In our last post we discussed the importance of a due diligence review when you're considering purchasing a business, and covered the questions that should be answered with respect to the business' financial and corporate history. This week we talk about legal and regulatory matters, customers, goodwill, market share and potential for growth.

Blog

Today we start a 3-article series on how to conduct a due diligence review when you are considering buying an existing business. Part I of the series covers the financial, corporate and historical data you should look at with your accountants and your lawyer. If you're thinking about purchasing a business, there are many issues you need to consider and many documents you need to review with your legal and financial advisers before you close the deal. It's not only important to know the current status of the business, but also its past history, its long-term viability, future market opportunities, and potential for growth.

You've invested a lot of time, money and resources into your business - you need to protect not only the business, but also your employees, your premises, your assets and your future. You cannot afford to leave yourself exposed to unnecessary risk. Stinting on your insurance as a means of saving money is false economy - it's a short-term saving, at the expense of future viability.

Determining the Coverage You Need

Do you know what types of insurance coverage your business actually needs? Each industry has its own unique risks and liability issues. It's important to analyze each facet of your operation to determine what could conceivably go wrong, what sorts of hazards your employees and customers may be exposed to (even minor ones), and what different types of policies are available to limit your liability and protect yourself and your business against claims and damages.

In an era when people will sue for just about any silly reason (remember the infamous McDonald's hot coffee lawsuit?), it has become increasingly important to get it right when putting together your business insurance package. You should start by obtaining risk analyses and insurance quotes from at least three insurance agents, preferably agents who have experience with your type of business and are familiar with the inherent risks. Whenever possible, you should insure with a local agent so you can arrange face-to-face discussions about your specific insurance needs - someone to whom you can become a recognizable person instead of just a policy number. Here is a list of the types of business insurance that you should consider in your Quest for Ideal Coverage.

Business Owner's Insurance

Business owner's insurance coverage is like a homeowner's policy for a business. It packages together a number of coverages and the premiums typically cost less than they would if you purchased these coverages separately. A business owner's policy usually includes:

- property insurance (buildings, equipment and inventory),

- business interruption insurance, to cover situations that may cause you to temporarily shut down operations or reduce production,

- casualty protection,

- crime insurance (theft, fraud and destruction),

- liability and product liability insurance,

- vehicle coverage for borrowed or rented / leased vehicles.

This type of insurance is more cost effective for small to mid-sized businesses, and may include much, if not most, of the coverage that your operation requires.

Property Insurance

The business owner's policy may not extend to damage outside of your premises. If you're located in a multi-occupancy building, you may be required to carry additional property insurance as a condition of your lease.

Liability Insurance

Liability insurance insures against claims for damage to property or injury to persons for which you are held to be responsible, including negligence claims, and suits filed by employees injured on the job. Liability insurance policies cover the legal costs and any damages awarded to the claimant.

Product Liability Insurance

Product liability insurance covers you in the event a product you produce causes harm to a purchaser of that product, or any third party. The purpose of product liability insurance is to protect your business against paying legal or court costs for claims arising from such an event.

Professional Liability Insurance

Professional liability (or professional indemnity) insurance protects service providers against claims for negligence, misrepresentation, violations of fair dealing and good faith, and inaccurate or incorrect professional advice. It is required by law to be carried by medical practitioners (malpractice insurance) and legal practices (errors and omissions - known as E&O - insurance).

Vehicle Insurance

If your business owns any vehicles, you are required by law to have adequate collision and liability coverage on all of your commercially used vehicles.

Workers' Compensation Insurance

Workers' compensation provides wage replacement and medical benefits for employees who are injured on the job. In return for receiving workers' compensation, the employee relinquishes the right to sue the employer for negligence. By law, employers must carry workers' compensation insurance for all employees.

How to Save Money on Your Business Insurance

As mentioned earlier, a Business Owner's Policy will bundle a lot of essential coverages into one package, at a lower premium. But remember that you get what you pay for. The cheapest policy may not provide you with the best protection. There are other ways to keep your insurance costs down without compromising the safety of your business and your employees.

