Products tagged with 'promissory note form'

Sort by

Display per page

Purchase Agreement for Shares and Promissory Note | Canada

Sell your shares in a Canadian company and transfer a shareholder loan to the purchaser with this Purchase Agreement for Shares and Promissory Note.

- The vendor represents to the buyer that it owns the shares and has the legal right and authority to transfer them.

- Upon payment of the cash to close, the vendor will transfer title to the shares over to the purchaser.

- The vendor also transfers a promissory note from the corporation for a shareholder loan owing to the vendor.

- The vendor relinquishes any further interest or right to repayment under the promissory note.

- Available in MS Word format.

- Intended to be used only in Canada.

$6.29

Alberta Collateral Mortgage and Promissory Note

Use this template Collateral Mortgage and Promissory Note for credit facilities in Alberta.

- A collateral mortgage can be used to secure a line of credit, a revolving loan, or other credit facility where the balance owing changes from time to time.

- The borrower is responsible for insuring, repairing, and maintaining the mortgaged property and for paying all taxes and assessments.

- The lender is appointed as the borrower's attorney (agent) for the purpose of recovering any insurance proceeds with respect to the property.

- The lender has power of attorney to sell, lease or encumber the property if the borrower defaults in its obligations.

- The full balance owing is immediately payable if the borrower sells the property or, if the borrower is a corporation, there is a change in control.

- This is a downloadable legal template in MS Word format.

- Intended for use in the Province of Alberta, Canada.

$29.99

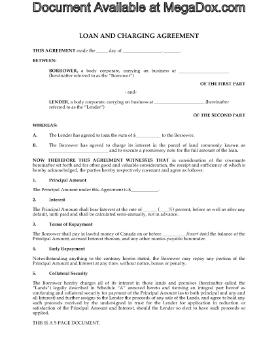

Loan and Charging Agreement | Canada

Canadian lenders can use this downloadable Loan and Charging Agreement to prepare loan documents for a borrower.

- The template includes both the Loan Agreement and a promissory note for the principal amount of the loan plus interest.

- The borrower agrees to register an encumbrance against title to real estate owned by the borrower, as collateral security for the loan.

- If the borrower defaults in repaying the loan, title to the property will be transferred to the lender.

- Available in MS Word format.

- Intended to be used only in Canada.

$17.99

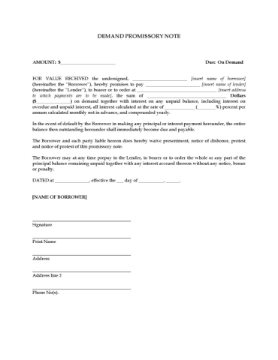

Demand Promissory Note

If you are loaning money to someone, make sure you get paid back by having them sign this Demand Promissory Note.

- A demand promissory note is a note that must be repaid in full (including all interest) when the lender demands repayment.

- Interest on the principal amount accrues at a fixed rate and is calculated monthly.

- The principal can be prepaid by the borrower at any time without a penalty or premium being charged.

- The promissory note is a legal contract. When the borrower signs it, they are making a promise to repay the loan. If they don't pay it on time, you can take legal action.

- This is a generic legal form which is not country-specific.

- Download a free copy of the Demand Promissory Note and keep it handy for the next time you make a loan to anyone.

$0.00

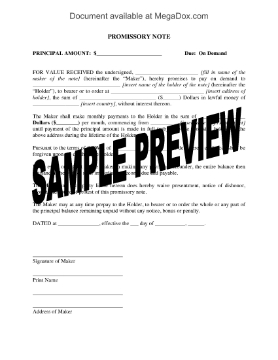

Promissory Note (Debt Forgiven on Death of Lender)

If you are loaning money to a family member or close friend, you can secure the loan with this Promissory Note to be Forgiven on Death.

- This promissory note template provides that the balance outstanding on the loan will be forgiven when the lender dies.

- The borrower agrees to make monthly payments against the loan secured by the promissory note.

- The borrower can prepay the full amount at any time without paying a prepayment penalty.

- If the lender dies before the loan is completely repaid, any balance remaining unpaid at that time is forgiven.

- This Promissory Note to be Forgiven on Death of Lender form is a downloadable MS Word file which can be used anywhere.

$2.29

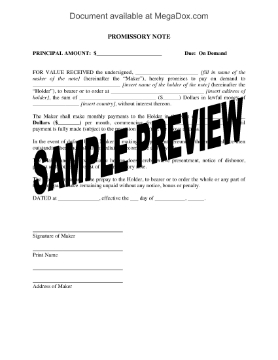

Promissory Note (Regular Payments, No Interest)

This promissory note template is made by a borrower to secure an interest-free loan to be repaid by regular payments.

- The Promissory Note allows the borrower to repay the loan in monthly, weekly, or bi-weekly payments.

- No interest will be charged on the outstanding loan balance. The borrower will only be repaying the principal amount.

- This is a generic legal form which can be used anywhere.

- You can download the form immediately after purchasing it.

$2.29