Customers who bought this item also bought

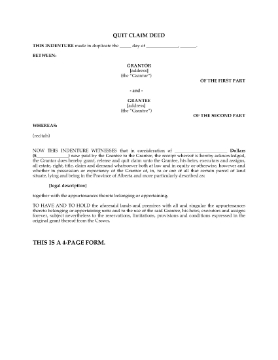

Alberta Quit Claim Deed

File a Quit Claim Deed on title to land situated in Alberta with this downloadable easy-to-use template.

- The party transferring the land (the Grantor) transfers its entire interest in the land to the recipient (the Grantee).

- The Grantor agrees to quit claim (give up any claim) against the land.

- The document includes the affidavits required to register the deed at the Alberta Land Titles Office.

- Available in MS Word format.

- Intended to be used only in the Province of Alberta, Canada.

$6.99

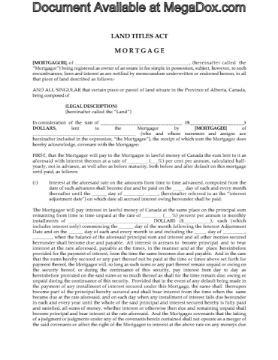

Alberta Vendor Take-Back Mortgage

Have you found a buyer for your property who can't qualify for a mortgage? Lend them the amount they need with this Vendor Take-Back Mortgage for Alberta real estate properties.

- A vendor take-back mortgage (also known as a 'purchase money mortgage') is often used for real estate transactions between family members.

- The seller (vendor) agrees to carry all or part of the purchase price for the real estate and the buyer will make regular payments to the seller, just as with a regular mortgage.

- The seller has the right to take back the property if the buyer fails to make the payments or meet its other obligations under the mortgage.

- A Vendor Take-back Mortgage is an alternative method of financing a real estate purchase that allows buyers who cannot get a conventional mortgage a chance to own a home.

- This legal document is intended solely for use in the Province of Alberta, Canada.

$17.99

General Release of a Company by Another Company

Protect your company against future claims or legal actions with this downloadable General Release form.

- The company giving the release does so in its own right and on behalf of its directors, officers, employees, affiliates and agents.

- The releasing party releases any claims it may have now or in future against the party being released.

- In exchange for the release, the releasing party will paid compensation as a settlement amount.

- This is a generic legal form which can be used almost anywhere.

- Available in MS Word format.

$2.49

General Release of an Individual by a Company

This General Release form allows a company or corporation to release its rights to file a legal claim against an individual person, as part of a settlement arrangement.

- The company relinquishes its right to bring suit for any claims it may have now or in future against the person.

- The release is given on behalf of the directors, officers, employees, affiliates, subsidiaries, agents and representatives of the company.

- The release is being given in exchange for a cash payment or other settlement.

- You can use this generic legal template anywhere.

- To obtain the General Release form, add it to your shopping cart and proceed through the secure checkout. When the transaction is done you can download your copy of the form.

- Available in MS Word format.

$2.99