Increase your deductibles. Increasing the amount of your deductible under each policy will decrease the amount of your premiums. While it will also mean that you will pay more money out-of-pocket in the event that something goes wrong in the future, it will positively affect your cash flow in the here-and-now.

Take advantage of group rates through business organizations and professional associations. Many business organizations offer special discounted insurance rates to their members. Calculate the cost of paying the association dues plus what you'll pay with the special insurance rate, and compare that to what you're paying now.

Use the risk analyses as a guide to reducing your liability. Remember those risk analyses you obtained from the insurance brokers? They pinpoint the areas of risk in your business. Eliminate or deal with as many as you can, and inform your broker about what actions you've taken. This should help reduce your premium costs.

Shop around. Get quotes from several brokers, do some Internet research, and talk to friends and business associates about their insurance coverages. Be informed before you decide.

Insure the building, not the land. There is no need to insure the land that the building stands on. The land can't be damaged, destroyed or stolen. Your property insurance should cover the replacement value of the structures only, NOT the land.

Schedule Annual Insurance Reviews

Review your policies once a year with your insurance agent, to make sure you're still adequately covered and still getting the best value for your money. Laws and regulations change, and it's important to be sure that you haven't left a gaping hope in your coverage out of neglect or lack of information. You may have bought new equipment, expanded your operations, hired more employees since you bought your insurance - any of these events can mean your coverages are no longer adequate. Or perhaps you've scaled back your business and sold some assets, in which case you may be over-insured.

Regular reviews are the best way to determine whether your current insurance coverage is still sufficient for your growing business.

Image by Steve Buissinne from Pixabay

You've finally found an ideal location for your business, and you can start negotiating the lease with the landlord. But what should you be looking for in the commercial lease agreement? Before you sign anything, review the lease and make sure it answers each of the following questions:

1. Will you be given a copy of the building inspection report? If not, can you arrange for your own inspection?

2. Is a drawing of the leased premises attached with the demised area clearly marked?

3. What is the date of possession? What are your remedies if the space is not available to you on the date of possession?

4. Are you required to obtain any approvals or comply with any local regulations or ordinances before you can commence business in the leased premises?

5. How long is the free rent period? When do the lease payments begin?

6. How will your security deposit be handled? How long will it take to receive a refund of the deposit at the end of the lease term?

7. Are there restrictions on your use of the space? What are those restrictions?

8. What are the provisions for rental increases? How much prior notice will be given?

9. Are the tenants required to pay a percentage of the property taxes?

10. What types of insurance coverage, in what amounts, are you required to carry?

11. Which utilities and services will you be responsible for paying?

12. What other costs are associated with the space (advertising, merchant association dues, etc.)?

13. How much will the landlord pay towards your leasehold improvements?

14. Are there any restrictions on what kind of signage you can have? Do you need to get the landlord's prior approval before installing your signs?

15. What are the landlord's obligations for repairs and maintenance on the building, the common areas and your premises?

16. How much are your common area maintenance costs?

17. What are the provisions for renewal of the lease at the end of the term?

18. Do you have the right to assign the lease or sublease any of the space?

19. What are your rights in the event of eminent domain, foreclosure, or partial or total destruction of the premises?

20. What happens if you default in any of your obligations?

21. What are your remedies if the landlord defaults?

22. Are you required to return the premises to its original condition at the end of the lease period? Based on the original condition, what will the costs be to do this?

23. Is there an obligation to pay legal fees and costs in the event of a dispute?

If you are satisfied with the answers, you can proceed with submitting a Letter of Intent or a Lease Proposal to the landlord which sets out all the negotiable elements of the lease - square footage, initial term, renewals, base rent, rent-free period, allowance for leasehold improvements, etc. and the relevant tone of your negotiations to date. The LOI will allow the parties to continue to negotiate the final terms of the lease. Keep every draft of the LOI as a paper trail documenting the negotiations.

Finally, have your lawyer review the lease BEFORE you sign. And never sign anything that you don't fully agree with.

