Mortgage Forms

Before you lend money to someone to buy real estate, secure the loan with these downloadable, customizable Mortgage Forms.

According to Wikipedia.com, the word 'mortgage' is French for 'death contract'. As ominous as that may sound, it merely means that the charge against the land which was created by the mortgage ends (dies) when the debt that it secures is paid or, alternatively, if the property is foreclosed.

Few individuals or businesses can afford to buy real estate without getting a loan to fund the purchase. Because the amount being borrowed is so high, the only collateral of sufficient value that can adequately secure the repayment of the debt is the property itself.

Nova Scotia Condominium Mortgage Schedule

Prepare a schedule for a Condominium Mortgage with this template form for Nova Scotia condominiums.

- The mortgagor covenants and agrees:

- To comply with all the provisions of the Nova Scotia Condominium Act;

- To promptly pay all assessments and payments due to the condo corporation;

- That the mortgagee can treat any default under the schedule as a default under the mortgage;

- To assign all of its voting rights to the mortgagee;

- That if the mortgagor sells the property, the entire balance of the mortgage will become due.

- Available in MS Word format.

- Intended to be used only in the Province of Nova Scotia, Canada.

Nova Scotia Postponement Agreement

Use this template to prepare a Postponement Agreement between two mortgage lenders holding mortgages on the same property in Nova Scotia.

- The parties agree that the second mortgage will take priority over the first mortgage.

- The first mortgagee agrees to postpone its security, in return for the second mortgagee paying the first mortgagee a specified sum.

- The template can be re-used over and over again, and edited to fit your business' requirements.

- Available in MS Word format.

- Intended to be used only in the Province of Nova Scotia, Canada.

Ohio Installment Land Contract

Are you selling a home to a buyer and financing all or part of the purchase price through owner financing? Then you need this Ohio Installment Land Contract.

- An installment contract is also called a Contract for Deed, because at the end of the contract when the buyer has paid all of the amounts due under the contract, the seller transfers the title deed to the buyer.

- This type of contract is often used when selling property to a family member.

- You can only use the land contract for selling a property that has a home built on it, or a mobile home which is attached to the property. You can't use this contract to sell bare land.

- If the buyer fails to keep up the payments or does not perform any of its other obligations, the seller can repossess the property and keep all payments made as liquidated damages.

- The template includes a Lead Paint Disclosure, as required by federal laws.

- Intended to be used only in the State of Ohio.

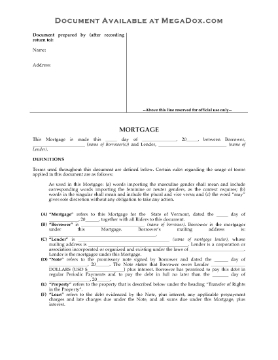

Ohio Residential Mortgage Form

Write up a Residential Mortgage to secure repayment of a home purchase loan with this fully editable template for Ohio mortgage lenders.

- Mortgage payments will be made in regular periodic instalments of blended principal and interest.

- Unpaid interest becomes part of the principal and bears interest at the mortgage rate.

- The mortgagor must pay all taxes and levies assessed against the property.

- The mortgagor must keep the property insured in an amount and to an extent approved by the mortgagee.

- Contains an acceleration upon default provision, which states that if the mortgagor defaults in any of its obligations, the entire amount of the indebtedness will become immediately due and payable, and the lender may foreclose and sell the property.

- Available as a downloadable MS Word template.

- Intended to be used only in the State of Ohio.

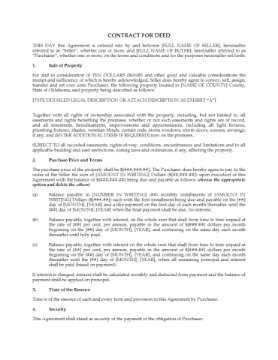

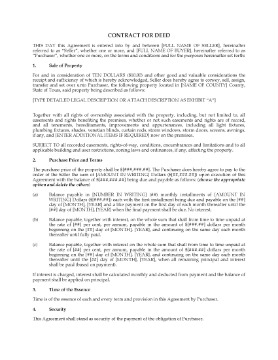

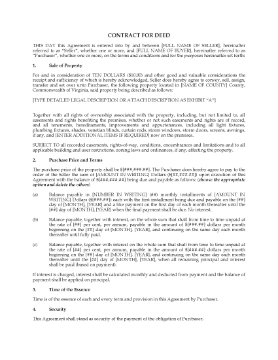

Oklahoma Contract for Deed

When credit is tight, it can be tough to qualify for a home loan. If you're trying to sell your home in that market, you'll find the pool of available buyers much smaller. That's when you need this Oklahoma Contract for Deed.

- A contract for deed allows a buyer to pay over time, with the seller carrying the balance until the last payment is made.

- The buyer can take possession and live in the home but doesn't own it. Once the price is paid in full, including any agreed interest, the seller conveys title to the buyer.

- You can only use the land contract for selling a property that has a home on it. You can't use this contract to sell bare land.

- If the buyer defaults under the contract, the seller has the right to repossess the property and keep all payments made as liquidated damages.

- The template includes a Lead Paint Disclosure, as required by federal laws.

- Intended for use only in the State of Oklahoma.

