Customers who bought this item also bought

Ontario Section 85 Share Rollover Agreement for Common Shares

Exchange shares for shares with this Ontario Section 85 Share Rollover Agreement for Common Shares.

- The vendor shareholder sells the subject shares to a holding company in exchange for common shares in the capital stock of the holding company, pursuant to Section 85 of the Income Tax Act (Canada).

- The parties agree to file joint elections under Section 85(1) under the ITA and as required under the Ontario Corporations Tax Act.

- The file includes a Section 116 Affidavit to be sworn by a corporate officer of the vendor, if applicable.

- This Section 85 Share Rollover Agreement for Common Shares is intended for use only in the Province of Ontario, Canada.

- Available in MS Word format, fully editable to fit your specific circumstances.

$17.99

Setoff and Cancellation Agreement | Canada

Prepare an Agreement for Set-off and Cancellation of Shares between two affiliated Canadian companies with this downloadable template.

- One of the companies (selling company) sells shares to the other (purchasing company), as part of a rollover transaction.

- The purchase price of the shares is set off against the redemption of shares of stock held by the purchasing company in the capital of the selling company.

- The purchaser pays for the shares by way of a promissory note. The vendor redeems the shares and pays the redemption price also by way of promissory note.

- Both promissory notes are for the same amount and set each other off.

- This legal template is available in MS Word format, and is fully editable to fit your specific circumstances.

- This is a Canadian legal document pursuant to the Income Tax Act (Canada).

$6.29

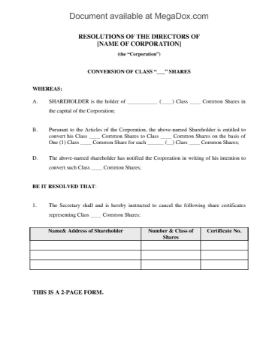

Directors Resolution Converting Common Shares

Download this template Directors' Resolution form which authorizes a corporation to convert a shareholder's common shares into another class.

- The Board of Directors of the corporation pass the resolution to convert common shares held by a shareholder into shares of another class, on a one-for-one basis.

- The resolution presupposes that the corporation's articles allow for such a conversion.

- This is a generic template which does not refer to the laws of a specific country and can be used in either the USA or Canada.

- The Directors Resolution Converting Common Shares is downloadable in MS Word format and is fully editable.

$6.29 $4.99