Image by H. Cuthill

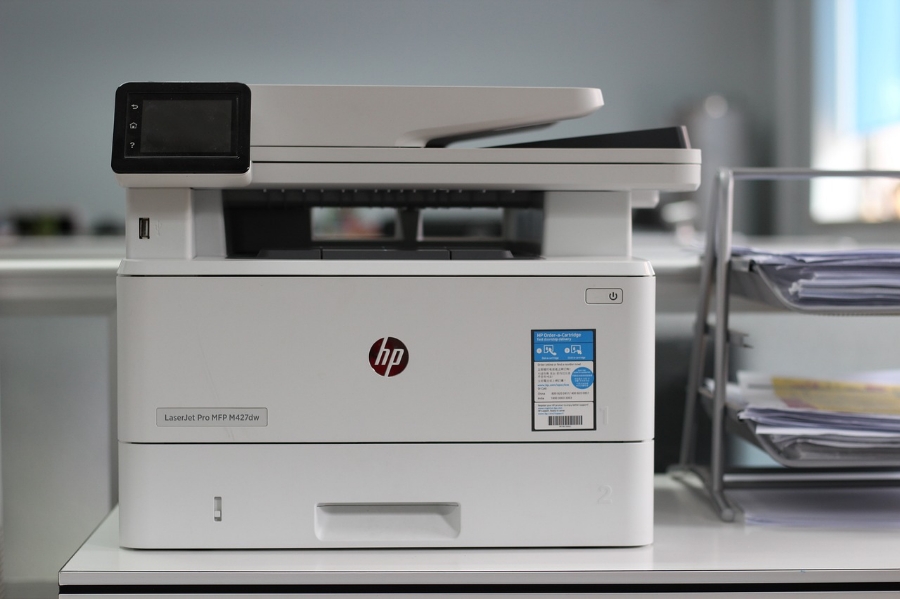

If you're starting up a business, cost drives every decision you make. And when it comes to business equipment, you need to determine whether it is most cost-effective and advantageous to lease or purchase the equipment necessary to your business.

There are essentially three options available for acquiring the equipment you need: a straight lease, lease-to-own (a "finance lease"), or outright purchase. The term "business equipment" can apply to anything you need for your operations, including computers, printers, and other electronics; office furniture; communications systems (cell phones, pagers, Blackberries; alarms and security systems; shelving and storage; specialized machinery; warehouse forklifts and loaders; and vehicles.

The Upside and Downside of Leasing

The upside of leasing is that it requires less of an initial outlay than purchasing, so you're not tying up so much money right off the bat. And for computer equipment, it can be the best option. Your lease costs can be deducted as an operating expense, and they don't depreciate. Since the average equipment lease runs for 3 years, your lease will be expiring right about the same time that your computer equipment is obsolete, and you can upgrade to a new system under a new lease. Review the lease terms to make sure they provide for maintenance, updates and support.

The downside of leasing? Your overall costs are almost always higher, you don't own the assets, and you build no equity in the equipment. And there will probably be restrictions on whether, and how much, you can customize the equipment for your business.

Should I Buy Instead?

When you buy it, you own it. And you can probably deduct a good portion of those asset purchases on your business income tax return. You also get the benefit of the depreciation deduction. If the equipment you need has a lifespan of more than 3-5 years and you've got the capital to do it, you probably should purchase instead of leasing it.

Office furniture is a good example of equipment with a long lifespan. While you may replace the chairs every few years, it's likely that the desks, shelving and filing cabinets will be around for a long time. These items are readily available from second-hand office suppliers, which can save you money. Buying second hand can be a great way to save money and still get what you need. Look for classified ads, listings on Craig's List and Kijiji, and shops that specialize in used office equipment and supplies.

Check out the local and online auctions as well. You have more recourse when buying from a dealer since you can usually take the item back, although there will probably be no warranty. The price might be higher than if you bought it from an individual, but the ability to return the item is worth paying more for. The risk you run when buying from an auction is that you can't actually test the equipment beforehand. Many auctions sell goods as seen, which means if the goods do not work, you have almost no chance of getting your money back, except for online auctions such as eBay. Find out what the restrictions are - and what your rights are - before bidding on any auction items.

