Real Estate Forms

Are you buying or selling real estate? When you purchase one of our template Real Estate Forms, you get a convenient ready-made product that saves you money on costly legal fees.

- Standardized forms for residential or commercial real estate property.

- Downloadable, customizable, fill-in-the-blank templates.

- Country, state, and province specific legal forms.

- Offers, real estate purchase and sale contracts, For Sale by Owner packages.

- Title deeds and conveyancing forms.

- Realtor and broker listing contracts.

- Forms updated regularly to comply with changes to laws and regulations.

New Hampshire Quitclaim Deed

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This New Hampshire Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

New Hampshire Quitclaim Deed for Joint Ownership

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This New Hampshire Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

New Hampshire Quitclaim Deed from Husband and Wife to Individual

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This New Hampshire Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

New Hampshire Special Warranty Deed

Transfer ownership of a NH real estate property with this easy-to-use New Hampshire Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.This New Hampshire Special Warranty Deed form is a downloadable legal document in MS Word format.

New Hampshire Warranty Deed for Joint Ownership

Transfer title to a NH real estate property from joint tenants to joint tenants with this New Hampshire Warranty Deed for Joint Ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the surviving joint tenant.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

New Hampshire Warranty Deed Form

Transfer ownership of a real estate property in New Hampshire from a seller to a buyer with this New Hampshire Warranty Deed form.

The seller (the grantor) covenants that:- it has good and marketable title to the property,

- it has the legal right and authority to transfer the title to the buyer, and

- it will forever defend the right of the buyer (the grantee) to possess the property.

New Jersey Bargain and Sale Deed with Covenants

Transfer title for a real estate property in New Jersey with this Bargain and Sale Deed with Covenants as to Grantor's Acts.

- In this document, the seller of the property is called the grantor and the buyer is called the grantee.

- The grantor warrants (guarantees) the title only against those defects that arose during his/her ownership of the property, but not against any title defects that existed before that time.

- The Deed also contains a covenant (promise) that the grantor has not done anything to encumber the property (such as a mortgage).

- This form of Deed is commonly used to transfer ownership of properties that have been seized for unpaid taxes, or that are being sold by an executor of an estate.

New Jersey Exclusive Real Estate Listing Agreement

Hire a realtor to list a New Jersey residential property for sale using this New Jersey Exclusive Real Estate Listing Agreement.

- The property owner gives the listing agent the full rights to sell the property for an agreed minimum selling price.

- The owner agrees to provide a certificate of title.

- The owner agrees to allow a certain number of days for the listing to be in effect.

- Provisions regarding commission splits required under NJAC 11:5-6.1.

- The contract includes a Waiver of Broker Cooperation form.

- This form is available in MS Word format and is fully editable to fit your specific circumstances.

- Intended to be used only in the State of New Jersey.

New Jersey Quitclaim Deed

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This New Jersey Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

New Jersey Quitclaim Deed for Joint Ownership

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This New Jersey Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

New Jersey Quitclaim Deed from Husband and Wife to Individual

Transfer title to a real estate property in New Jersey from two spouses to one person with this easy-to-use Quitclaim Deed from Husband and Wife to Individual.

- Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property.

- This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

- Available in MS Word format and easy to use and fully customizable.

- Intended to be used only in the State of New Jersey.

New Jersey Warranty Deed for Joint Ownership

Transfer title of a NJ real estate property from two sellers to two buyers with this New Jersey Warranty Deed for joint ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

New Jersey Warranty Deed Form

Transfer ownership of a New Jersey real estate property from a seller to a buyer with this New Jersey Warranty Deed form.

The seller (the grantor) covenants that:- it has good and marketable title to the property,

- it has the legal right and authority to transfer the title to the buyer, and

- it will forever defend the right of the buyer (the grantee) to possess the property.

New Mexico Quitclaim Deed

Transfer your interest in a real estate property in New Mexico with this easy-to-use Quitclaim Deed.

- Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property.

- This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

- The form is provided in MS Word format and is easy to download, fill in and print.

- This Quitclaim Deed form is intended for use in the State of New Mexico.

New Mexico Quitclaim Deed for Joint Ownership

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees can take title either as:

- joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant, or

- community property with rights of survivorship, or

- community property without rights of survivorship.

This New Mexico Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

New Mexico Quitclaim Deed from Husband and Wife to Individual

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This New Mexico Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

New Mexico Special Warranty Deed

Transfer ownership of a real estate property in New Mexico with this Special Warranty Deed form.

- Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property and not against defects existing before that time.

- This is a downloadable MS Word document which is easy to fill in with the details of your transaction.

- Intended solely for use in the State of New Mexico.

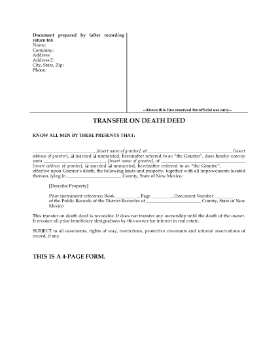

New Mexico Transfer on Death Deed Forms

Avoid probate of your real estate property upon your death with these New Mexico Transfer on Death Deed Forms.

