Customers who bought this item also bought

Shareholder Agreement with Put Option | Canada

A Shareholder Agreement protects the interests of a corporation's shareholders and minimizes the risks of share ownership. This Canadian template contains a buy-sell or "put" option.

- This is a Canadian legal form which can be used anywhere in Canada except Quebec.

- The Shareholder Agreement establishes the obligations of the shareholders and the corporation to each other, and sets out any restrictions on share transfers or the issue of new shares.

- The remaining shareholders have a right of first refusal to acquire the shares of a departing shareholder, before the shares can be offered to a third party.

- A departing shareholder also has a buy-sell or 'put' option, which would require the remaining shareholders to purchase his/her shares. The put option is available only after the departing shareholder has been unsuccessful in finding a third party purchaser for a period of 6 months.

- The template contains buy-sell options for both an assured buy-out and a mandatory or 'shotgun' buy-sell.

- If a shareholder dies, the surviving shareholders have the option to buy the deceased shareholder's shares, failing which they must be purchased by the corporation.

- The Shareholder Agreement can serve to avoid unnecessary conflict by having the owners agree on management issues and exit strategies at the outset.

$29.99

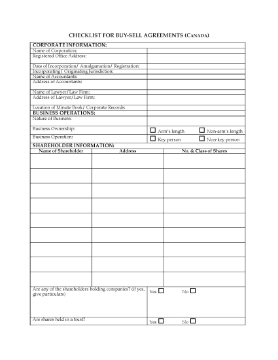

Shareholder Agreement Guide | Canada

Discover the legal and practical issues you need to consider when entering into a shareholder agreement with this Shareholder Agreement Guide and Checklist for Canadian companies.

- Topics in the Guide include:

- how to avoid misunderstandings between shareholders;

- distribution of profits;

- decision-making;

- exit strategies;

- employee shareholders;

- default by a shareholder;

- disability or death;

- loss of shareholder control.

- Available as a PDF download.

- This checklist was created for use in Canada.

$29.99