Determining the Actual Costs

I'm assuming that, like most start-up businesses, your company will need to finance any equipment purchases by securing a loan. There are some questions that you will have to get answered in order to determine what the actual cost of leasing versus purchasing will be.

- What is the required down payment for the equipment?

- What is the term of the lease or loan?

- What are the monthly payments?

- What is the interest rate?

- Is there a final balloon payment at the end of the term? If so, what is the amount?

- What is the cost of an extended warranty (if applicable)?

- If lease-to-own, can you buy out early? At what cost?

- What is the total cost of the lease or loan (including maintenance and warranties) over its lifetime?

- If leasing to own, how much more are you paying to lease the equipment over and above its actual value?

- What are the tax deductions available if you purchase the equipment?

- What would the resale value of the purchased equipment be?

Can You Afford It?

Now that you know what the costs will be, ask yourself whether the business can afford it? Do you have sufficient cash flow at present to support your monthly lease or loan payments? If your business is seasonal, you'll need enough cash to support those payments during your off-season. And what about the maintenance costs? Are they included in your lease? Did you provide for them in the loan calculations? Do you know what they are? Then there's insurance. How much is the annual insurance cost to cover the equipment? Is it included in the lease?

If the answer to any of the above questions is "No", you should determine which equipment is absolutely essential for your business, and which items can wait until your cash flow improves. If you have to have it and the cash isn't there to buy it, then talk to several leasing companies and negotiate the best lease you can.

Image by xuefei wang from Pixabay

Careful preparation for meetings with the investment community seems as obvious as it is necessary. However, good intentions all too often get sidetracked and key preparations can easily be overlooked. The questions outlined below will serve as a checklist to make sure that every important item is addressed well in advance of your next investor session.

Are you a software developer? More to the point, are you a software developer who wants to draft up a standard form of contract yourself, instead of having a lawyer do it? This checklist can help you cover the bases, but remember that it's always advisable to have a lawyer review your final form of agreement before anyone signs it, to make sure everyone's interests are addressed (it saves on litigation costs later).

Let's look at each of the sections that should be included in a standard-form Software Development Agreement, and the issues that should be addressed to protect your interests and those of your clients.

1. Parties

Every contract should begin with the names, addresses and contact information of the parties. If any party is a corporate entity, the jurisdiction in which it was incorporated should be included as well.

2. Full Description of the Software and the Development Process

All of these items should be addressed. They can be briefly described in the main body of the Development Agreement, with the detailed specifics attached as a schedule or appendix.

- Specifications of the software being developed.

- Definition of milestones and criteria for the start and end of each phase of development.

- Timetable for deliverables.

- Progress reports, including: milestones achieved, problems encountered, potential future problems, any changes to functionality, time schedule or milestones.

- Testing specifications and criteria for passing each test.

- Standards and procedures to be applied.

- Customer's right to conduct quality audits and to witness the developer's testing of the software.

- Installation, support and training that will be provided by developer.

- Developer's obligation to deliver the software and documentation in accordance with the specifications.

- Customer's obligation to supply hardware, software, support, personnel.

- Provisions describing the process for customer's acceptance of the software and documentation.

3. Background Technology

Any background technology (e.g. existing code and applications that will be utilized in the development of the software) must be described in sufficient detail, and the ownership of that background technology established - whether it is owned by the customer or the developer.

4. Definition of 'Proprietary Information'

Each party will be providing such things as business data, source code, and other types of confidential information. The term 'proprietary information' should be defined, as it applies to both the developer and customer.

5. Ownership of Software and Documentation

- Who owns the software and documentation (taking into consideration ownership of the background technology)?

- What are the rights of each party are with respect to licensing and sublicensing the software?

- The developer should assign its intellectual property rights in the software to the customer.

- It is also important to set out any restrictions on the use of the software (if applicable).

6. Payments

The section of the Agreement that deals with payment of the development fee should deal with more than just how much and when payments are to be made. All of the following should be addressed:

- Payment schedule should be based on accomplishment of development milestones.

