's needs and specifications. Download it today.

$17.99

USA Employee Stock Purchase Plan (payroll deduction based)

Give employees a chance to participate in the company under this payroll-deduction based Employee Stock Purchase Plan.

- Employees are given the opportunity to acquire a proprietary interest in the company by purchasing shares through automatic payroll deductions.

- The employee may reduce or increase the amount of payroll deduction at certain times.

- The employee will be granted a separate purchase right for each offering period, which will be automatically exercised in installments on each successive purchase date within the offering period.

- The employee may terminate outstanding purchase rights at any time prior to the next scheduled purchase date.

- Shares may not be transferred until they have been held at least one year.

This payroll-deduction based employee stock purchase plan is for U.S. companies and is prepared in accordance with United States laws and regulations.

$29.99

USA Equity Based Long Term Incentive Plan

Set up an Equity-Based Long Term Incentive Plan in your company with this downloadable template for U.S. companies.

- The Plan was created pursuant to United States securities legislation.

- The Plan allows a company's key employees and officers to participate in the company as stockholders.

- A good incentive plan like this one improves the company's ability to attract and retain top-notch dedicated key employees.

- Awards under the Plan might take the form of stock options, stock appreciation rights, deferred stock or restricted stock, or any combination of these.

Get your copy of the USA Equity Based Long Term Incentive Plan and start rewarding your key people.

$29.99

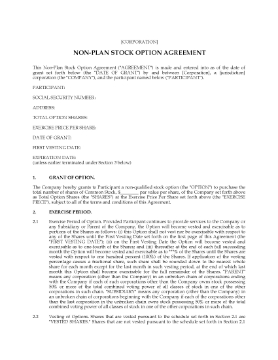

USA Non-Plan Stock Option Agreement

Set up a Non-Plan Stock Option Agreement for a U.S. company under the terms of this downloadable template.

- The Option Agreement provides a means for a qualified employee to purchase stock which is not subject to a stock option plan.

- The option may not be transferred.

- There may be tax liability upon the exercise of the Option.

- To exercise the option, the employee must give the company a signed option notice, together with payment for the shares.

- Includes procedures for dealing with the options upon termination of the employee's employment due to death, disability, or for cause.

The USA Non-Plan Stock Option Agreement is a customizable digital template that you can download immediately after purchasing.

$29.99

USA Non-Qualified Stock Option and Stock Appreciation Rights Plan

Establish a stock incentive plan for your officers and key employees with this Non-Qualified Stock Option and Stock Appreciation Rights Plan.

- The Plan is intended to enable officers and employees to acquire an interest in the company, and to provide incentives and encourage loyalty.

- Executive, administrative, professional and technical personnel are eligible to receive options or stock appreciation rights for common shares under the Plan.

- The Board of Directors may require the employee to remain employed by the company for a specified amount of time.

- A participant may be granted Stock Appreciation rights at the same time that they are awarded options.

- The Plan is written pursuant to United States securities regulations.

Get the Non-Qualified Stock Option and Stock Appreciation Rights Plan template and start rewarding your key people.

$17.99

- 1

- 2