- The Transfer on Death Deed (also called a Beneficiary Deed or a TOD) must be signed and registered with the Recorder's Office before the original owner passes away.

- Even though the property is deed into the beneficiary's name, the original owner still has rights to the property and can do whatever he or she pleases with the property until the time of his or her death, without the beneficiary's permission.

- The package also includes a Revocation of Transfer on Death Deed, in case you want to cancel the Transfer on Death Deed after it has been filed.

- These New Mexico Transfer on Death Deed Forms are easy to use. Fill them in, sign them, and have them notarized before recording the Deed with the County Recorder.

New Mexico Warranty Deed for Joint Ownership

Transfer title of a NM real estate property from two sellers to two buyers with this New Mexico Warranty Deed for joint ownership with rights of survivorship.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

- The buyers can take title either as:

- joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant, or

- community property with rights of survivorship, or

- community property without rights of survivorship.

- The Warranty Deed includes a Community Property Agreement to be signed by the buyers, if applicable.

- This is a downloadable legal form intended for use in the State of New Mexico.

New Mexico Warranty Deed Form

Transfer ownership of a real estate property in New Mexico from a seller to a buyer with this New Mexico Warranty Deed form.

The seller (the grantor) covenants that:

- it has good and marketable title to the property,

- it has the legal right and authority to transfer the title to the buyer, and

- it will forever defend the right of the buyer (the grantee) to possess the property.

This New Mexico Warranty Deed form is a downloadable legal document in MS Word format.

New York Bargain and Sale Deed With Covenants

Transfer ownership of a real estate property in the State of New York with this Bargain and Sale Deed With Covenants Against Grantor's Acts.

- A Bargain and Sale Deed makes no warranty as to encumbrances against title.

- This form of Deed is commonly used to transfer title for properties that have been seized for unpaid taxes or that are being sold by the executor of an estate.

- The grantor covenants that it has not encumbered the property, and that it will hold the consideration for the property in compliance with Section 13 of the Lien Law.

This New York Bargain and Sale Deed With Covenants Against Grantor's Acts form is provided in MS Word format and is easy to download, fill in and print.

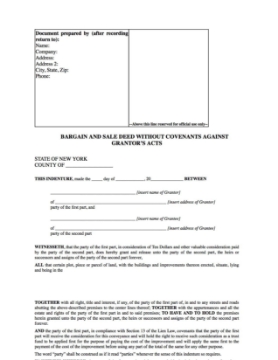

New York Bargain and Sale Deed Without Covenants

Transfer ownership of a real estate property in the State of New York with this Bargain and Sale Deed Without Covenants Against Grantor's Acts.

- A Bargain and Sale Deed is commonly used to transfer title for properties that have been seized for unpaid taxes or that form part of the estate of a deceased and that is being sold by an executor.

- There are no warranties given as to title.

- The grantor does not make any covenants with the grantee as to any acts of the grantor with respect to the property. But the grantor does covenant to hold the consideration for the property in compliance with Section 13 of the Lien Law.

This New York Bargain and Sale Deed Without Covenants Against Grantor's Acts form is available as a MS Word document and is easy to download, fill in and print.

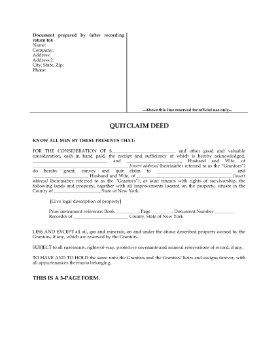

New York Quitclaim Deed

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This New York Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

New York Quitclaim Deed for Joint Ownership

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This New York Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

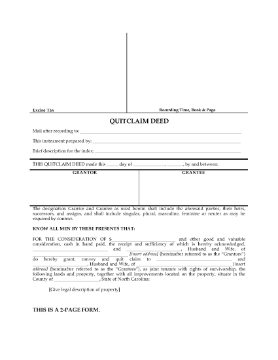

New York Quitclaim Deed from Husband and Wife to Individual

Transfer ownership of a real estate property in New York State from two spouses to one person with this easy-to-use Quitclaim Deed from Husband and Wife to Individual.

- Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property.

- This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

- This legal form template is available in MS Word format and is easy to use and fully customizable.

- Intended for use only in New York State.

New York Warranty Deed for Joint Ownership

Transfer ownership of a NY real estate property from joint tenants to joint tenants with this New York Warranty Deed for Joint Ownership.

- This form of Warranty Deed is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, title to the property will pass to the surviving joint tenant.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

New York Warranty Deed with Full Covenants

Transfer ownership of a New York real estate property from a seller to a buyer with this New York Warranty Deed with Full Covenants form.

The seller (the grantor) covenants that:

- it has good and marketable title to the property,

- it has the legal right and authority to transfer the title to the buyer, and

- it will forever defend the right of the buyer (the grantee) to possess the property.

This New York Warranty Deed with Full Covenants form is a downloadable legal document in MS Word format.

New Zealand Option to Purchase Land

The option will remain valid until a Sale & Purchase Agreement is submitted to the optionee for signing. The Agreement must be signed and returned to the optionor within a specified number of days or the option will automatically lapse.