- Amount of development fees, and allowable expenses, including any maximum amount.

- Do expenses over a certain amount require customer's prior written approval?

- Do the development fees include applicable taxes?

- Developer's invoicing schedule and due dates for payment of invoices.

- Process for customer's acceptance of development milestones.

- Customer's right to buy out of the contract in the event of early termination.

7. Termination

- Provisions for termination by either party, and for what reasons.

- Notice period and form of notice, which should include the reasons for termination and the effective date of termination.

- Survival of terms (such as confidentiality), licenses, and sub-licenses after termination. Which provisions will survive (continue to be binding after termination), and for how long?

8. Training

- What types of training services will be provided by developer?

- Where will the training take place?

- How long will training sessions take place, and how many participants will be accommodated?

- What sort of training materials will be provided? Who provides them?

- Is there a separate fee for training, or is it included in the development fees?

9. Modifications to Software

- Spell out the customer's rights to modify the software, and to acquire any modifications by the developer.

- Who owns the modifications?

- Are there additional fees?

10. Errors and Defects

- The customer should have sufficient time to use the software to detect any errors or defects in the software. This section should set a reasonable notice period, such as 90 days, during which the customer should notify the developer in writing of any errors or defects.

- The developer has an obligation to correct the problems, provided that the errors or defects did not come about by misuse on the part of the user.

- The parties must also agree on a fair and reasonable arrangement as to any additional fees for work required to fix errors and defects.

11. Warranties

The developer's warranties to the customer should include:

- Performance of the software.

- Customer's right to use software and documentation.

- Ownership of the software, and developer's ownership of any background technology used in the development.

- Indemnification of the customer against third party infringement claims and damages.

- Survival of warranties after termination or expiration of the contract.

The customer should also provide a warranty of ownership if any of the customer's background technology was used in the development, and should indemnify the developer against claims and damages in that regard.

12. Standard Clauses

There are certain boilerplate clauses that are included (in whole or in part) in all legal agreements:

- Procedure for giving notice by one party to the other party. It should always be in writing, and can be delivered personally, by mail (whether regular or registered/certified), by fax, or any of these.

- Governing law clause.

- Headings not to be construed as part of the agreement.

- Force majeure provisions.

- Severability of clauses, in the event that certain provisions are deemed invalid.

- No amendments unless agreed to by all parties.

- Schedules and attachments to form part of the agreement.

- Entire agreement, i.e. no other agreement exists between the parties with respect to the software development.

- Non-merger (survival) clause setting out which provisions will survive termination.

To get you started, you can find template software licensing and development contracts at MegaDox.com. These are fully editable templates which are easily customized to include all the details of your client transactions.

To answer my own question, not dead yet (nod to Monty Python). But it's definitely ailing. It seems like most of the service sectors could use a refresher course in courtesy. Remember back in the day when you would pull into a service station (keyword "service"), and a smiling attendant would come out, pump your gas, check your oil and even wash your windows? And when you paid for the gas, you might even get a free air freshener for your car! (If you're under 30, all of this will sound like some Pleasantville fantasy.) Today you drive up to the self-serve gas bar, pump your own gas, clean your own windows (if you can find a squeegee), check your oil (or decide to skip it because you'll get your hands dirty and you're on your way to work), and pay by credit or debit card at the pump because they don't take cash (too risky - might get robbed). Faster? Decidedly. More enjoyable? Get real. Smiling? Not.

We all realize that we save money by doing it ourselves - whether it's pumping gas or bagging our groceries. Nobody is against saving money if it means skipping a few little amenities. But the whole concept of "Service" seems to have gone out the window along with those little amenities. And as a side effect of convenience, we're robbing millions of high school kids of potential after-school jobs at the gas station or the grocery store. So whatever cash we save on gas and groceries, we end up having to pay out for our kids' gas and cell phone bills.