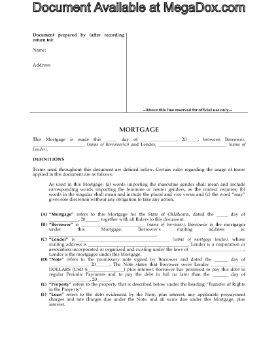

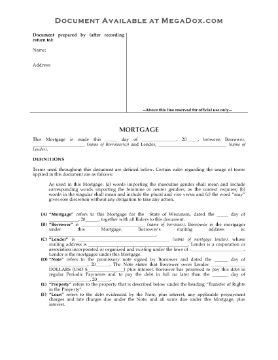

Oklahoma Mortgage

Place a mortgage on a residential property with this Oklahoma fixed rate mortgage form.

- The mortgage form contains both uniform (multistate) covenants and non-uniform covenants for foreclosure, discharge of the mortgage when paid in full, and a waiver of homestead exemption pursuant to Oklahoma law.

- The mortgage secures the lender's position in connection with a loan and a promissory note signed by the borrower.

- This is a downloadable and fully editable legal template for single family dwellings.

- This is a standard legal form template in MS Word format.

- Intended for use in the State of Oklahoma.

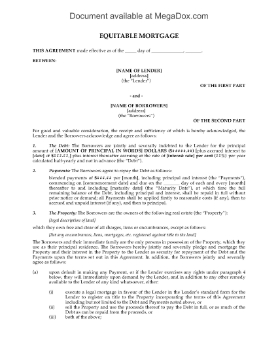

Ontario Equitable Mortgage

Prepare an Equitable Mortgage between the owners of a property and a lender with this template form for Ontario.

- The mortgage is security for a loan from the lender to the borrowers.

- The borrowers agree that if they default in repayment of the debt, they will either register a conventional mortgage against the property or sell the property and use the proceeds to pay off the debt.

- The lender has the option to accelerate the loan upon default by the borrowers.

- This legal form template is available in MS Word format.

- Intended only for use in the Province of Ontario, Canada.

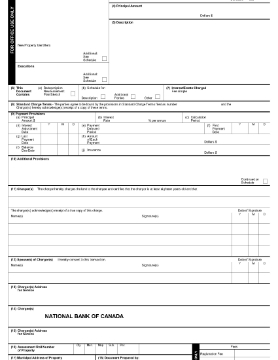

Ontario Form 2 Charge / Mortgage of Land

Register a mortgage or other charge against land in the Province of Ontario by filing this Form 2 Charge / Mortgage of Land.

- This is a free fill-in PDF form. Download it, fill it in and file it with the Land Title Office.

- Governed by the Ontario Land Registration Reform Act.

- Available directly from the Province of Ontario website.

Ontario Standard Terms for Commercial Collateral Mortgage

Use this downloadable template to prepare a set of Standard Charge Terms for a commercial collateral mortgage under Section 9 of the Ontario Land Registration Reform Act.

- You first need to complete and file the Set of Standard Charge Terms with the Land Titles Office, which issues you a filing number.

- Each time you enter into a loan transaction with a borrower which is secured by this type of mortgage, you simply file a Form 2 Charge â„ Mortgage of Land which refers to this set of standard terms by filing number.

- This set of standard terms, and any addenda filed with the Form 2, will then govern the loan agreement between the parties.

These Standard Terms for Commercial Collateral Mortgage are a must-have item for any commercial lender in Ontario.

Ontario Standard Terms for Fixed and Variable Rate Residential Mortgage

These Standard Charge Terms are for a fixed and variable rate residential mortgage / charge pursuant to Section 9 of the Ontario Land Registration Reform Act.

- Complete and file the Set of Standard Charge Terms with the Land Titles Office, which issues a filing number.

- Each time you enter into a loan transaction with a borrower which is secured by this type of mortgage, you simply file a Form 2 Charge / Mortgage of Land which refers to this set of standard terms by filing number.

- This set of standard terms, and any addenda filed with the Form 2, will then govern the loan agreement between the parties.

- For use only in the Province of Ontario.

Ontario Standard Terms for Straight Charge / Mortgage

Ontario lenders can use this template form to prepare Standard Charge Terms for a straight charge or mortgage under Section 9 of the Land Registration Reform Act.

- When you file your initial set of Standard Charge Terms with the Land Titles Office, they issue you a filing number.

- Each time you submit a Form 2 Charge / Mortgage of Land to secure a loan, you refer to the filing number.

- That will ensure that the loan agreement secured by the mortgage is governed by this set of standard terms.

To get your copy of the Standard Terms for Straight Charge / Mortgage, add it to your cart, check out and pay, and download the form to your computer.

Oregon Contract for Deed

If you are selling a real estate property in Oregon, you can assist the buyer by carrying part or all of the purchase price with this Contract for Deed (or purchase money mortgage).

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

- Available in MS Word format.

- Intended to be used only in the State of Oregon.

Oregon Deed of Trust

Transfer title of an Oregon real estate property from a seller to a trustee with this Oregon Deed of Trust form.

- A Deed of Trust is often used instead of a mortgage for purchasing real property except for agricultural farm land.

- Under the Deed of Trust, title is conveyed by the seller to a trustee instead of to the purchaser. The trustee holds the title as security to ensure the purchaser's performance of its obligations (including payment of the purchase price, maintenance and upkeep of the property, payment of taxes, etc).

- If the borrower defaults in payment, the balance becomes due and payable and the trustee may sell the property.

- The Deed of Trust contains uniform covenants regarding payments, funds for taxes and insurance, prior mortgages, hazard insurance, occupancy as principal residence, care and maintenance of the property, protection of the lender's security, and other standard clauses.