The New Zealand Option to Purchase Land is provided in MS Word format and can be easily edited.

Newfoundland GST Certificate of Exempt Supply

When reselling real estate property in NL, provide the purchaser with this GST Certificate of Exempt Supply.

- The seller of the property certifies that:

- the property is a residential property being resold within the meaning of the Excise Tax Act,

- the seller is not the builder, and

- the seller has not claimed an input tax credit.

- Available in MS Word format.

- Intended to be used only in the Province of Newfoundland and Labrador, Canada.

North Carolina Quitclaim Deed

Transfer your interest in a real estate property in North Carolina with this easy-to-use Quitclaim Deed.

- Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property.

- This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

- This template form is provided in MS Word format and is easy to download, fill in and print.

- Intended for use only in the State of North Carolina.

North Carolina Quitclaim Deed for Joint Ownership

Transfer the interest in a real estate property in North Carolina from a husband and wife to another husband and wife with this Quitclaim Deed for Joint Ownership with rights of survivorship.

- The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property.

- The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

- This form is available in MS Word format and is easy to use.

- Intended to be used only in the State of North Carolina.

North Carolina Quitclaim Deed from Husband and Wife to Individual

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This North Carolina Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

North Carolina Quitclaim Deed to Transfer to LLC

The sellers convey and transfer the property to the limited liability company but do not provide any warranties regarding the property.

This North Carolina Quitclaim Deed to Transfer to LLC form is provided in MS Word format and is easy to download, fill in and print.

North Carolina Real Estate Purchase and Sale Agreement

Sell a residential NC property with this North Carolina Real Estate Purchase and Sale Agreement.

- Fee Simple Title. The seller is responsible for providing fee simple title to be conveyed by warranty deed to the buyer.

- Forms of Financing. The contract can be used in transactions with new mortgage financing, seller financing and/or assumption of an existing mortgage loan. The contract also contains optional clauses for FHA/VA financing.

- Property Inspection. The buyer has the option to accept the property as is or perform a property inspection.

- Lead Disclosure. The form includes a lead paint disclosure, as required by federal law.

- Default. Provisions setting out the consequences of default by either party.

North Carolina Special Warranty Deed

Transfer title of a NC real estate property to a new owner with this easy-to-use North Carolina Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against any title defects existing prior to that time.

This North Carolina Special Warranty Deed form is a downloadable legal document in MS Word format.

North Carolina Warranty Deed for Joint Ownership

Transfer ownership of a NC real estate property from two sellers to two buyers with this North Carolina Warranty Deed for Joint Ownership.

- This form of Warranty Deed is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the surviving joint tenant.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

- This form is provided in MS Word format and is easy to download, fill in and print.

- Intended for use only in the State of North Carolina.

North Carolina Warranty Deed Form

A Warranty Deed is the most common means of transferring ownership of real estate properties in North Carolina.

- In a warranty deed, the grantor (seller) covenants that:

- he or she has good and marketable title to the real estate,

- he or she has the authority and power to transfer the title to the buyer, and

- he or she will forever defend the buyer's right to possession of the property.

- Available in MS Word format.

- Intended to be used only in the State of North Carolina.

North Dakota Quitclaim Deed

Transfer your ownership interest in a ND real estate property with this easy-to-use North Dakota Quitclaim Deed.

- The transferor (grantor) conveys all of its interest in the property to the transferee (grantee) but does not provide any warranties regarding the property.

- This form of Deed is generally used to remove one spouse's name from title following divorce proceedings.

North Dakota Quitclaim Deed for Joint Ownership

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This North Dakota Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

North Dakota Quitclaim Deed from Husband and Wife to Individual

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This North Dakota Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

North Dakota Special Warranty Deed

Transfer ownership of a real estate property in the State of North Dakota with this Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property, but not against any title defects that existed before that time.This North Dakota Special Warranty Deed form is available as a downloadable MS Word document, and is easy to fill in with the details of your transaction.

North Dakota Warranty Deed for Joint Ownership

Transfer ownership of a ND real estate property from two sellers to two buyers with this North Dakota Warranty Deed for Joint Ownership.

- This form of Warranty Deed is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the surviving joint tenant.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

North Dakota Warranty Deed Form

Transfer ownership of a property in North Dakota from a seller to a buyer with this easy-to-use North Dakota Warranty Deed form.

The grantor (seller) covenants that:- it has good and marketable title to the real estate,

- it has the authority and power to transfer the title to the buyer, and

- it will forever defend the buyer's right to possession of the property.

Nova Scotia Assignment of Real Estate Purchase and Sale Agreement

Transfer your interest as purchaser of a real estate property in Nova Scotia with this ready-made Assignment of Real Estate Purchase and Sale Agreement.

- In exchange for a specified sum, the assignor signs over his/her interest in the Purchase and Sale Agreement to an assignee.

- This form is provided in MS Word format and is easy to download and use.

- Intended to be used only in the Province of Nova Scotia, Canada.

Nova Scotia Confirmatory Deed

Prepare a Confirmatory Deed for a Nova Scotia property with this template form.

