Product tags

Related products

Alberta GST Exemption Certificate for Sale of Real Property

If you are selling real estate property in Alberta, you will need to provide the purchaser with this GST Exemption Certificate for Sale of Real Property.

The seller of the property certifies that the property is a residential property being resold within the meaning of the Excise Tax Act, and that the seller has not claimed an input tax credit.

This Alberta GST Exemption Certificate for Sale of Real Property is a free form provided in MS Word format.

The seller of the property certifies that the property is a residential property being resold within the meaning of the Excise Tax Act, and that the seller has not claimed an input tax credit.

This Alberta GST Exemption Certificate for Sale of Real Property is a free form provided in MS Word format.

$0.00

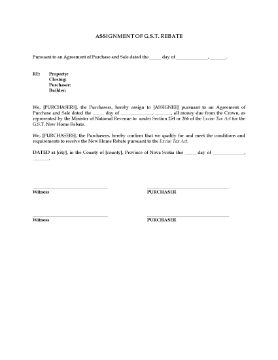

Assignment of GST New Home Rebate | Canada

Assign a GST rebate on a new home purchase to the builder with this free Assignment Form for Canadian real estate properties.

- The assignment is made under Section 254 or Section 266 of the Excise Tax Act.

- This form is used when a purchaser of a new home assigns their GST rebate to the builder.

- Downloadable and easy to use.

- Available in MS Word format.

- Only for use in Canada.

$0.00

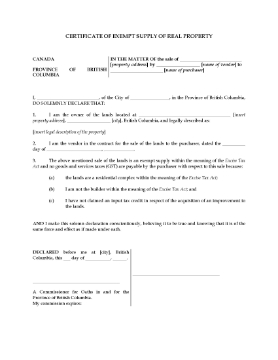

Brtitish Columbia GST Exemption Certificate for Sale of Real Property

The GST Exemption Certificate must be provided by the seller to the purchaser of a residential real estate property in British Columbia, to comply with the Excise Tax Act.

The seller certifies that the real estate in question is a residential property being resold within the meaning of the Excise Tax Act, and that the seller has not claimed an input tax credit. This form is for resales only and cannot be used for new construction.

This British Columbia GST Exemption Certificate for Sale of Real Property is a free form provided in MS Word format.

The seller certifies that the real estate in question is a residential property being resold within the meaning of the Excise Tax Act, and that the seller has not claimed an input tax credit. This form is for resales only and cannot be used for new construction.

This British Columbia GST Exemption Certificate for Sale of Real Property is a free form provided in MS Word format.

$0.00

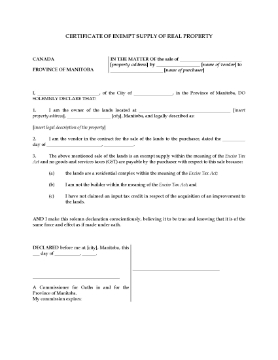

Manitoba GST Exemption Certificate for Sale of Real Property

When you resell a residential property in Manitoba, you must complete this GST Exemption Certificate and provide it to the purchaser.

- The seller certifies that the real estate in question is a residential property being resold within the meaning of the Excise Tax Act and that the seller has not claimed an input tax credit.

- Resales of residential property in Canada are exempt from GST. This form is only for resold property and cannot be used for new construction.

$0.00

New Brunswick GST Certificate of Exempt Supply

When reselling real estate property in New Brunswick, provide the purchaser with this GST Certificate of Exempt Supply.

- The seller of the property certifies that:

- the property is a residential property being resold within the meaning of the Excise Tax Act,

- the seller is not the builder, and

- the seller has not claimed an input tax credit.

- Available in MS Word format.

- Intended to be used only in the Province of New Brunswick, Canada.

$0.00

Newfoundland GST Certificate of Exempt Supply

When reselling real estate property in NL, provide the purchaser with this GST Certificate of Exempt Supply.

- The seller of the property certifies that:

- the property is a residential property being resold within the meaning of the Excise Tax Act,

- the seller is not the builder, and

- the seller has not claimed an input tax credit.

- Available in MS Word format.

- Intended to be used only in the Province of Newfoundland and Labrador, Canada.

$0.00

Nova Scotia GST Exemption Certificate for Sale of Real Property

If you are selling real estate property in Nova Scotia, you will need to provide the purchaser with this GST Exemption Certificate for Sale of Real Property.

The seller of the property certifies that the property is a residential property being resold within the meaning of the Excise Tax Act, and that the seller has not claimed an input tax credit.