- Attorney's fees payable by a party under the Trust Deed shall include those awarded by an appellate court.

- The Deed secures any advances made by the lender to protect its interest in the property and rights under the Deed.

Partial Purchase Agreement for Note and Deed of Trust | USA

Transfer a part interest in a Deed of Trust and underlying promissory note with this Partial Purchase Agreement for Note and Deed of Trust.

- The buyer agrees to purchase the interest without recourse as to the borrower's future financial performance.

- The buyer will be entitled to a specified number of installment payments, following which the interest will revert back to the seller.

- The seller's liability is limited to the seller's residual interest in the Note and Deed of Trust.

- The agreement is conditional upon the buyer obtaining adequate funds to finance the purchase.

- If the seller cancels the agreement prior to closing, the seller must pay a cancellation fee, plus any costs incurred by the buyer.

- The seller indemnifies the buyer against any liability or expense arising from any inaccuracy or breach of any of the seller's representations or warranties.

- Available in MS Word format.

- This template form can be used by lenders anywhere in the United States.

Participating Mortgage on Condo Project | Canada

Prepare a Participating Mortgage for a loan on a condominium project in Canada with this template form.

- A participating mortgage is a loan under which the lender (Mortgagee) participates in the revenues of the property.

- A portion of the interest on the loan is to be paid to the Mortgagee annually.

- A further portion of the interest will be paid from the balance of sale proceeds of each of the condo units (if any), after payment of development costs, financing charges and marketing costs.

- The borrower (Mortgagor) will be paid a general and administrative fee for construction and management of the project.

- A further project expense consisting of interest on the equity is to be paid to the developer.

- After one year, the Mortgagor can prepay all or part of the mortgage loan without bonus or penalty.

- Available in MS Word format.

- Intended to be used in Canada.

Pennsylvania Contract for Deed

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

Pennsylvania Mortgage Form

Place a mortgage on a residential property in Pennsylvania with this fixed rate mortgage form.

- The mortgage form contains both uniform (multistate) covenants under federal mortgage regulations and non-uniform covenants pursuant to Pennsylvania law, including discharge of the mortgage upon payment in full, and provisions for foreclosure of the mortgage if the borrower defaults.

- The mortgage secures the lender's position in connection with a loan and a promissory note signed by the borrower.

- This is a downloadable and fully editable legal template for single family dwellings.

- Available in MS Word format.

- Intended to be used only in the Commonwealth of Pennsylvania.

Purchase Agreement for Mortgage | USA

Use this Purchase Agreement to transfer a mortgage and promissory note from one lender to another.

- The agreement is conditional upon the buyer obtaining adequate funds to finance the purchase.

- The buyer will pay for all closing costs, including report and appraisal fees, title examination and insurance.

- If the seller cancels the agreement prior to closing, the seller must pay a cancellation fee, plus any costs incurred by the buyer.

- The seller indemnifies the buyer against any liability or expense arising from any inaccuracy or breach of any warranty or representation made by the seller.

- The seller sells and assigns the note and mortgage without recourse, and the seller assumes no responsibility or liability with respect to the mortgagor's financial performance.

- Available in MS Word format.

- The form can be used throughout the United States.

Rhode Island Contract for Deed

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

Rhode Island Mortgage Form

Take out a mortgage on a residential property with this Rhode Island fixed rate mortgage form.

- The mortgage form contains both uniform (multistate) covenants under federal mortgage regulations and non-uniform covenants pursuant to Rhode Island law, including discharge of the mortgage upon payment in full, and waiver of homestead exemption, so that the borrower cannot protect the property against possession and sale by the lender if the borrower defaults.

- The mortgage also contains representations with respect to automatic orders in domestic relations cases under Rhode Island General Laws Chapter 15-5.

- This is a standard type of mortgage for single family dwellings.

- Available in MS Word format.

- Intended to be used only in the State of Rhode Island.

Saskatchewan Mortgage

If you are lending a large sum of money to a borrower, secure repayment of that loan with this Saskatchewan Mortgage which can be registered against the borrower's property.

- The borrower will repay the loan in regular instalment payments of blended principal and interest.

- The borrower must keep the property insured.

- The borrower releases all of its claim to the land to the lender until the mortgage has been repaid in full, however, the borrower may continue to remain in possession of the land so long as not in default under the terms of the mortgage.

- Interest is calculated half-yearly and is not payable in advance (meaning that it must be earned before it is payable).

- The borrower has the privilege of renewing the mortgage on any instalment payment date during the original term.

- The mortgage contains the required affidavits and consents under the Saskatchewan Homesteads Act, 1989.

Holding a mortgage is a good way to ensure that a debt is repaid. Add the Saskatchewan Mortgage to your shopping cart, check out, and download the form.

South Carolina Contract for Deed

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

South Carolina Mortgage

Take out a mortgage on a home in South Carolina with this fixed rate mortgage form.

- The mortgage form contains standardized uniform (multistate) covenants under federal mortgage regulations.

- It also contains additional covenants specific to South Carolina law, including provisions for foreclosure, discharge and release once the borrower has paid in full, and a waiver of appraisal rights in the event of a foreclosure.

- This is a standard type of mortgage for single family dwellings. Available in MS Word format.

