Products tagged with 'royalty agreement'

Sort by

Display per page

Royalty Agreement for Intellectual Property | Canada

Set the terms for payment of royalties on intellectual property with this contract template for Canadian businesses.

- This agreement covers royalties accruing on intellectual property that was developed by the seller, which is being transferred to a purchaser as part of a transfer of business assets.

- The intellectual property will continue to be used by the purchaser in connection with the business operations, and royalties will continue to accrue.

- The purchaser agrees to pay the seller an ongoing royalty for a specified number of years following the closing of the purchase and sale transaction.

- The royalty will be calculated based on the customer base and non-exempted gross earnings of the business.

- This Royalty Agreement refers to the laws of Canada. It can be used in any Canadian province or territory. A French language version may be required in Quebec.

$12.49

Alberta Seismic Option Agreement

Grant a seismic option over an oil and gas property in Alberta using this downloadable template option agreement.

- The optionee will shoot a 3-D seismic shot across the option lands sufficient to allow the optionor to evaluate the hydrocarbon-bearing potential of the lands.

- Trading rights for the seismic program would be earned 100% by the optionee.

- In return for shooting the seismic program, the option will have the right to either terminate the agreement or elect to drill a well.

- Provisions for drilling a substitute well if serious difficulties are encountered with the original well.

- The optionee will earn an undivided 100% interest in the optionors interest in the earning well spacing unit, and a specified undivided percentage interest in the remainder of the lands.

- The parties authorize the operator to make GST elections on their behalf.

- An Overriding Royalty Agreement is included with the package.

- This Seismic Option Agreement is governed by the laws of the Province of Alberta, Canada.

$34.99

Alberta Gross Overriding Royalty Agreement

Prepare a Gross Overriding Royalty Agreement with this downloadable template contract for oil and gas properties in the Province of Alberta.

- Gross Royalty. The Grantee receives a gross overriding percentage royalty on its interest in petroleum substances on the lands covered by the agreement. The royalty is free and clear of any costs involved in exploration, drilling, operation, production, transportation, etc.

- Sale of Interest. The Grantor, acting as agent for the Grantee, will sell the petroleum substances on the same terms and conditions as its own interest, so that the Grantee is entitled to any market available.

- Funds Held in Trust. If royalties are paid to the Grantor by a purchaser, those funds are held in trust by the Grantor until they are paid to the Grantee.

- Election to Take in Kind. The Grantee has the right, upon proper notice, to elect to takes its royalty percentsage of production in kind.

- Lien Rights. The Grantee has the right to a lien over the Grantor's interest to secure payment of royalties.

- Governing Laws. This Gross Overriding Royalty Agreement is governed by the laws of the Province of Alberta, Canada.

$17.99

Alberta Overriding Royalty Agreement

Write up an Overriding Royalty Agreement pursuant to a Farmout and Option Agreement with this customizable template for Alberta oil & gas properties.

- Parties. The Agreement is between (1) the grantor who owns interests in leases and royalty lands and (2) the grantee who is being allowed to reserve royalties out of the earned interest.

- Royalty Calculations. The agreement contains methods of calculating the royalties for crude oil, natural gas, and condensate.

- Overriding Royalty. The royalty under this Agreement is not subject to other royalties, burdens or encumbrances payable on the royalty lands.

- Agency. The grantee appoints the grantor as its agent to enter into contracts and to sell petroleum substances on the same terms and conditions as it sells its own share.

- Management Fee. The grantee has the right to take its share in kind, provided that if it does not take possession and separately dispose of its own share, it will pay the grantor a management fee equivalent to a percentage of gross proceeds received from such share.

- Governing Laws. This Overriding Royalty Agreement is intended for use in the Province of Alberta, Canada and is governed by Alberta and Canadian law.

- Format. The document provided in MS Word format and can be easily edited to fit your circumstances. Other formats available on request.

$29.99

Shareholder Royalty Agreement

This Royalty Agreement allows a corporation to reward a shareholder who is vital to the operations with an ongoing royalty in exchange for ongoing support and direction.

- The royalty is calculated as a percentage of the corporation's gross receipts.

- The shareholder has the right to audit the company's books to determine if the royalty being paid is correctly calculated.

- The corporation agrees not to sell any product or service for less than current market price.

- This legal form is fully customizable to fit your circumstances. Download it immediately after you purchase it.

$17.99

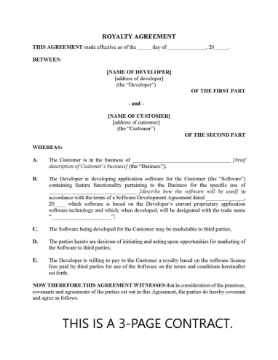

Royalty Agreement for Software Licensing | Canada

Do you develop software for customers that could be licensed to third parties with similar businesses? Set up a licensing and royalty arrangement with this Royalty Agreement contract for Canadian software developers.

- The agreement is between the developer and a client who has hired the developer to create a software package specifically for its business purposes.

- The parties agree to work together to initiate marketing opportunities to license the software to third parties.

- The developer will pay a royalty to the customer for each software license it grants to an end user.

- Royalties will be calculated and paid annually based on the total amount of end-user license fees paid during the preceding calendar year.

- Both parties will use best efforts to promote and market the software to potential end users.

- The Agreement is governed by Canadian laws and can be used in any province or territory of Canada except Quebec.

- This Royalty Agreement template is available as a downloadable MS Word document which can be easily modified to fit your unique needs.

$12.49 $11.99

- 1

- 2