- The Confirmatory Deed must be registered with the Registry of Deeds in order to correct an error in the original Deed under which the land described in the Deed was transferred by the previous owner to the current owner.

- Available as a MS Word download.

- Intended to be used only in the Province of Nova Scotia, Canada.

Nova Scotia Counter Offer for Sale of Real Estate Property

Respond to an offer to buy a real estate property in Nova Scotia with this easy-to-use Counter Offer form.

- You can use this template to change the price or make other changes to the original offer.

- Complete the form and provide it to the interested party.

- The form is available as a downloadable MS Word template.

- This document can only be used in the Province of Nova Scotia, Canada.

Nova Scotia Deed Transfer - Affidavit of Value

If you are transferring the deed of a real estate property in Nova Scotia, this Affidavit of Value must be presented with the deed for registration.

- The Affidavit is to be sworn by the new owner(s) of the property.

- It sets out the sale price paid by the purchaser, the HST and any HST rebate applicable to the transaction.

- You can access the fillable form directly from the Nova Scotia Government website by clicking the link.

Nova Scotia Direction to Pay Proceeds from Sale of Property

Use this easy Direction to Pay template to have your client authorize how the proceeds from the sale of their real estate property are to be paid out.

- This is a letter form that the client signs in order to direct and authorize the lawyer to:

- receive and hold the funds in trust,

- pay out any outstanding mortgage amounts owing on the property that are not being assumed by the purchaser,

- pay any property taxes that are to be paid,

- pay the real estate commissions,

- pay or accept the purchaser's undertaking to pay any existing encumbrances, and

- release the Direction to any third parties as necessary to complete the closing.

- Available in MS Word format.

- Intended to be used only in the Province of Nova Scotia, Canada.

Nova Scotia Disbursement of Purchase Funds

Use this free Disbursement of Purchase Funds form to report to the purchaser how the purchase funds in the transaction have been paid out.

- The form details how the purchaser's deposit and the mortgage funds from the lender have been disbursed:

- taxes and tax certificate,

- mortgage payout,

- surveyor's fees,

- recording fees,

- legal fees and disbursements,

- balance payable (whether to the purchaser or to the seller).

- Available in MS Word format.

- Intended to be used only in the Province of Nova Scotia, Canada.

Nova Scotia Disbursement of Sale Proceeds

Use this free Disbursement of Sale Funds form to report to the seller how the sale proceeds in the transaction have been paid out.

- The form details how the sale proceeds received from the purchaser's solicitor have been disbursed:

- real estate commission,

- mortgage payout,

- taxes, liens and encumbrances,

- recording fees,

- legal fees and disbursements,

- balance payable to the seller.

- Available in MS Word format.

- Intended to be used only in the Province of Nova Scotia, Canada.

Nova Scotia GST Exemption Certificate for Sale of Real Property

The seller of the property certifies that the property is a residential property being resold within the meaning of the Excise Tax Act, and that the seller has not claimed an input tax credit.

This Nova Scotia GST Exemption Certificate for Sale of Real Property is a free form provided in MS Word format.

Nova Scotia Matrimonial Property Act Affidavit (combined)

Complete this free combined Affidavit of Execution and Matrimonial Property Act Affidavit for any real estate transaction made in Nova Scotia.

- You will need to complete the Affidavit if you are buying, selling, mortgaging or transferring title to a real estate property in Nova Scotia.

- The form is required in order to fulfill the requirements of the Matrimonial Property Act .

- Available as a Microsoft Word download.

- Intended to be used only in the Province of Nova Scotia, Canada.

Nova Scotia Occupancy Agreement

Grant a life estate to a family member (such as a parent) to reside on property you own with this Nova Scotia Occupancy Agreement.

- The owners of the property grant give one or more persons the right to reside in the premises for as long as they live - this is called a life interest or life estate.

- The occupants are only given a lifelong right to reside in the property, they do not have any right of ownership, and there is no transfer of title to the property.

- Available in MS Word format.

- Intended to be used only in the Province of Nova Scotia, Canada.

Nova Scotia Purchase & Sale Agreement for Bare Lot

Buy and sell a bare land lot in Nova Scotia with this Purchase & Sale Agreement.

- The contract is for the sale of a residential lot, with the construction of a dwelling to occur at a later date.

- The vendor must provide the purchaser with a Metes and Bounds description.

- The vendor is responsible for paying the costs of drawing up the conveyance.

- This Bare Lot Purchase & Sale Agreement is intended for use solely in the Province of Nova Scotia, Canada.

- This real estate contract template is provided in MS Word format. Other formats available on request.

Nova Scotia Residential Purchase and Sale Agreement

Buy or sell a residential real estate property in the Province of Nova Scotia with this ready-made Agreement of Purchase and Sale.

- Equipment. The purchaser will assume the hot water tank and furnace heating system rentals (if any). If this equipment is not rented, the purchase price includes the hot water tank and furnace heating system.

- Metes and Bounds. The vendor must furnish a metes and bounds description, and the purchaser will then have 15 days to investigate the title to the property.

- HST. If HST is applicable, it is in addition to (not included in) the purchase price. If HST is not applicable, the vendor must provide a certificate in that regard.