South Dakota Contract for Deed

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

South Dakota Mortgage (180 Day Redemption)

Take out a mortgage on a home in South Dakota with this One Hundred Eighty Day Redemption Mortgage.

- The mortgage form contains standardized uniform multistate covenants under federal mortgage regulations.

- It also contains additional covenants specific to South Dakota law, including provisions for foreclosure, waiver of homestead exemption, and an agreement that the mortgage will be subject to the One Hundred Eighty Day Redemption Mortgage Act.

- This is a standard type of mortgage for residential single family dwellings.

- Available in MS Word format.

- Intended to be used only in the State of South Dakota.

South Dakota Statement of Occupancy

This Statement of Occupancy and Financial Status forms part of the documentation for a real estate purchase loan in South Dakota.

- The purchasers of the property must make the Statement and give it to the mortgage lender and to FHA, FNMA, FHLMC, or Department of Veterans Affairs (as applicable).

- The purchasers certify that they will occupy the property after closing.

- The purchasers also confirm that there has been no significant change to their financial status since their mortgage loan application.

The South Dakota Statement of Occupancy and Financial Status is a free form that you can download and fill in.

Statement of Amount Owing on Mortgage | Canada

Download this free Statement of Amount Owing on Mortgage for Canadian mortgage lenders.

- This form is typically used when a mortgaged property is being sold and the mortgage is being paid out from the sale proceeds.

- The Statement sets out the principal and interest amounts owing up to the date of the statement, with a per diem thereafter, and the terms of repayment.

- This is a free downloadable MS Word document.

- Intended for use only in Canada.

Tennessee Contract for Deed

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

Tennessee Deed of Trust

Transfer title of a real estate property in Tennessee from a seller to a trustee with this Tennessee Deed of Trust form.

- A Deed of Trust can be used in place of a mortgage in the sale and purchase of real estate (other than agricultural farm land).

- Title to the property is conveyed by the seller to a trustee instead of to the purchaser. The trustee holds the title as security for performance of the purchaser's obligations (including payment of the purchase price, maintenance and upkeep of the property, payment of taxes, etc).

- If the purchaser (borrower) defaults in payment, the balance becomes due and payable and the trustee may sell the property.

- The Deed of Trust contains uniform covenants regarding payments, funds for taxes and insurance, prior mortgages, hazard insurance, occupancy as principal residence, care and maintenance of the property, protection of the lender's security, and other standard clauses.

- The borrower waives all homestead exemptions or other statutory right or redemption in the property that he/she may be entitled to under State law.

Texas Contract for Deed

If you are selling a real estate property in Texas, you can assist the buyer by carrying part or all of the purchase price with this Contract for Deed (or purchase money mortgage).

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

- Available in MS Word format and fully editable to fit your exact circumstances.

- Intended to be used only in the State of Texas.

Texas Deed of Trust

Transfer title of a Texas real estate property from a seller to a trustee with this Texas Deed of Trust form.

- A Deed of Trust can be substituted for a mortgage deed in the purchase of real estate property except for agricultural farm land.

- Title to the property is conveyed by the seller to a trustee instead of to the purchaser. The trustee holds the title as security to ensure the purchaser's performance of its obligations (including payment of the purchase price, maintenance and upkeep of the property, payment of taxes, etc).

- If the borrower defaults in payment, the balance becomes due and payable and the trustee may sell the property.

- The Deed of Trust contains uniform covenants regarding payments, funds for taxes and insurance, prior mortgages, hazard insurance, occupancy as principal residence, care and maintenance of the property, protection of the lender's security, and other standard clauses.

- The loan being secured by the Deed of Trust cannot be a home equity loan. The loan can be made to purchase property, to renew and extend an existing debt, or as a loan against non-homestead property.

- Available in MS Word format.

- Intended to be used only in the State of Texas.

Texas Release of Deed of Trust

Record this Release of Deed of Trust with the County Recorder to discharge a mortgage lien from property in the State of Texas.

- This form contains clauses for both a full release and a partial release, and can be used for either.

- This is a reusable legal form template. Once you download it, you can use it as often as you require.

- This Texas Release of Deed of Trust form is available in MS Word format. We can convert it to another format upon request.

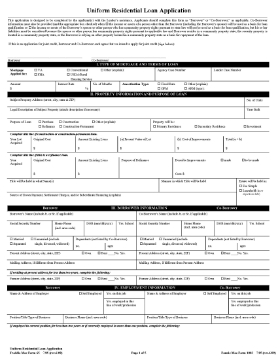

Uniform Residential Loan Application (FNMA Form 1003) | USA

Download a free FNMA (Fannie Mae) Form 1003 (Freddie Mac Form 65) loan application for a residential mortgage loan, for US residents.

- The form is to be completed by the applicant with the assistance of the lender.

- The lender uses the form to record relevant financial information about an applicant who applies for a conventional one- to four-family mortgage.

- You can download the form and additional guide directly from the FannieMae.com website through the link provided. There you will also find information and other resources to help you with your application.

- For use only in the United States.

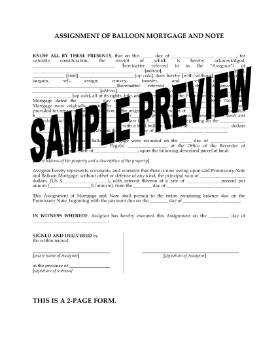

USA Assignment of Balloon Mortgage and Note

You can assign an interest in a balloon mortgage to another party with this easy-to-use Assignment Form.

