Products tagged with 'forms for canadian employers'

Sort by

Display per page

Independent Contractor Agreement | Canada

Reduce your employer contributions by hiring workers as contractors instead of employees with this Independent Contractor Agreement for Canadian businesses.

- The independent contractor is responsible for remitting their own payroll deductions and taxes and for filing their own GST returns (if applicable).

- The contractor is not eligible for the company's employee medical benefits, pension fund or other incentive plans.

- The contractor agrees not to disclose or use any of the company's confidential information disclosed to the contractor during the term of the contract.

- This engagement contract template can be used in most Canadian provinces and territories except for Quebec.

- You can cut costs and increase your monthly cash flow by retaining staff on a contractor basis. Buy and download the Independent Contractor Agreement for Canada today.

$17.99

Employment Agreement | Canada

Canadian employers, write an Employment Agreement for a new employee with this easy-to-use template.

- The contract covers relevant points of the employment including:

- Duties, responsibilities and job description of the position being filled by the employee;

- Starting salary, and any other compensation being paid;

- Benefits and expense accounts;

- Assessment or probationary period to be completed by the employee;

- Procedure for termination of the employee with cause.

- Available in MS Word format and fully editable to meet your specific needs.

- Intended to be used only within Canada.

$34.99

Non-Plan Stock Option Agreement | Canada

Give your directors and employees an opportunity to buy shares with this non-plan Stock Option Agreement for Canadian companies.

- Stock options are valuable incentives for attracting and retaining great people to your organization.

- This form of Stock Option Agreement is for a company which does not have a stock option plan.

- In the event of retirement, disability or death of the optionee, the optionee's legal representative may exercise the option within 1 year.

- If the optionee is no longer employed by the company, the option will expire.

- If the company subdivides or reorganizes its capital, the option and the option price will be adjusted accordingly.

- This legal contract template is downloadable and fully editable.

- Intended for use only in Canada.

$17.99

Guidelines to Determine Independent Contractor or Employee Status | Canada

Do you know how the tax authorities determine the difference between an employee and an independent contractor?

- Many employers are considering hiring staff on a contractor basis, instead of employing them outright, as a means of reducing the employer's obligation for payroll remittances. But it's important to be sure that you know which factors determine whether a worker is an employee or not.

- This set of free Guidelines for Canadian employers explain what Canada Revenue Agency looks at, and how a court would determine whether someone who works for you is an employee, even if you assumed you were retaining them as a contractor.

- Available as a PDF download.

- This information is for Canada only.

$0.00

Employee Nondisclosure Agreement | Canada

Your company's confidential information is worth protecting. This Employee Nondisclosure Agreement for Canadian businesses is intended to do just that.

- Under the terms of the Agreement, the employee is legally bound not to disclose any confidential information, proprietary data or trade secrets.

- The provisions of the Agreement survive the termination of employment, so if an ex-employee decides to use his/her knowledge of your customers, data and processes for personal gain, you have legal recourse.

- This employee nondisclosure agreement is written to be used in Canada and is governed by Canadian law.

- This is a reusable legal form in MS Word format. Buy the form once, download it, save it and it's yours to use as often as required.

$12.49

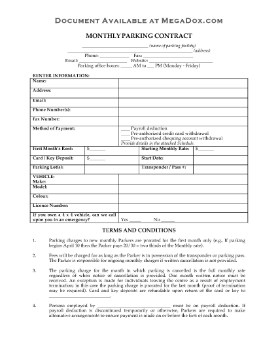

Monthly Employee Parking Contract | Canada

Rent a parking space to an employee with this Monthly Employee Parking Contract for Canadian businesses.

- The contract is for employees who work in a commercial building and rent a parking space in the building's parkade or lot.

- The employee can either pay by cheque, pre-authorized credit or debit card payment, or can authorize the company to deduct the monthly parking fee from the employee's paycheque.

- This is a reusable legal form in MS Word format. Once you have purchased and downloaded it, you can use it as often as you like.

- This form can be used in any province or territory in Canada except for those jurisdictions where a French language translation may be required by law.

$12.49

- 1

- 2