Customers who bought this item also bought

Will Clause re Insurance Proceeds | Canada

Add this clause to a Will made in Canada to direct how life insurance proceeds are to be distributed.

- The testator (person making the Will) declares that the proceeds of life insurance policies, except for RRSPs, are to form part of the estate and be paid to the beneficiaries as such.

- This clause is intended to be considered a declaration within the meaning of the Insurance Act (Canada).

- This Canada Will Clause re Insurance Proceeds is a downloadable form in MS Word format.

$2.29 $1.99

Ontario Continuing Power of Attorney for Property

Who will look after your financial affairs if you are unable to do so for any reason? Appoint someone you trust to handle those matters with this Continuing Power of Attorney for Property.

- The Power of Attorney is made in accordance with the Ontario Substitute Decisions Act, 1992.

- This document allows you to appoint someone you trust to make decisions on your behalf for issues relating to your property.

- The Power of Attorney does NOT grant your agent authority to make health care or personal care decisions for you.

- You can impose conditions and restrictions on your agent's powers as you see fit.

- You can choose if the power of attorney will come into effect only if you become mentally incapable or if you wish to have it become effective immediately.

- The form includes instructions for completing it, and information you need to help guide you through the process.

- This Continuing Power of Attorney for Property is only for use in the Province of Ontario, Canada.

- The template is provided in MS Word format, and is easy to use and understand.

$9.99

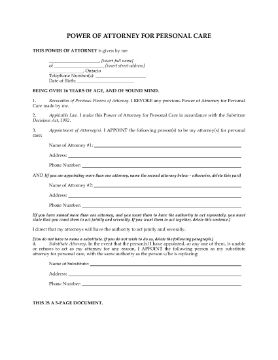

Ontario Power of Attorney for Personal Care

Appoint an attorney to make personal care and medical decisions for you with this Ontario Power of Attorney for Personal Care.

- The Power of Attorney is in accordance with the Ontario Substitute Decisions Act, 1992.

- This document allows you to appoint someone you trust to make personal care decisions on your behalf in the event that you can no longer do so. Personal care decisions include such things as health care, housing, clothing, hygiene, safety, and diet.

- This Power of Attorney does NOT grant your attorney authority to manage your finances or property.

- The form includes clear instructions on how to complete and execute the Power of Attorney form to ensure that it is valid.

- The form is for use only in the Province of Ontario, Canada.

- No need to purchase multiple forms. You and your spouse / partner can both make a Power of Attorney for Personal Care using this template.

$9.99

Ontario Codicil to Will

Make additions to your Last Will & Testament with this template Codicil to Will form for the Province of Ontario.

- The Codicil must be executed and witnessed in the same manner as the original Will.

- If you are making substantial changes to your Will, you should make a new Will instead of doing a codicil to the old one.

- The document also includes the required form of Affidavit of Execution of Will or Codicil (Form 74.8).

- This form is provided in MS Word format and is totally editable to meet your needs.

- Intended to be used only in the Province of Ontario, Canada.

$2.49

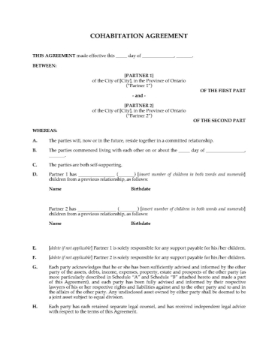

Ontario Cohabitation Agreement

Cohabiting couples in Ontario can establish their rights and obligations and the ownership of their separate and joint property in a Cohabitation Agreement, under section 53 of the Family Law Act.

- The Agreement allows you and your partner to specify which assets each of you owned prior to the relationship, and which are jointly owned by both of you.

- You can also set out how your joint assets will be distributed if you decide to end the relationship.

- You can also agree upon how household expenses will be split, and who is responsible for other debts. For instance, if your partner owes money on a student loan incurred before you met, he/she may be solely responsible for paying it off.

- If the two of you decide to get married, the Cohabitation Agreement becomes a prenuptial (pre-marriage) agreement.

- You will both need to get independent legal advice from a lawyer before you sign the Agreement. A Certificate of Independent Legal Advice is included for each of you, which the lawyer will sign after seeing you.

Ontario law treats married and cohabiting couples differently with respect to property rights. Make sure yours are protected - get this Ontario Cohabitation Agreement.

$29.99