Seriously, though, the term "customer service" is made up of two words that naturally go together. Customer Service is defined as "an organization's ability to supply their customers' wants and needs." The definition of a customer is someone who purchases goods or services (that word again). Whether we do business in a brick and mortar building, online, or a combination of both, when we serve a customer we are promoting our brand. The way in which we serve that customer will shape how they perceive our business and will determine not just whether or not the customer will return, but also what they will have to say about us to family, friends and colleagues.

Every businessperson knows that a business survives solely on the goodwill of its customers. No matter how deep the pockets of your investors are, no matter how flashy and cool and sexy your products are - if your customers leave your store feeling unsatisfied or unhappy, your business is doomed. Bad word-of-mouth gets around pretty quickly these days via Twitter, Youtube, Facebook and customer complaint and review websites. This morning's bad customer experience can become this afternoon's trending topic on Twitter. Your marketing fail could soon be plastered all over the Internet for all to see, and your brand can be dragged through the virtual mud. For a business that relies on local visitors - such as a restaurant - this is the kiss of doom. You now will have to look at spending a lot of time, effort and cash cleaning up the PR mess and hoping people will forgive and forget. Or you could just take steps to avoid it in the first place

Let's go back to that definition of customer service and the part about "supplying a customer's wants and needs." How can we know what they want and need? Well, you can get a clue as to what they NEED by the fact that they've come to your shop or your website. If you sell cars, chances are they're not shopping for window blinds. So you have your first clue - now you narrow the field by asking them what they're looking for, then leading them to the items that fit that description. Narrow the field more by determining the price range, color, size, and other factors that will ultimately affect their decision to purchase.

We've dealt with what the NEED. But what do they WANT (other than a new car)? That's pretty easy. They want what YOU want - to be dealt with respectfully and fairly, and to be treated as a person. An important person. Someone whose opinion matters. Someone whose time is as valuable as yours.

I'm going to share an incident that happened to me not long ago. I went to the Customer Service counter in Real Canadian Superstore to ask a question. There were three people behind the counter who were obviously enjoying themselves, joking and giggling together. Unfortunately there were also three of us customers standing on the OTHER side of the counter waiting, and waiting, and waiting, while they had their little laugh fest, and we were not amused. After a couple of minutes of wasting my valuable time, I gave up and left. Now to be fair, I've had positive experiences with Superstore's customer service people on other occasions. But THAT one stands out in my mind. Do I still shop there? Yes, but only because they have a big gluten-free section and their prices are better than the competitors. (Celiac disease sometimes means compromise.) But just because I want to save money doesn't mean I want to cease being treated like a human being. Every business, no matter the size and no matter the clientele, must train their staff to be prompt, courteous and respectful. Don't waste our time.

Now let's take an example from the other side of the aisle. I stopped at Tim Horton's one morning to fill up my travel mug with Tim's Dark Roast. The lady behind the counter got my coffee for me and then asked me if I was right- or left-handed. Why? Well, so she could put the lid back on my travel mug with the drinking spout on the appropriate side. Now THAT is customer service.

And remember to SMILE, people. If you don't enjoy your work, then go work somewhere else. Don't take it out on your customers. We didn't hire you. You may be asking, "How do you do all this if your business is online? How can I strike up a meaningful relationship with people I've never met?" Well, people chat with customers on social media every day. "Prompt, courteous and respectful" still apply. Using the words "Thank you" liberally in your emails, post-checkout pages, and contact pages will make your customers feel appreciated. And yes, you can SMILE with your telephone voice and with the words you use on social media. The folks at Big Fish Games do it all the time!

Let's keep Customer Service alive and well by practicing it every day in our own businesses, and by reinforcing it in others whenever we encounter it in our lives. If a support person or salesperson meets or exceeds your expectations, let them know - and let their supervisors know too. Recognition is like a pat on the back - it encourages people to strive to do their best at all times. If your employees are doing their best for your customers, word will get around and your business will be all the better for it.

Strategic planning is critical to the success of your business. It is an opportunity for management and staff to brainstorm and discuss a wide variety of ideas that might not otherwise be suggested or considered as potential strategies. It also reinforces the company's core values and sharpens the focus of the whole team on the mission, the goals and the objectives.