- Fill in the principal amount owing, the interest rate, and the amount of the monthly payments to be made under the mortgage.

- The assignment transfers both the mortgage and the entire unpaid balance under the promissory note from the assignor to the assignee.

- This is not a State-specific form. It can be used in any U.S. state that does not have a statutory form of assignment.

You can download the USA Assignment of Balloon Mortgage and Note to your computer or tablet immediately after you pay for it.

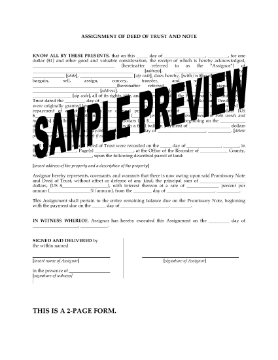

USA Assignment of Deed of Trust and Note

Assign your interest in a Deed of Trust to another party with this downloadable Assignment of Deed of Trust and Note.

- The assignor gives representations to the assignee regarding the principal amount owing, the interest rate, and the amount of the monthly payments.

- The assignment pertains to the entire unpaid balance under the promissory note.

- This digital template can be used in any U.S. state.

Download the Assignment of Deed of Trust form immediately after purchasing it. Use it as often as you like - no additional licensing fees required.

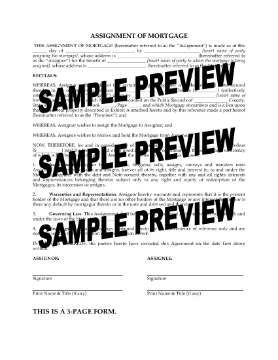

USA Assignment of Mortgage

U.S. lenders can assign an interest in a mortgage to another party with this easy-to-use Assignment of Mortgage form.

- The assignor transfers all of its right, title and interest in and to the mortgage (including the debt and promissory note secured by the mortgage) to the assignee.

- The assignor warrants that no other party holds an interest in the mortgage.

- The assignment form can be used anywhere in the United States.

Add the Assignment of Mortgage form to your cart and pay for it via our secure checkout. You can then download the digital file.

USA Balloon Mortgage & Security Agreement

Prepare a Balloon Mortgage and Security Agreement for borrowers with this easy-to-use template.

- The entire unpaid balance of the mortgage loan and interest is due on the maturity date.

- The borrower (mortgagor) will pay all taxes, rates and assessments levied against the mortgaged property.

- The borrower must keep the mortgaged property insured for such risks and in such amounts as the lender may require.

- The borrower must get the lender's consent before making any alterations to the property, and must maintain the property in good condition and repair.

- If the borrower attempts to transfer all or any part of the property, the mortgage loan plus interest will immediately become due.

- The borrower waives all right of homestead exemption in the property.

- The mortgage will secure not only the borrower's existing debt to the lender, but any future advances made within 20 years of the date of the mortgage to the same extent as if they were made on the date of execution of the mortgage.

The USA Balloon Mortgage and Security Agreement is not state-specific. Some state laws require specific wording to be added to balloon mortgages. Check your state legislation online for details.

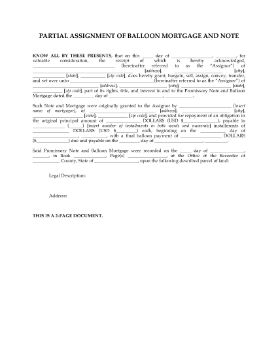

USA Partial Assignment of Balloon Mortgage and Note

Transfer a portion of your interest in a balloon mortgage to another party with this easy-to-use Partial Assignment of Balloon Mortgage Note.

- The assignment can be used throughout the United States.

- The assignor gives representations to the assignee regarding the principal amount owing, the interest rate, and the amount of the monthly payments.

- The partial interest is being transferred to the assignee until a certain amount has been paid by the borrower, after which the assignee will transfer full interest back to the assignor.

To download the Partial Assignment form, just add it to your shopping cart and click on the Checkout button.

USA Partial Assignment of Deed of Trust

USA lenders can assign part of an interest in a Deed of Trust and the accompanying promissory note to another party with this easy-to-use Partial Assignment.

- The assignor's representations include the principal amount owing, the interest rate, and the amount of the monthly payments.

- The partial interest is being transferred to the assignee until a certain amount has been paid by the borrower, after which the assignee will transfer full interest back to the assignor.

- This form is only for use in the United States.

You can download the Partial Assignment form just as soon as your purchase goes through. Use it as often as you require.

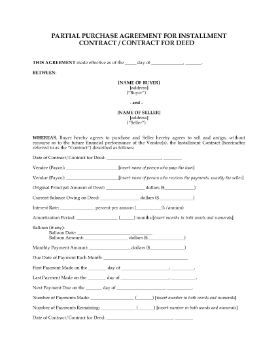

USA Purchase Agreement for Contract for Deed

Sell your interest in a Contract for Deed (installment land contract) with this Partial Purchase Agreement for U.S. real estate properties.

- The buyer agrees to purchase the interest without recourse as to the borrower's future financial performance.

- The buyer will be entitled to a specified number of installment payments, following which the interest will revert back to the seller.

- The seller's liability is limited to the seller's residual interest in the Contract.

- The agreement is conditional upon the buyer obtaining adequate funds to finance the purchase.

- If the seller cancels the agreement prior to closing, the seller must pay a cancellation fee, plus any costs incurred by the buyer.

- The seller indemnifies the buyer against any liability or expense arising from any inaccuracy or breach of any of the seller's representations or warranties.