This Nova Scotia GST Exemption Certificate for Sale of Real Property is a free form provided in MS Word format.

The seller of the property certifies that the property is a residential property being resold within the meaning of the Excise Tax Act, and that the seller has not claimed an input tax credit.

This Nova Scotia GST Exemption Certificate for Sale of Real Property is a free form provided in MS Word format.

$0.00

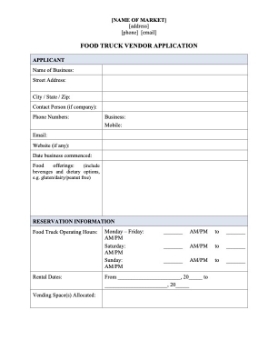

Food Truck Vendor Application for Market

Prepare an application for a food truck vendor to operate at a regularly scheduled market with this Application Form and Terms of Use template.

- This document outlines the application process, requirements, and terms for food truck vendors seeking to operate at a market (such as a farmer's market). It includes reservation specifics, fees and charges, required permits, insurance, and vendor responsibilities.

- Rental fees can be a flat rate or a percentage of sales, and additional charges like electrical hook-up fees may apply.

- Reservations can be canceled due to vendor no-show, inclement weather, or other circumstances, with specific conditions for refunds and discounts.

- Vendors must obtain and provide proof of required permits and comply with all relevant laws and regulations.

- Vendors must maintain commercial general liability and worker's compensation insurance, naming the market as an additional insured.

- Vendor responsibilities include setup, equipment provision, waste management, water supply, payment processing, electrical arrangements, and maintaining professional conduct.

$17.99

Nunavut GST Exemption Certificate for Sale of Real Property

When reselling real estate property in Nunavut, provide the purchaser with this GST Certificate of Exempt Supply.

- The seller of the property certifies that:

- the property is a residential property being resold within the meaning of the Excise Tax Act,

- the seller is not the builder, and

- the seller has not claimed an input tax credit.

- Available in MS Word format.

- Intended to be used only in the Territory of Nunavut, Canada.

$0.00

Northwest Territories GST Certificate of Exempt Supply

When reselling real estate property in NWT, provide the purchaser with this GST Certificate of Exempt Supply.

- The seller of the property certifies that:

- the property is a residential property being resold within the meaning of the Excise Tax Act,

- the seller is not the builder, and

- the seller has not claimed an input tax credit.

- Available in MS Word format.

- Intended to be used only in the Northwest Territories, Canada.

$0.00

PEI GST Certificate of Exempt Supply of Real Property

When reselling real estate property in Prince Edward Island, provide the purchaser with this GST Certificate of Exempt Supply.

- The seller of the property certifies that:

- the property is a residential property being resold within the meaning of the Excise Tax Act,

- the seller is not the builder, and

- the seller has not claimed an input tax credit.

- Available in MS Word format.

- Intended to be used only in the Province of Prince Edward Island, Canada.

$0.00

Purchaser's GST Warranty and Indemnity | Canada

Prepare a GST Warranty and Indemnity for the purchase of real estate or a bulk sale of goods in Canada with this downloadable template.

- The Warranty and Indemnity is supplied by the purchaser to the vendor as part of the documentation required for the transaction.

- The purchaser warrants that it is a GST registrant and indemnifies the vendor against any liability incurred by the vendor with respect to the collection and remittance of Goods and Services Tax in connection with the purchase and sale transaction.

- The form is a downloadable MS Word document.

- For use only in Canada.

$2.29

Saskatchewan GST Exemption Certificate for Sale of Real Property

When you resell a residential property in Saskatchewan, you must complete this GST Exemption Certificate and provide it to the purchaser.

- The seller certifies that the real estate in question is a residential property being resold within the meaning of the Excise Tax Act and that the seller has not claimed an input tax credit.

- This form is for resales only and cannot be used for new construction.

$0.00

Yukon GST Exemption Certificate for Sale of Real Property

If you are selling real estate property in Yukon, you will need to provide the purchaser with this GST Exemption Certificate for Sale of Real Property.

The seller of the property certifies that the property is a residential property being resold within the meaning of the Excise Tax Act, and that the seller has not claimed an input tax credit.

This Yukon GST Exemption Certificate for Sale of Real Property is a free form provided in MS Word format.

The seller of the property certifies that the property is a residential property being resold within the meaning of the Excise Tax Act, and that the seller has not claimed an input tax credit.

This Yukon GST Exemption Certificate for Sale of Real Property is a free form provided in MS Word format.

$0.00