Forms Package to Organize For-Profit Corporation | USA

Organize a newly incorporated for-profit corporation with this Organizational Forms Package for the USA. This package contains the following forms, which must be kept in the corporation's minute book:

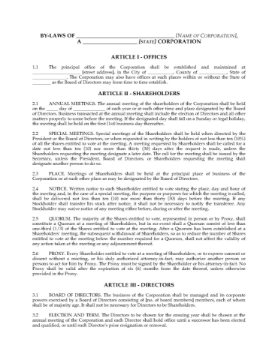

- By-laws of the corporation.

- Subscription form for shares of stock.

- Minutes of the first meeting of directors and shareholders following the incorporation.

- Consent to Act form which must be signed by each director and officer before they can be appointed.

- Resignation form to be signed by the first director / incorporator.

- Indemnity of Director, by which the corporation indemnifies each director against any costs or damages incurred as a result of his/her acting as a director.

- Register of directors and managers.

- Stock issuance and transfer register.

- Capitalization summary.

- Ledgers containing details of all common stock, stock options and warrants issued and outstanding.

Every for-profit corporation in the United States must keep its constating documents and up-to-date corporate records in its minute book. You can download all of the forms you need in one package at one low price.

Officer's Undertaking to Repay Compensation (USA)

This free Officer's Undertaking template can be used by a U.S. business corporation to obtain a promise from an officer to repay any unreasonable compensation.

- The determination of whether or not compensation is unreasonable is made by the Internal Revenue Service when calculating the corporation's federal income tax liability.

- If the compensation is deemed to be unreasonable and the corporation's tax deduction disallowed, the corporation may recoup the amount paid to the officer.

- You can download the Officer's Undertaking form as a MS Word template, or simply copy and paste the text below to create your own version.

OFFICER'S UNDERTAKING TO REPAY COMPENSATION DECLARED UNREASONABLE

The undersigned, an officer of _____________________________ [NAME OF CORPORATION] (the "Corporation"), hereby undertakes, in the event that any part of the compensation paid to the undersigned by the Corporation be disallowed as unreasonable compensation and/or an unreasonable deduction in the calculation of the federal income tax liability of the Corporation, by the Internal Revenue Service of the Department of the Treasury of the United States, to repay to the Corporation the full amount of all such compensation deemed unreasonable within _____ days after a final disallowance of such deduction by the Internal Revenue Service and the conclusion of any appeals made from such a determination.

DATED at ____________________ this _____ day of ______________, 20____.

___________________________________

Signature of Officer

___________________________________

Print Name

___________________________________

Office Held