Transferring your interest in the Contract for Deed could be a good tax planning move. Download the Purchase Agreement template in MS Word.

USA Purchase Agreement for Deed of Trust

Mortgage lenders, sell your interest in a Deed of Trust and underlying promissory note with this template Purchase Agreement.

- The buyer is purchasing the interest without recourse.

- The seller is entitled to keep any payments received under the Deed of Trust until the agreement becomes effective. These payments will be deducted from the purchase price.

- The agreement is conditioned upon the buyer obtaining adequate financing to complete the purchase.

- If the seller does not go through with the deal, the seller must pay a cancellation fee as well as the buyer's costs.

- The seller indemnifies the buyer against any liability or expense arising from any inaccuracy or breach of any warranty or representation.

- The parties acknowledge that the buyer has no fiduciary obligation to the seller and is acting as an independent investor.

- The Agreement can be used throughout the United States.

To obtain the Purchase Agreement template, add it to your cart, check out and download the form.

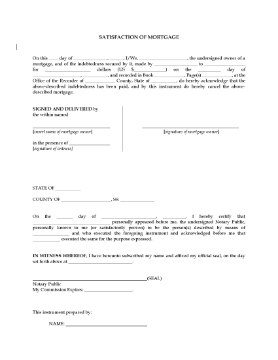

USA Satisfaction of Mortgage

USA property owners, record a Satisfaction of Mortgage with the county office when your mortgage has been paid in full.

- The document states that the mortgage is satisfied and cancelled.

- Filing a Satisfaction of Mortgage will discharge the mortgage from the title deed to your property.

- Check with your mortgage lender - they may have a form that they require you to use.

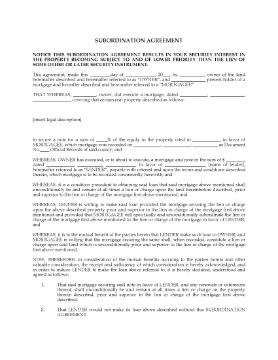

USA Subordination Agreement

Allow a second mortgage priority over an existing mortgage under this Subordination Agreement template.

- This legal form is governed by United States laws.

- The first mortgagee agrees to subordinate its security interest on the owner's property to a second loan and allow the second loan to take priority until it is paid off.

- The first mortgage will remain as a lien and charge on the property.

- The second lender will notify the mortgagee of any default by the owner in payment on the second loan.

You can download this USA Subordination Agreement immediately after you purchase it.

Utah Contract for Deed

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

Utah Deed of Trust

Transfer title to a Utah real estate property from a seller to a trustee with this Utah Deed of Trust.

- A Deed of Trust is often used instead of a mortgage in the purchase of real estate, except for agricultural land.

- Under the Deed of Trust, title is conveyed by the seller to a trustee instead of to the purchaser.

- The trustee holds the title as security to ensure the purchaser's performance of its obligations (including payment of the purchase price, maintenance and upkeep of the property, payment of taxes, etc).

- If the borrower defaults in payment, the balance becomes due and payable and the trustee may sell the property.

- The Deed of Trust contains uniform covenants regarding payments, taxes and insurance, care and maintenance of the property, protection of the lender's security, and other standard clauses.

- The borrower requests copies of any notices of default and sale be sent to the property address, as the borrower's residence address.

- Available in MS Word format and fully editable to meet your needs.

- Intended to be used only in the State of Utah.

Vermont Contract for Deed

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

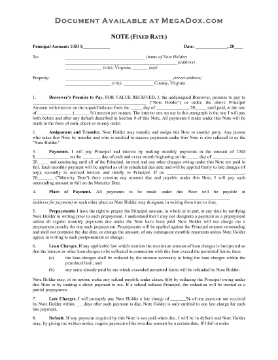

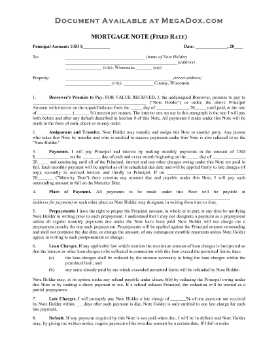

Vermont Fixed Rate Mortgage Note

Prepare a promissory note for a mortgagor to sign with this Vermont Fixed Rate Mortgage Note form.

- The loan will be paid by monthly payments of principal and accrued interest.

- If there is any amount still owing on the maturity date, the borrower will pay the entire outstanding balance.

- If the borrower is in default under the Note, the note holder has the right to accelerate the loan and demand that the borrower repay the entire loan balance in 30 days.

- The borrower promises to pay any costs that the note holder incurs in enforcing the Note, including attorneys' fees.

- This is a downloadable legal form template that is written in plain English.

- Intended to be used only in the State of Vermont.

Vermont Mortgage Form

This is a downloadable standard Mortgage Form for the State of Vermont.

- The mortgage template contains uniform covenants under federal mortgage regulations which apply to most states.

- It also contains additional provisions under Vermont law, such as acceleration and sale if the borrower defaults, and waiver of homestead exemption.

- This is a fixed rate standard form of mortgage for residential properties.

- Available in MS Word format.

- Intended to be used only in the State of Vermont.

Virginia Contract for Deed

If you are selling a real estate property in Virginia, you can assist the buyer by carrying part or all of the purchase price with this Contract for Deed (or purchase money mortgage).

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

- This is a MS Word template form and is fully editable to fit your exact circumstances.

