Product tags

- offer to purchase (11)

- ,

- share purchase form (25)

- ,

- takeover bid form (10)

Related products

Alberta Share Lockup Agreement for Takeover Bid

Lock up the shares of a privately held Alberta corporation in connection with a takeover offer to purchase the shares with this downloadable template.

- The agreement must be signed by each of the shareholders, pursuant to a pre-acquisition agreement between the corporation and the offeror.

- Each shareholder agrees to deposit its shares and to surrender any options or warrants it has to purchase shares.

- Each shareholder agrees not to acquire any additional shares and not to dispose of any of its existing shares except in accordance with the offer.

- The shareholders will not exercise any rights or remedies they may have under Alberta law to delay, hinder or challenge the offer.

- A share lock-up agreement ensures that every shareholder is prepared to accept the offer.

- Available in MS Word format.

- Intended to be used only in the Province of Alberta, Canada.

$17.99

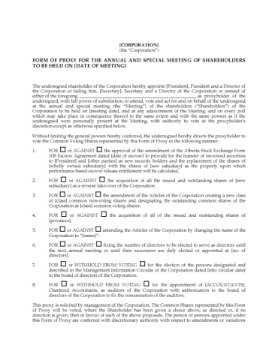

Alberta Reverse Takeover Information Package

Prepare an Offering Circular and shareholder documents for a reverse takeover bid with this downloadable package of forms for an Alberta public company.

- The offering circular must be distributed to all the corporation's shareholders by an offeror who wishes to acquire all of the securities of the corporation in a reverse takeover.

- The package includes:

- Notice of Annual and Special Meeting of Shareholders;

- Form of Proxy for the meeting, to be completed by those shareholders unable to attend in person;

- Glossary of Terms and Abbreviations used in the documentation;

- Management Information Circular, detailing the current status of the corporation, and setting out the details of the proposal and recommending that the shareholders accept the offer;

- Corporate Certificates.

- Available in MS Word format.

- Intended to be used only in the Province of Alberta, Canada.

$46.99

Takeover Bid Offering Circular | Canada

An Offering Circular must be distributed to the shareholders and security holders of any Canadian corporation which is the target of a takeover bid.

- The Circular contains information required by the shareholders, such as:

- history of the offeror and a description of its business,

- the purpose of the offering and the offeror's plans following the purchase,

- beneficial ownership and trading of the offeror's securities,

- securities subject to the offering,

- effects of the offer on the market for the corporation's securities,

- source of the offeror's funds for the purchase,

- income tax considerations,

- Competition Act legislation,

- statutory rights of offerees.

- Available in MS Word format and fully editable.

- Intended for use only in Canada.

$29.99