- Costs. The vendor is responsible for paying the costs of drawing up the conveyance deed.

- Building Inspection. The agreement is conditional upon the purchaser performing a building inspection.

- Condominiums. THIS AGREEMENT CANNOT BE USED FOR CONDOMINIUMS.

- Available in MS Word format.

- Intended to be used only in the Province of Nova Scotia, Canada.

Nova Scotia Right of Way Agreement

Nova Scotia landowners can use this template to draw up a Right-of-Way Agreement with the owner of an adjoining property.

- One of the adjoining property owners grants the other one access over their respective land by means of a common right-of-way.

- One of the parties will be responsible for maintenance and upkeep of the right-of-way.

- The form is customizable and re-usable, downloadable and easy-to-use.

- Available in MS Word format.

- Intended to be used only in the Province of Nova Scotia, Canada.

Nunavut Declaration of Residency

Download a free Nunavut Declaration of Residency forms for real estate sales in Nunavut Territory.

- If you are the vendor of the real estate property, you will need to provide the purchaser with the Declaration of Residency in order to fulfill the residency requirement of the Income Tax Act (Canada).

- This is a free form provided in MS Word format.

- For use in the Territory of Nunavut, Canada.

Nunavut GST Exemption Certificate for Sale of Real Property

When reselling real estate property in Nunavut, provide the purchaser with this GST Certificate of Exempt Supply.

- The seller of the property certifies that:

- the property is a residential property being resold within the meaning of the Excise Tax Act,

- the seller is not the builder, and

- the seller has not claimed an input tax credit.

- Available in MS Word format.

- Intended to be used only in the Territory of Nunavut, Canada.

NWT GST Certificate of Exempt Supply

When reselling real estate property in NWT, provide the purchaser with this GST Certificate of Exempt Supply.

- The seller of the property certifies that:

- the property is a residential property being resold within the meaning of the Excise Tax Act,

- the seller is not the builder, and

- the seller has not claimed an input tax credit.

- Available in MS Word format.

- Intended to be used only in the Northwest Territories, Canada.

Offer to Purchase Controlled Land | Canada

Buy farm land in Canada for development with this Offer to Purchase Controlled Land.

- Controlled land means land that falls outside of the boundaries of a city, town, village or summer village (for example, farm land).

- This type of Offer is often used by a developer to purchase land adjacent to city limits for future development.

- The vendor warrants that it is not aware of any proposed expropriation of the land.

- The vendor has not received notice of any circumstance which might affect the zoning or use of the land.

- The vendor is not aware of any environmental issues affecting the land.

- The vendor will transfer title to the land over to the purchaser, on trust conditions, to allow the purchaser to secure mortgage financing in order to complete the sale.

- This legal form is not province-specific and can be used in many regions in Canada with minimal changes.

Ohio General Warranty Deed Form

Transfer an Ohio real estate property from a seller to a buyer with this downloadable Ohio General Warranty Deed form.

A General Warranty Deed provides the buyer with the broadest protection of any form of title deed. The seller (the grantor) makes certain warranties to the buyer (the grantee), i.e.:- that the grantor has good title to the property,

- that the grantor is legally authorized to convey the property to the buyer, and

- that the grantor will forever defend the right of the grantee to possess the property.

Ohio Homestead Exemption Application DTE 105A

OH home owners, apply for a reduction in your property taxes with this free Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses (Form DTE 105A).

- The home owner can apply to have the appraised value of his/her primary residence reduced by $25,000 with a corresponding savings in property taxes.

- The form must be completed and submitted to the county auditor.

- The exemption application form can only be used by seniors (age 65 or older), disabled persons, or the surviving spouse of a homeowner.

- The application for exemption can be made for single family dwellings, units in a multi-unit building, condominiums, cooperatives, manufactured and mobile homes.

- This is a free PDF form provided by the Ohio Department of Taxation. Click the link to download the form from their website.

Ohio Purchase Agreement for Vacant Land

Buy and sell bare land in the State of Ohio with this Land Purchase Agreement.

- There is a 30-day period for satisfaction or waiver of the buyer's contingencies prior to closing. The closing date may be extended if agreed to by the parties.

- The escrow agent will hold the buyer's deposit and apply it to the purchase price as earnest money at closing. The balance of the purchase price will be paid over time under the terms of a promissory note, which will be secured by a pledge agreement.

- The purchase is contingent on the seller obtaining an acceptable Phase I environmental report on the property.

- The buyer must obtain a commitment for title insurance on the parcel.

- The buyer will be responsible for the costs of any desired surveys or additional environmental reports, as well as the cost of the title insurance. The seller will be responsible at its sole cost for curing any defects in title that are not acceptable to the buyer.

- At closing the seller will provide the buyer with a registrable warranty deed, a seller's affidavit regarding all off-record title matters, a FIRPTA affidavit, a closing statement, and any other documents that are necessary to complete the conveyance of the real property.

- Both parties agree to indemnify and hold the other party harmless from any commissions or broker's fees.

- Available in MS Word format. Fully editable.

- Intended to be used only in the State of Ohio.

