Product tags

Related products

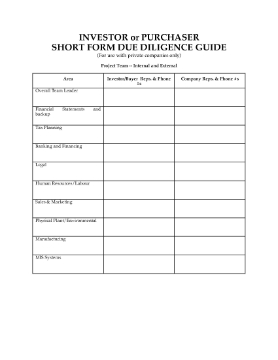

Due Diligence Guide for Private Company Investment or Purchase

Before you purchase or invest in a privately held company, do your due diligence with this 5-page guide and checklist covering such items as:

- a review of the corporate documents,

- shareholders, shareholder loans, guarantees, options and warrants,

- financial review,

- corporate borrowing, credit facilities, and debt obligations,

- taxes and government compliance,

- operations management,

- products, competition, sales and marketing,

- employees and senior management,

- tangible and intellectual property,

- legal action by and against the business,

- overview of the company's insurance coverages,

- third party consents and approvals required.

Don't put your investment at risk by not doing your homework. Get the Investor / Purchaser Due Diligence Guide for private companies.

$9.99

Guaranty of Payment and Endorsement of Instrument | USA

Get a guaranty of payment of a borrower's loan from a guarantor with this easy downloadable form.

- In addition to guaranteeing repayment of the loan, the guarantor acknowledges that a signature on the guarantee is intended to be an endorsement of the loan instrument.

- Any change, extension, or waiver under the loan instrument will not affect the guarantor's liability.

- This form can be used in any part of the United States or its territories with the applicable notary acknowledgement.

- Available in MS Word format.

$2.29

Merchant Cash Advance Agreement | USA

Make a cash advance to a US merchant against its future credit card receivables with this template USA Merchant Cash Advance Agreement.

- The merchant sells to the cash advance company all of its right in a percentage of its future credit card sales for an immediate cash injection, until a specified amount has been paid.

- The purchase and sale of the credit card receivables constitutes a sale of accounts under the Uniform Commercial Code, which vests full ownership in the cash advance company. The merchant has no right to repurchase or resell the receivables.

- The merchant will authorize the credit card company to pay the credit card sales directly to the cash advance company until the specified amount is paid.

- The merchant also grants the cash advance company a security interest in its accounts, inventory, assets, property, all future receivables, and the proceeds thereof.

- The agreement also contains a Personal Guaranty form, to be given by the principal(s) of the merchant, who agree(s) to assume all of the merchant's obligations under the agreement.

- This template is a downloadable and fully editable Microsoft Word document.

- Intended to be used only in the United States.

$29.99

USA Non-Recourse Guaranty of Commercial Lease by Spouse

Have the spouse of the owner of a business tenant provide this Non-Recourse Guaranty of the tenant's lease in order to secure performance of the lease obligations.

- The guarantor is the spouse of a principal of the corporate tenant and is provided in addition to a guaranty made by the principal.

- The landlord requires the guaranty as a condition for accepting the sufficiency of the principal's guaranty.

- The spouse gives the landlord the right to obtain payment of sums due under the lease from property and assets owned by the spouse, whether community or jointly held property or as separate property.

To obtain the Non-Recourse Guaranty of Commercial Lease by Spouse, add it to your shopping cart and check out using one of the payment methods provided.

$12.49