Customers who bought this item also bought

Corporate Resolutions Repurchasing Shares for Cancellation

Prepare corporate resolutions to authorize a corporation to repurchase and cancel shares from a shareholder with this easy-to-use template.

- The shareholders consent to the repurchase and the directors authorize the transaction and set the share purchase price.

- The file includes a Certificate of Corporate Officer certifying that the corporation is financially able to repurchase the shares and pay its debts.

- The Corporate Resolutions Repurchasing Shares for Cancellation do not contain specific references to federal or state / provincial laws and could be used in many jurisdictions.

- The form is available as a MS Word download and easy to fill in or customize where required.

$6.29

Share Purchase and Loan Agreement | Canada

Acquire all the shares of a Canadian corporation with this Share Purchase and Loan Agreement.

- The purchaser agrees to purchase the shares and to loan the corporation enough funds to pay out existing loans to shareholders or other related parties.

- The purchaser and the vendor mutually indemnify each other against any claims arising due to any breach or misrepresentation.

- The vendor also indemnifies the purchaser against claims arising from the business and operations of the company prior to the closing of the transaction.

- The corporation warrants that there are no outstanding options, agreements or warrants to purchase its shares.

- This legal form template is available in MS Word format and is fully editable to meet your business needs.

- Governed by Canadian laws and intended for use only in Canada.

$29.99

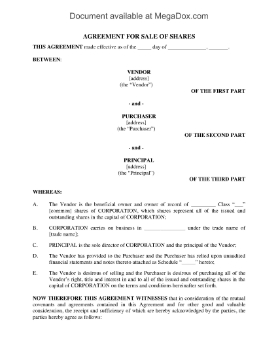

Share Purchase Agreement with Vendor Take-Back Provisions | Canada

Prepare a Share Purchase Agreement with Vendor Take-Back Provisions with this template form for Canadian corporations.

- A portion of the share purchase price will be paid by the purchaser to the vendor over time, secured by a promissory note.

- If the purchaser defaults, the promissory note will become due and the vendor may take back ownership of the shares (this is called vendor take-back).

- If the purchaser postpones consecutive payment, the second postponement will incur a late payment fee.

- The vendor's accountants will prepare closing financial statements.

- The purchaser must provide personal and corporate guarantees.

- The corporation's income taxes will be allocated between the parties in accordance with the closing.

- This Share Purchase Agreement with Vendor Take-Back Provisions is available as a fully editable MS Word document.

- This is a Canadian legal document.

$29.99

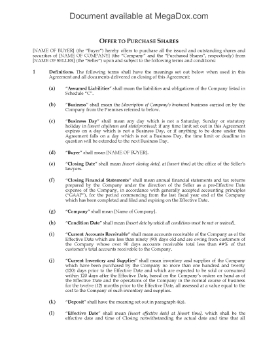

Ontario Offer to Purchase Business Assets and Shares

Have you decided to buy an established business in Ontario? You can write up your offer to purchase the assets and shares of the company with this downloadable template.

- The offer is for the assets (excluding cash on hand and receivables) and the shares, but not the debt obligations of the company.

- Upon being accepted, the offer automatically becomes a legally binding purchase and sale agreement.

- The buyer will not assume any of the business liabilities except for the premises lease, maintenance contracts and salaries of employees that will be kept on after the closing.

- The parties agree to review and make any adjustments to the purchase price six months after closing.

- It is the seller's responsibility to terminate employees, prepare financial statements, file the final income tax return and pay corporate taxes as of the closing date.

- This is a downloadable fully editable template in MS Word format.

- Intended for use in the Province of Ontario, Canada.

$29.99

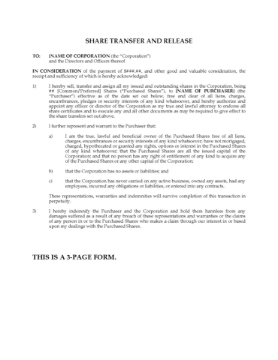

Ontario Share Transfer and Release Forms

Prepare share transfers for an Ontario corporation with this Share Transfer and Release Forms package.

- The package contains the following items:

- Share Transfer and Indemnity Form, to transfer all of the shares of a corporation to a purchaser. The seller indemnifies the buyer and releases the corporation from any claims the seller may have with respect to the seller's involvement with the corporation.

- A simpler form of Share Transfer, to transfer all or part of a shareholder's shares to another party.

- A resolution of the directors of the corporation approving the share transfer.

- Available in MS Word format.

- Intended to be used only in the Province of Ontario, Canada.

$9.99