Product tags

Related products

Mortgage Note | USA

This Promissory Note form is for loans that are backed by a mortgage against the borrower's real property.

- You can use the template in any U.S. state.

- There is no prepayment penalty or premium if the borrower prepays the loan in whole or in part.

- If the borrower defaults under the note or the mortgage, the borrower promises to pay interest at the highest rate allowed by law.

- The borrower will pay any collection costs incurred by the lender, including reasonable legal fees.

- Intended to be used only in the United States.

- Available in MS Word format.

$12.49

Multistate PUD Mortgage Rider | USA

Attach this PUD Mortgage Rider to mortgages for single family residences that are part of a planned unit development (PUD).

- The Rider will become part of the mortgage or deed of trust and supplements the provisions of the loan document.

- The borrower agrees to perform all of its obligations under the Declaration, bylaws, and other documents governing the PUD property, and to pay all dues and assessments when they become due.

- The PUD owners' association must maintain blanket property insurance and public liability insurance on the condominium project.

- If the borrower fails to pay dues and assessments when they become due, the lender may pay them, and they will form part of the debt owed by the borrower.

- Form 3150 USA Multistate Planned Unit Development (PUD) Mortgage Rider is a free download from FreddieMac.com.

$0.00

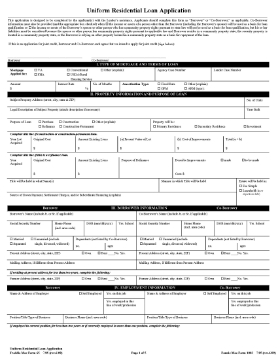

Uniform Residential Loan Application (FNMA Form 1003) | USA

Download a free FNMA (Fannie Mae) Form 1003 (Freddie Mac Form 65) loan application for a residential mortgage loan, for US residents.

- The form is to be completed by the applicant with the assistance of the lender.

- The lender uses the form to record relevant financial information about an applicant who applies for a conventional one- to four-family mortgage.

- You can download the form and additional guide directly from the FannieMae.com website through the link provided. There you will also find information and other resources to help you with your application.

- For use only in the United States.

$0.00

Wraparound Mortgage Rider | USA

Designate a mortgage as a wraparound mortgage by attaching this USA Wraparound Mortgage Rider to the mortgage form.

- The Rider clarifies that the new mortgage is subordinate to the original first mortgage on the property.

- A wraparound mortgage is often used as a form of seller financing. It enables buyers who may not qualify for a conventional mortgage to purchase a home at a higher interest rate but with a smaller downpayment.

- The mortgagor (buyer) will make payments under the new mortgage to the mortgagee (seller), who will continue to pay the original mortgage.

- The seller has the same rights under a wraparound mortgage that a mortgage lender has under a conventional mortgage, including the right to foreclose.

- This Rider can be used in any State in which wraparound mortgages are allowed by law.

- This is a template legal form which can be customized to fit your circumstances.

$12.49