- Intended for use only in the Commonwealth of Virginia.

Virginia Deed of Trust

Transfer title to a Virginia property from a seller to a trustee with this Virginia Deed of Trust.

- A Deed of Trust is often used in place of a mortgage when purchasing real estate. It cannot be used for agricultural land.

- Under the Deed of Trust, title is conveyed by the seller to a trustee instead of to the purchaser.

- The trustee holds the title as security to ensure the purchaser's performance of its obligations (including payment of the purchase price, maintenance and upkeep of the property, payment of taxes, etc).

- If the borrower defaults in payment, the balance becomes due and payable and the trustee may sell the property.

- The Deed of Trust contains uniform covenants regarding payments, taxes and insurance, care and maintenance of the property, protection of the lender's security, and other standard clauses.

- The debt secured by the Deed of Trust is subject to being called in full, or the terms being modified in the event of sale or conveyance of the property.

- This Virginia Deed of Trust form is provided in MS Word format, and is fully editable to meet your needs.

Virginia Fixed Rate Note

This template is a fixed rate Promissory Note signed by a borrower in connection with a loan secured by the borrower's property. The form is for loans in Virginia.

- In addition to the Note, the borrower will execute a Deed of Trust, transferring the title deed to a trustee until the loan is repaid.

- The borrower will make monthly payments on the outstanding balance of the loan.

- If the borrower defaults in making the payments, the note holder has the right to accelerate the loan and demand repayment of the entire loan balance in 30 days.

- The borrower also promises to pay the note holder's costs in enforcing the Note, including reasonable attorneys' fees.

- The Virginia Fixed Rate Note is prepared in plain language so it is easy to understand.

Waiver of Three Day Right of Rescission for New Financing | USA

Prepare a Waiver of Three Day Right of Rescission for New Financing for your customers with this template form.

- The waiver is signed by a customer in relation to new mortgage financing.

- The form sets out the customer's legal right to rescind the contract within three business days of the transaction date, and gives the customer the opportunity to waive the right of rescission.

- The Waiver is governed by federal laws and can be used in any U.S. state.

- Buy the form once, and it's yours to use as often as you require.

Washington Contract for Deed

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

Washington Deed of Trust

Transfer ownership of a Washington property from a seller to a trustee with this Washington Deed of Trust form.

- A Deed of Trust is an alternative for a mortgage loan when purchasing real estate property (other than agricultural land).

- The title to the property is conveyed to a trustee instead of to the purchaser. The trustee holds the title to ensure that the purchaser honors its obligations (including payment of the purchase price, maintenance and upkeep of the property, payment of taxes, etc).

- If the borrower defaults in making a payment, the entire balance becomes due and payable and the trustee can sell the property.

- The Deed of Trust contains uniform covenants regarding payments, funds for taxes and insurance, prior mortgages, care and maintenance of the property, protection of the lender's security, and other standard clauses.

- The property cannot be land that is used principally for agricultural purposes.

Washington Request for Full Reconveyance

Prepare a Request for Full Reconveyance with this easy template form for Washington.

- The form is used in connection with a promissory note and Deed of Trust executed as part of a real estate purchase.

- Once the note has been paid off, the holder of the note uses the Request form to instruct the trustee to transfer the property to the purchaser.

- The property is transferred without warranty.

To obtain a copy of the Washington Request for Full Reconveyance, put it in your shopping cart, go through the checkout and pay for the form. You will then be able to download it.

Washington Resignation and Appointment of Successor Trustee

Appoint a new trustee to replace a resigning trustee under a Deed of Trust with this Washington Resignation and Appointment of Successor Trustee.

- A Deed of Trust is used in place of a mortgage in the sale and purchase of real property other than agricultural farm land.

- The form should be filed in the same title office as the original Deed of Trust.

- Downloadable form, easy to fill in and use. Fully editable so you can make any necessary changes.

- Available in MS Word format.

- Intended to be used only in the State of Washington.

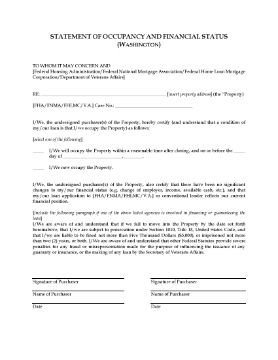

Washington Statement of Occupancy

The Statement of Occupancy and Financial Status is part of the mortgage paperwork required for a home purchase loan in Washington State.

- Have the purchasers complete the form so you can submit it to FHA, FNMA, FHLMC, or Department of Veterans Affairs (whichever is applicable).

- The purchasers must certify that (i) they will occupy the property as their residence, and (ii) there has been no significant change to their financial status since their mortgage loan application.

The Washington Statement of Occupancy and Financial Status form is provided in MS Word format. Download a copy now - it's free.

West Virginia Contract for Deed

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

West Virginia Deed of Trust

Transfer title to a West Virginia property from a seller to a trustee with this West Virginia Deed of Trust.

- A Deed of Trust is often used in place of a mortgage when purchasing real estate. It cannot be used for agricultural land.

- Under the Deed of Trust, title is conveyed by the seller to a trustee instead of to the purchaser.

- The trustee holds the title as security to ensure the purchaser's performance of its obligations (including payment of the purchase price, maintenance and upkeep of the property, payment of taxes, etc).

- If the borrower defaults in payment, the balance becomes due and payable and the trustee may sell the property.

