Product tags

- estate executor form (19)

- ,

- probate form (4)

- ,

- california estate administration (2)

Related products

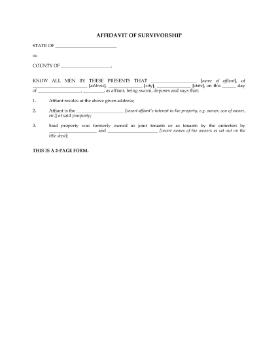

Affidavit of Survivorship | USA

Use this USA Affidavit of Survivorship to transfer title of real property to a surviving joint tenant after the other joint tenant has died.

- The affidavit must be sworn and filed in the appropriate County office to transfer the title into the name of the surviving owner.

- The Affidavit sets out the details of the deceased's passing and the value of the estate.

- The surviving joint tenant also declares whether or not there is any federal or state inheritance tax liability on the property.

- You must provide a copy of the death certificate when you register the affidavit.

- This legal form can be used in any U.S. state which does not have a prescribed form.

- There's no need to place the property in probate. Just sign this USA Survivorship Affidavit in front of a notary, record it with the land records office, and the title deed will be reissued in the name of the surviving joint tenant.

$2.29

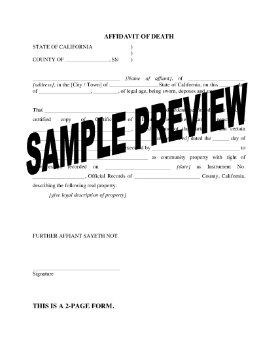

California Affidavit of Death - Community Property

Has your spouse recently passed away? If the two of you held title to real estate as community property in California, you need to file this California Affidavit of Death form.

- First you will need to sign the Affidavit in front of a Notary.

- Then you must file it with the County Clerk in order to have title to the property transferred solely into your name.

- You'll need to attach a copy of the Certificate of Death to the form.

- Buy and download the form, fill in your details, print it, and take it to a notary for signing.

- Available in MS Word format.

- Intended to be used only in the State of California.

$5.99

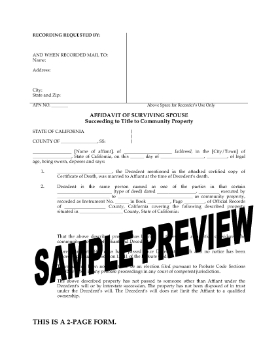

California Affidavit of Surviving Spouse

File this California Affidavit of Surviving Spouse if you and your spouse owned property which was NOT held as community property before he or she passed away.

- The Affidavit is made under California Probate Code section 13540.

- The surviving spouse states that he/she and the deceased spouse at all times considered the property to be community property.

- The Affidavit must be filed 40 days after the decedent's death to protect the interest of your successors in title and that of other parties with an interest in the property (such as title insurers).

- The affiant must also attest that no election to probate the deceased's interest in the property has been or will be filed.

- Available in MS Word format.

- Intended to be used only in the State of California.

$6.29