Aim to hold a strategic planning meeting for all key personnel once a year, and encourage departments to hold followup sessions at 3- or 6-month intervals for executive managers and department heads.

Bring a copy of your current business plan to the meeting so it can be referred to when needed. Keep in mind the purpose of the meeting: to evaluate past projects and goals and to develop new strategies based on opportunities discovered through market research and analysis.

The 11-Step Checklist

Follow these 11 steps to help you set the stage for a more creative and productive strategic planning meeting:

Pick a venue that is outside of your business premises. Look for a casual and quiet setting with few distractions so that the participants will feel relaxed and can focus on the business at hand.

Arrange for beverages and snacks and, if the timing and duration of the meeting calls for it, bring in lunch or dinner.

Make it clear that each person will be treated as an equal, no matter what their position in the organization may be, and that everyone will have an equal voice in terms of suggestions and criticisms.

Promote a more comfortable atmosphere by inviting everyone to dress casually.

Encourage open discussion of the topics. This will not only stimulate more brainstorming as the meeting progresses, but it will also serve to fully define the subject and determine its merits.

Don’t let the meeting devolve into a "bitch session". Point out ideas that merit consideration and explain how certain suggestions may not fit into the overall scope of the company’s strategy. Celebrate strengths and look for solutions to weaknesses.

Don’t try to prioritize ideas brought forth in the meeting. This is mainly a brainstorming session where ideas are explored in relation to their strategic impact on the business, and they are best discussed and explored as they are suggested and not according to an imposed agenda.

Provide the means for people to advance ideas visually and immediately to the whole room - white board, flip chart, colored markers, etc.

Cover each topic thoroughly before progressing to the next. Keep in mind that you are exploring strategic solutions. When discussing each subject, come up with realistic timelines for specific actions to be taken after the meeting has been adjourned.

Within a week of the meeting, write a summary of all the ideas discussed at the meeting and circulate it to everyone who is part of the strategic planning team.

Follow up at regular intervals to ensure that progress is being made in implementing the ideas that were adopted.

Image AI generated by Pixabay.com

This is a question that we get asked frequently, so it seemed like a natural topic for a blog post. Let's do a comparison of the two structures.

Formation and Duration

A partnership is a business entity that is not registered as a corporation or a limited liability company and which is owned and carried on by two or more parties for the purpose of generating profit for the partners.

A joint venture or (JV) is formed when two or more parties join together to take on a specific project. The parties share the costs and the risks, as well as any gains and benefits, and contribute money, property, effort and know-how to the venture.

While a joint venture is usually set up for a fixed time frame (i.e. the life of the project), a partnership is typically long-term and is intended to carry on as long as the partners want to continue doing business together.

Participants in a JV do not usually intend to conduct a common business with the other co-venturers, and they're free to carry on their own businesses outside of the business of the JV. Partners in a partnership, on the other hand, are typically already carrying on their business within the context of the partnership (for instance, attorneys or accountants).

Participants' Contributions to the Business

Participants in a joint venture are required to contribute money, property, expertise, knowledge, time and other resources to be used by the joint venture. They are also entitled to receive a percentage of the revenues or proceeds from the business of the joint venture in proportion to the resources they contribute.

In a partnership arrangement, the partners may also contribute money, property, know-how, and other resources to the partnership, but they are not required to do so. Partners are also entitled to a commensurate share of the profits from the partnership.

Partners usually intend to treat any property contributed to the partnership as partnership property. In a joint venture, the property contributed by the co-venturers is returned to each of them when the joint venture is wrapped up unless it has been sold to the other participants.

Management of the Business

The day-to-day business of a joint venture might be carried out by one co-venturer on behalf of all of them, but usually major strategic and operational decisions will require the consent of all the participants and cannot be made by one co-venturer as agent for the rest. This helps to ensure that the participants have mutual control.

In a partnership, mutual control is not always a consideration. Sometimes only particular partners (such as senior partners in a law firm) have management roles. And a general partner can act as the agent for all other partners and can transact business and enter into contractual obligations and debts without the consent of the other partners.