Ohio Quitclaim Deed

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This Ohio Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

Ohio Quitclaim Deed for Joint Ownership

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This Ohio Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

Ohio Quitclaim Deed from Husband and Wife to Individual

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Ohio Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Ohio Special Warranty Deed

Transfer ownership of an Ohio real estate property with this Ohio Special Warranty Deed.

Under the Special Warranty Deed, the seller (the grantor):- conveys title to the property over to the buyer (the grantee),

- relinquishes all interest in the property, and

- promises to warrant and defend the buyer's title, but only against claims claimed by, through, or under the grantor.

Ohio Special Warranty Deed for Joint Tenants

This form is for a property that is being purchased by two or more persons as joint tenants (typically, a husband and wife who will both hold title to the property).

This deed should be recorded with the appropriate land title office. Under the Warranty Deed, the Grantors (sellers) convey title to the property to the buyers (the Grantees), relinquish all of their interest in the property, and promise to warrant and defend the buyers' title against all claims claimed by, through, or under the Grantor, but not otherwise.

This Ohio Special Warranty Deed for Joint Tenants form is provided in MS Word format, and is easy to download, fill in and print.

Ohio Transfer on Death Designation Affidavit

Avoid probate and transfer your real property to a beneficiary with this Ohio Transfer on Death Designation Affidavit.

- The Transfer on Death Designation Affidavit (also called a TOD Designation Affidavit) is signed and filed with the Recorder's Office before the original owner passes away.

- When the owner dies, the transfer is completed by filing a death certificate and an affidavit signed by any person who knows all of the facts (this person can be the beneficiary).

- Even though title to the property will transfer to the beneficiary, the original owner still has full ownership rights to the property and can mortgage, rent, lease, or sell the property, without the beneficiary's consent.

- The TOD Designation Affidavit does not any eliminate any estate taxes that are payable.

Ohio Warranty Deed - Joint and Survivor

Transfer title of an Ohio real estate property from two sellers to two buyers with this Ohio Warranty Deed - Joint and Survivor.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the survivor.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

Oklahoma Quitclaim Deed

Transfer your interest in an OK real estate property with this easy-to-use Oklahoma Quitclaim Deed.

- Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property.

- The form is downloadable and easy to use. Buy, download, fill in, print and sign.

Oklahoma Quitclaim Deed for Joint Ownership

Transfer title to an OK real estate property from a husband and wife to another husband and wife with this Oklahoma Quitclaim Deed for Joint Ownership with rights of survivorship.

- The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property.

- The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

- This form is provided in MS Word format and is easy to download, fill in and print.

- Intended to be used only in the State of Oklahoma.

Oklahoma Quitclaim Deed from Husband and Wife to Individual

Transfer title to an OK real estate property from two spouses to one person with this easy-to-use Oklahoma Quitclaim Deed from Husband and Wife to Individual.

- Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property.

- This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

Oklahoma Special Warranty Deed

Transfer ownership of an Oklahoma real estate property with this easy-to-use Oklahoma Special Warranty Deed form.

- Under the terms of a Special Warranty Deed the seller (grantor) warrants or guarantees the title only against any defects arising during his/her ownership of the property but not against title defects existing before that time.

- This is a downloadable legal form template available in MS Word format.

- This Special Warranty Deed is intended for use only in the State of Oklahoma.

Oklahoma Transfer on Death Deed Forms

Avoid probate of your real estate upon your death by recording an Oklahoma Transfer on Death Deed with the County Recorder.

This package contains the following two forms:

- A Transfer on Death Deed (or TOD) form, and

- A Revocation of Transfer on Death Deed form, so that you can cancel the TOD at any time after it has been recorded, if necessary.

Even though title to the property is being transferred into the beneficiary's name, you will still have all the ownership rights to the property, and you can deal with the property in any way you like, without requiring the permission or consent of the beneficiary. You can even sell the property.

These Oklahoma Transfer on Death Deed Forms are downloadable legal forms which just need to be filled in, signed and notarized.

Oklahoma Warranty Deed for Joint Ownership

Transfer title of an Oklahoma real estate property from two sellers to two buyers with this Oklahoma Warranty Deed for Joint Ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the survivor.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

Oklahoma Warranty Deed Form

Transfer title to a real estate property in Oklahoma from a seller to a buyer with this easy-to-use Oklahoma Warranty Deed form.

The seller (the grantor) covenants that:- it has good and marketable title to the property,

- it has the legal right and authority to transfer the title to the buyer, and

- it will forever defend the right of the buyer (the grantee) to possess the property.

Ontario Declaration of Residency

Download this free Ontario Declaration of Residency forms for real estate sales in Ontario.

- If you are the vendor of the real estate property, you will need to provide the purchaser with the Declaration of Residency in order to fulfill the residency requirement of the Income Tax Act (Canada).

- This is a free form provided in MS Word format.

- Intended for use only in the Province of Ontario, Canada.

Ontario FSBO Real Estate Purchase and Sale Contract

Buy or sell a home in Ontario without a realtor with this For Sale by Owner (FSBO) Real Estate Purchase and Sale Contract.