- The Deed of Trust contains uniform covenants regarding payments, taxes and insurance, care and maintenance of the property, protection of the lender's security, and other standard clauses.

- The borrower waives all right of homestead exemption in the property.

West Virginia Fixed Rate Note

Write up a fixed rate Promissory Note for a mortgage loan in West Virginia with this affordable template form.

- The loan is secured by a Deed of Trust, under which the title deed is transferred to a trustee until the loan is repaid.

- The borrower will make monthly payments of principal and accrued interest until the loan is repaid.

- If there is any amount still owing on the maturity date, the borrower agrees to pay the full balance at that time.

- If the borrower fails to make payments as required, the note holder can demand repayment of the entire amount of principal and accrued interest outstanding.

- The borrower agrees to pay the note holder's costs, including reasonable attorneys' fees, incurred in enforcing the Note.

- The West Virginia Fixed Rate Note is a plain language legal form, easy to use and understand.

Wisconsin Contract for Deed

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

Wisconsin Fixed Rate Mortgage Note

Wisconsin mortgage lenders can prepare a promissory note for a mortgagor to sign with this template Fixed Rate Mortgage Note.

- The borrower will repay the loan by making monthly payments against the principal balance, plus accrued interest.

- If on the maturity date there is still a balance outstanding, the borrower will pay the entire balance at that time.

- The note holder has the right to accelerate the loan if the borrower defaults in making payments, and the entire loan balance will become due and payable.

- The Wisconsin Fixed Rate Mortgage Note is a downloadable legal form template written in plain English so it is easy to understand.

Wisconsin Mortgage Form

Register a mortgage on title to a property in Wisconsin with this standard fixed rate Wisconsin Mortgage.

- The mortgage is given as security for a promissory note signed by the purchaser / borrower.

- The template contains the standard provisions required under federal mortgage regulations.

- It also includes provisions required by Wisconsin laws with respect to accelerated redemption periods, and a definition of attorneys' fees consistent with Chapter 428 of the Wisconsin Statutes.

- Available in MS Word format.

Wraparound Mortgage Rider | USA

Designate a mortgage as a wraparound mortgage by attaching this USA Wraparound Mortgage Rider to the mortgage form.

- The Rider clarifies that the new mortgage is subordinate to the original first mortgage on the property.

- A wraparound mortgage is often used as a form of seller financing. It enables buyers who may not qualify for a conventional mortgage to purchase a home at a higher interest rate but with a smaller downpayment.

- The mortgagor (buyer) will make payments under the new mortgage to the mortgagee (seller), who will continue to pay the original mortgage.

- The seller has the same rights under a wraparound mortgage that a mortgage lender has under a conventional mortgage, including the right to foreclose.

- This Rider can be used in any State in which wraparound mortgages are allowed by law.

- This is a template legal form which can be customized to fit your circumstances.

Wraparound Mortgage Security Agreement | USA

Prepare a Wraparound Mortgage Security Agreement with this comprehensive ready-to-use template for US mortgages.

- The wraparound mortgage (also called a piggyback mortgage) is a second mortgage with a face value of both the amount it secures and the balance due under the first mortgage on the subject property.

- The wraparound mortgage is subordinate to the first mortgage.

- The borrower makes payment to the new mortgagee (lender or seller) based on the face value of the wrap-around mortgage, and the new mortgagee in turn makes the monthly payments to the original mortgagee.

- The borrower must ask permission of the mortgagee prior to making significant alterations to the mortgaged property.

- Any agreement between the parties pursuant to the mortgage shall be superior to the rights of the holder of any intervening lien or encumbrance.

- Any award or compensation payable pursuant to condemnation proceedings will be payable to the mortgagee.

- Intended for use only in the United States. Individual States may have statutory forms which must be used instead.

Wraparound Promissory Note | USA

This template Promissory Note is part of a wraparound mortgage loan on a U.S. real estate property.

- The wraparound note is secured by either a mortgage or deed of trust (this will depend on which state the property is located in). The template contains language for both.

- A wraparound mortgage is a form of seller financing. The seller (holder of the note) continues to make the payments on the original underlying mortgage, and the buyer (borrower) will make payments under the Wraparound Note to the seller.

- This template contains additional provisions as to how any prepayments will be applied, in the event that the buyer is allowed to prepay the balance of the Note.

- The form can be in any State where wraparound mortgages are allowed by law.

To download the USA Wraparound Promissory Note, add it to your cart and pay for it over our secure checkout system.

Wyoming Contract for Deed

- Under the terms of this Contract, the seller effectively becomes the mortgage lender for the balance of the purchase money.

- Title will transfer to the buyer once payment in full of all principal and interest has been received by the seller.

- The seller has the right to take back the property if the buyer defaults in payment.

- At the seller's option, the balance can be repaid by monthly payments with or without interest until paid, or monthly payments with interest for a fixed number of payments with a balloon payment at the end to pay out the balance.

Wyoming Fixed Rate Mortgage

Record a mortgage on title to property in Wyoming with this fixed rate mortgage template.

- The mortgage is being given as security for repayment of a mortgage loan and note.

- The template contains the standard covenants under federal mortgage regulations.

- The lender has the right to accelerate payment and foreclose if the borrower defaults in making payments or performing any of its obligations.

- The borrower waives its homestead exemption rights.

- This is a downloadable Microsoft Word template which is fully editable.

- This legal form should only be used in the State of Wyoming.