Risks and Benefits of Each Type of Entity

Image by Gerd Altmann from Pixabay

There are risks in either type of relationship and it is important that you have a good level of trust in the people you are partnering or venturing with. Do some background checking on the other parties to make sure you feel comfortable about entering into a relationship with them.

- A partnership can incur obligations on its own account (much like a corporation) but a joint venture cannot - only the participants (co-venturers) can sign contracts and incur debts.

- In a partnership, each partner is jointly and severally liable for the debts and obligations of the partnership, with the exception of limited partnerships, in which the limited partners' liability is capped. In a joint venture, each participant is liable only to the extent of its interest in the JV.

- As for benefits, a partnership operates on the expectation that it will produce profits for the partners. That is the chief benefit that all of the parties work towards. The benefits of participating in a joint venture, on the other hand, may be tangible (such as development of a real estate property) or intangible (such as R&D of a new manufacturing process).

Tax Considerations

There are significant differences between the way taxes are calculated for joint ventures vs. partnerships, and tax laws vary from country to country. International ventures must also be aware of the rules governing their business under existing or future double tax treaties. Obtain the services of a tax consultant who knows the tax laws for partnerships / joint ventures in your own country and in any other country you're going to be doing business in.

For legal purposes, neither partnerships nor joint ventures are considered corporate entities separate and apart from their participants. But for income tax purposes, the net profit or loss of a partnership (i.e. expenses, capital cost allowances, etc are deducted) is calculated before a share of the net profit or loss is allocated to each partner, even though the partners will be taxed on that allocation. In a joint venture, the gross revenues / production, expenses, and capital receipts and outlays are allocated among the co-venturers based on their respective interests, and each of the participants then calculates its own net profit or loss and tax payable.

Selling or Transferring a Partnership or JV Interest

The transfer of a partnership interest typically requires the consent of the other partners. And because the partners generally have an indirect interest in the property and assets of the partnership, a partner can transfer its interest in the partnership itself but NOT its interest in the partnership assets. The partnership retains the beneficial interest in the partnership assets as long as the partnership is in operation, and the partners will not be entitled to a share of the net proceeds from those assets until the partnership is dissolved.

In a joint venture, the co-venturers retain their individual ownership of the property they have contributed to the joint venture, so they have full control over the contributed property. This means that the assets of the joint venture are not owned jointly by the co-venturers, and typically a co-venturer would be able to sell its interest without obtaining the consent of the other co-venturers (subject to any rights of first refusal the other participants may have under the terms of the Joint Venture Agreement).

A partnership interest is generally considered capital property for income tax purposes, and the sale of that interest would result in a capital gain or loss. An interest in a joint venture is not considered capital property and is taxed on the same basis as the sale of an interest in each of the assets of the venture.

Death of a Participant

Since a joint venture is usually limited to a single project or undertaking and only exists for a finite time, the death of one of the participants will not normally terminate the joint venture (unless the joint venture contract is a personal service contract), whereas the death of a partner has a significant impact on a partnership and may well mean the end of the partnership.

Put It In Writing

Whether you're setting up a partnership or joint venture, Do Your Research and get legal and accounting advice before you start. The participants should then put together a written agreement which clearly defines the terms of the relationship, the responsibilities of each of the participants, a procedure for transferring a party's interest, and a mechanism for terminating the agreement.

A written agreement is required if you intend to make a joint venture election for tax purposes. It is important to agree in writing as to the value of each participant's contribution of capital and resources, and to specify the proportionate interest of each participant in the profits or production of the JV in order to reduce the potential for conflict down the road. For instance, if the JV's activities involve the manufacture of products a participant's specified interest might be a percentage of each product produced.

Consult an Expert

Keep in mind that the foregoing information is a generalization and is intended as an overview. To get information about the specific laws and requirements in your area, you should obtain legal and financial advice from local experts.

Image by Gerd Altmann from Pixabay

- 2025

- 2024

- 2023

- 2021

- 2020

- 2019

- 2018

- 2017

- 2016

- 2014

- 2013

- 2012

- 2011