- This contract is only for use in transactions where neither party is using a realtor.

- If HST is payable on the transaction, the purchaser will be responsible for paying it.

- If the sale is not subject to HST, the vendor agrees to certify that there is no HST payable.

- The vendor pays the costs of preparing the transfer documents. The purchaser pays for the preparation of the mortgage (if any).

- This is not the OREA standard form of contract. OREA forms must be obtained from a member of the Ontario Real Estate Association.

- This legal contract template is provided in MS Word format and is fully editable.

- Intended to be used only in the Province of Ontario, Canada.

Ontario HST Exemption Certificate for Sale of Real Property

The seller of the property certifies that the property is a residential property being resold within the meaning of the Excise Tax Act, and that the seller has not claimed an input tax credit.

This Ontario HST Exemption Certificate for Sale of Real Property is a free form provided in MS Word format.

Ontario PREC Remuneration Agreement

Ontario realtors, take advantage of corporate tax rates on the commissions you earn by setting up a personal real estate corporation (PREC) and running your revenues through it.

- This Remuneration Agreement between the realtor, the PREC and the realtor’s brokerage establishes the relationship between the parties and sets out how revenues earned by the realtor will be paid.

- The realtor is engaged by the brokerage as a real estate salesperson and is the incorporator and shareholder of the PREC.

- Remuneration earned by the realtor is paid by the brokerage to the PREC instead of directly to the realtor.

- The Agreement does not create an employment, agency, partnership, joint venture or similar relationship between the brokerage and either of the other parties.

- The PREC and the realtor are responsible for withholding and remitting all required taxes and EI and other contributions.

- The PREC personnel are not eligible to participate in any benefit or compensation programs offered by the brokerage to its own employees.

- The PREC does not carry on business as a real estate brokerage.

- This document complies with the laws of the Province of Ontario, Canada.

Ontario Purchase and Sale Agreement for Commercial Property

Buy and sell commercial real estate property in Ontario with this Offer to Purchase and Agreement of Purchase and Sale for Commercial Property.

- The seller is responsible for all expenses and taxes on the property up to the closing date. The buyer is responsible for those costs from and including the closing date.

- The seller is entitled to all rental revenues up to the closing date. From and including the closing date, the buyer will receive all rents from the property.

- The seller will make available to the buyer all documents, authorizations, records, etc. to allow the buyer to perform its due diligence and complete its inspection and any environmental or structural audits required.

- The buyer agrees to assume the existing tenants and leases, but is not obligated to assume any contracts for supply of products or services to the property.

- The seller agrees not to enter into any new leases prior to closing, and will notify all utility and other services of the change of ownership.

- This legal form is available as a Microsoft Word file and is fully editable to fit your circumstances.

- Intended for use only in the Province of Ontario, Canada.

Open Listing Agreement for Real Estate Property

Hire a realtor to list your real estate property with this Open Listing Agreement template.

- The property owner gives the realtor a non-exclusive right to list the property for sale for a specified time period.

- The owner retains the right to sell the property directly, without paying commission, if the realtor does not locate a buyer.

- The owner also has the right to list the property with other realtors.

- If a deposit is forfeited by a buyer introduced by the realtor, the realtor can retain 50% of the deposit.

- Available in MS Word format and fully editable to fit your circumstances.

- This is a generic form that can be used in many locations.

Option to Purchase Land | Canada

Grant a tenant, a developer or other party an option to purchase a section of land with this downloadable template for Canada.

- The purchase price will include all permanent fixtures on the land.

- The vendor has the right to register a covenant restricting the use of the land, which the purchaser must agree to and abide by.

- The purchaser has the right to register a caveat on the title as public notice of its purchase option.

- The purchaser can exercise the option for all or just part of the optioned land.

- The option is irrevocable, meaning the vendor cannot revoke it until the option period has expired.

- The Option to Purchase Land form does not refer specifically to provincial laws and can be easily modified for use in most Canadian provinces and territories (Quebec excluded).

- This is a Microsoft Word document that is available for download immediately after you buy it.

Option to Purchase Land | UK

Grant a potential purchaser an option to buy land from you with this template Option to Purchase Land for real estate property in the UK.

- The deposit paid by the optionee will be credited against the purchase price if the option is exercised.

- If the option is not exercised, the option automatically expires at the end of the option period.

- The optionee is granted an option and an exclusive right to purchase the property.

- This template is provided in MS Word format, and is fully editable to meet your needs.

- Intended for use only within the United Kingdom.

Oregon Bargain and Sale Deed

Transfer ownership of a real estate property in the State of Oregon with this Bargain and Sale Deed.

- The Bargain and Sale Deed makes no warranty as to encumbrances against title.

- This type of Deed is often used to transfer title for properties that have been seized for unpaid taxes or that form part of the estate of a deceased and that is being sold by an executor.

- Available in MS Word format.

- Intended to be used only in the State of Oregon.

Oregon Joint Homestead Declaration

Do you and your spouse have debts or judgments against you? Protect your home to the maximum amount allowable under Oregon law with this Joint Homestead Declaration.

- The Declaration is made by a husband and wife, under Oregon Revised Statutes OR 18.395.

