Product tags

- share purchase form (27)

- ,

- takeover bid form (10)

- ,

- offering circular form (3)

- ,

- canada public company form (3)

Related products

Alberta Share Lockup Agreement for Takeover Bid

Lock up the shares of a privately held Alberta corporation in connection with a takeover offer to purchase the shares with this downloadable template.

- The agreement must be signed by each of the shareholders, pursuant to a pre-acquisition agreement between the corporation and the offeror.

- Each shareholder agrees to deposit its shares and to surrender any options or warrants it has to purchase shares.

- Each shareholder agrees not to acquire any additional shares and not to dispose of any of its existing shares except in accordance with the offer.

- The shareholders will not exercise any rights or remedies they may have under Alberta law to delay, hinder or challenge the offer.

- A share lock-up agreement ensures that every shareholder is prepared to accept the offer.

- Available in MS Word format.

- Intended to be used only in the Province of Alberta, Canada.

$14.99

Alberta Reverse Takeover Information Package

Prepare an Offering Circular and shareholder documents for a reverse takeover bid with this downloadable package of forms for an Alberta public company.

- The offering circular must be distributed to all the corporation's shareholders by an offeror who wishes to acquire all of the securities of the corporation in a reverse takeover.

- The package includes:

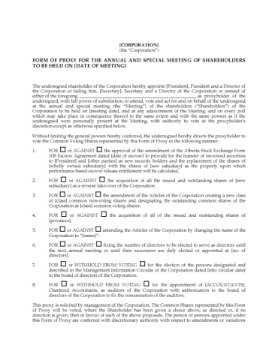

- Notice of Annual and Special Meeting of Shareholders;

- Form of Proxy for the meeting, to be completed by those shareholders unable to attend in person;

- Glossary of Terms and Abbreviations used in the documentation;

- Management Information Circular, detailing the current status of the corporation, and setting out the details of the proposal and recommending that the shareholders accept the offer;

- Corporate Certificates.

- Available in MS Word format.

- Intended to be used only in the Province of Alberta, Canada.

$64.99

Takeover Bid Offer to Purchase Securities | Canada

Make a takeover bid offer to purchase the securities of a publicly owned Canadian corporation with this customizable template.

- The purchaser reserves the right not to proceed if the offer is not accepted by sufficient security holders to represent a majority of the common shares of the corporation.

- The purchaser is not obligated to proceed if any undisclosed action results in a material change to the corporation.

- The terms of the takeover offer are for cash.

- If the purchaser acquires at least 90% of the outstanding securities, it will use any available statutory right of acquisition to acquire the remainder.

- Alternatively, it will propose an amalgamation or merger of the corporation with one of its affiliates, with the end result being that the corporation would no longer have any publicly held shares or securities convertible into shares.

- This legal form template is available in MS Word format and is fully editable to meet your needs.

- Intended for use only in Canada.

$34.99