Customers who bought this item also bought

Merchant Cash Advance Letter to Credit Card Processor | USA

Notify a credit card transaction processor of a cash advance made to a merchant against its credit card receivables with this template Merchant Cash Advance Letter to Credit Card Processor.

- The letter should also be sent to the credit card issuer.

- The letter sets out the details of the merchant's agreement with the cash advance lender, and instructs the processor to pay a percentage of the credit card receipts to the lender until further written notice is given by the lender and the merchant. All amounts in excess of that percentage will continue to be paid to the merchant.

- The lender's rights under the merchant cash advance agreement are subject to the rights of the credit card processor and the bank.

- The lender and the merchant indemnify and hold harmless the bank and the credit card processor against any claims, losses or liability whatsoever arising from any action taken by the bank or the processor under the terms of the letter.

- This USA Merchant Cash Advance Letter to Credit Card Processor is a downloadable and fully editable Microsoft Word template.

$12.49

Merchant Cash Advance Agreement | USA

Make a cash advance to a US merchant against its future credit card receivables with this template USA Merchant Cash Advance Agreement.

- The merchant sells to the cash advance company all of its right in a percentage of its future credit card sales for an immediate cash injection, until a specified amount has been paid.

- The purchase and sale of the credit card receivables constitutes a sale of accounts under the Uniform Commercial Code, which vests full ownership in the cash advance company. The merchant has no right to repurchase or resell the receivables.

- The merchant will authorize the credit card company to pay the credit card sales directly to the cash advance company until the specified amount is paid.

- The merchant also grants the cash advance company a security interest in its accounts, inventory, assets, property, all future receivables, and the proceeds thereof.

- The agreement also contains a Personal Guaranty form, to be given by the principal(s) of the merchant, who agree(s) to assume all of the merchant's obligations under the agreement.

- This template is a downloadable and fully editable Microsoft Word document.

- Intended to be used only in the United States.

$29.99

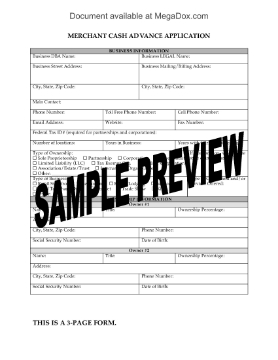

Merchant Cash Advance Application Form | USA

Does your firm make cash advances to merchants against future credit card receivables? Sign up clients with this Merchant Cash Advance Application Form for the USA.

- The information required in the 3-page application form includes:

- information about the merchant's business,

- information about the owners of the business,

- financial and sales information,

- disclosure about liens, lawsuits or judgments against the business.

- This is a downloadable and fully editable Microsoft Word document. Buy the form once, use it as often as required.

- Intended for use in the United States only.

$4.99