- A joint filing will protect the equity in your home to a maximum of $50,000 against sale by execution, judgment lien and liability for debts.

- The homestead exemption only applies to your actual residence. You can't use this form for revenue or vacation properties.

- When you have filled out the form, file it with the County Recorder's Office in the county in which your property is situated.

- Available in MS Word format.

- Intended to be used only in the State of Oregon.

Oregon Quitclaim Deed

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This Oregon Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

Oregon Quitclaim Deed for Joint Ownership

The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property. The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

This Oregon Quitclaim Deed for Joint Ownership form is provided in MS Word format and is easy to download, fill in and print.

Oregon Quitclaim Deed from Husband and Wife to Individual

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Oregon Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Oregon Special Warranty Deed

Transfer ownership of an Oregon real estate property with this easy-to-use Oregon Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property but not against title defects existing before that time.This Oregon Special Warranty Deed form is a downloadable legal document in MS Word format.

Oregon Warranty Deed for Joint Ownership

Transfer title of a real estate property in Oregon from two sellers to two buyers with this Oregon Warranty Deed for Joint Ownership.

- This is the type of Warranty Deed that is used to convey a property from one couple (spouses or partners) to another couple, who will live in the property.

- The buyers will own the property as joint tenants with rights of survivorship. That means when one joint tenant dies, the title will pass to the survivor.

- The sellers (grantors) covenant to the buyers (grantees) that they have good and marketable title to the property, they have the legal right and power to transfer the title, and they will defend the grantees' right to possess the property.

Oregon Warranty Deed Form

Transfer title to a real estate property in Oregon from a seller to a buyer with this easy-to-use Oregon Warranty Deed form.

The seller (the grantor) covenants that:- it has good and marketable title to the property,

- it has the legal right and authority to transfer the title to the buyer, and

- it will forever defend the right of the buyer (the grantee) to possess the property.

Party Wall Agreement | USA

Set out the obligations of two neighbors who share a common wall in their properties with this Party Wall Agreement for US home owners.

- The parties are the owners of adjoining properties which share a common wall (a party wall) between semi-detached townhouses, adjoining condominium units or the two halves of a duplex.

- The Party Wall Agreement sets out the rights and obligations of the owners with respect to shared walls, fences, and other common structural elements of the property.

- The Agreement can be used anywhere in the United States.

- Available in MS Word format, fully customizable.

PEI GST Certificate of Exempt Supply of Real Property

When reselling real estate property in Prince Edward Island, provide the purchaser with this GST Certificate of Exempt Supply.

- The seller of the property certifies that:

- the property is a residential property being resold within the meaning of the Excise Tax Act,

- the seller is not the builder, and

- the seller has not claimed an input tax credit.

- Available in MS Word format.

- Intended to be used only in the Province of Prince Edward Island, Canada.

PEI Real Estate Purchase & Sale Agreement

Buy and sell real estate property in the Province of Prince Edward Island with this Offer to Purchase / Agreement of Purchase and Sale of Real Property.

- The vendor (seller) is responsible for paying out and discharging any existing financial encumbrances on title to the property which are not being assumed by the purchaser.

- The purchaser is responsible for paying the costs of arranging new mortgage financing (if applicable) and the costs of conveyance of the title.

- This legal document is available as a fully editable MS Word form.

- Intended for use solely in the Province of Prince Edward Island, Canada.

Pennsylvania Quitclaim Deed

Under the Quitclaim Deed, the transferor conveys all of its interest in the property to the transferee but does not provide any warranties regarding the property. This form of Deed is often used to remove one spouse's name from title following divorce proceedings.

This Pennsylvania Quitclaim Deed form is provided in MS Word format and is easy to download, fill in and print.

Pennsylvania Quitclaim Deed for Joint Ownership

Transfer the interest in a real estate property in Pennsylvania from a husband and wife to another husband and wife with this Quitclaim Deed for Joint Ownership with rights of survivorship.

- The transferors convey their interest in the property to the transferees, but do not provide any warranties regarding the property.

- The transferees will hold title as joint tenants, with rights of survivorship, which means that if one of them dies, title to the property passes to the surviving joint tenant.

- This form is provided in MS Word format and is easy to download, fill in and print.

- Intended to be used only in the Commonwealth of Pennsylvania.

Pennsylvania Quitclaim Deed from Husband and Wife to Individual

Under the Quitclaim Deed, the transferors (grantors) convey all of their interest in the property to the transferee (grantee) but do not provide any warranties regarding the property. This form of Deed is often used following a divorce, to remove one spouse's name from title to the property.

This Pennsylvania Quitclaim Deed from Husband and Wife to Individual form is available in MS Word format and is easy to use and fully customizable.

Pennsylvania Special Warranty Deed

Transfer your ownership in a PA real estate property with this Pennsylvania Special Warranty Deed form.

Under a Special Warranty Deed, the seller (grantor) warrants or guarantees the title only against defects arising during his/her ownership of the property and not against defects existing before that time.This Pennsylvania Special Warranty Deed form is available as a downloadable MS Word document, and is easy to fill in with the details of your transaction.