CANADA

Set up a trust to protect your personal and business assets with a customizable Trust Agreement.

- Province-specific forms as well as documents that can be used anywhere within Canada.

- These legal documents were prepared pursuant to Canadian tax laws and should only be used within their intended jurisdiction.

- All documents can be easily edited to fit your unique needs.

Sort by

Display per page

Ontario Forms to Establish Family Trust

Set up a family trust as part of your tax planning strategy with this package of forms for Ontario.

- The package contains the following forms:

- Irrevocable Trust Agreement,

- Consent of Proposed Trustee, which must be signed by each of the designated trustees,

- Resolutions of the Trustees establishing the trust,

- Receipt for the initial trust property,

- Promissory Note,

- Register of Trustees.

- The trust will be an irrevocable discretionary trust.

- The division date will be the first to occur of (i) the date of the principal or (ii) the day before the 21st anniversary of the execution date of the trust agreement.

- The agreement provides for the incapacity of a trustee or a beneficiary.

- The settlor will derive no income or capital or other benefit from the trust.

- The settlor cannot act as a trustee.

- The settlor cannot revoke the trust.

- For the purposes of the Income Tax Act, the trust can only be resident in Canada.

- The trustees will be indemnified and held harmless against claims, losses and damages in connection with their acting as trustees. The indemnities and protections afforded to any trustee under the agreement will continue to run even if the trustee ceases to hold the position of trustee.

- No distributions of capital or income shall be made at any time that there are less than two trustees in office.

- Available in MS Word format, fully editable.

- Intended to be used only in the Province of Ontario, Canada.

$59.99

Revocable Trust Deed | Canada

Keep your estate assets out of probate by setting up a living trust under this Revocable Trust Deed form for Canadian residents.

- The trust can be used to hold many kinds of assets including cash, real property, personal property, stocks and bonds.

- The trustees can use cash held in the trust fund to pay taxes, mortgage payments, maintenance and other costs associated with any real estate properties that form part of the trust assets.

- The beneficiaries can use and enjoy any real property held in trust until the division date (i.e. the date on which the trust assets are distributed and the trust is wound up).

- The trustees are authorized to divide and distribute any share of the trust in order to ensure that taxable capital gains required to be paid by the trust are kept to a minimum.

- The trustees are given specific instructions for handling payments to be made to minor beneficiaries or beneficiaries who are incapacitated.

- Trustees must disclose any potential conflict of interest and refrain from voting on any decisions which may put them in a position of conflict.

- The trustees are indemnified and held harmless against claims and losses arising from their acting in good faith as a trustee.

- This is a revocable trust which can be revoked by the trustees in their discretion.

- The package includes:

- a Consent of Trustee form which should be signed by each trustee and successor trustee at the time they accept the appointment,

- a Resolution of the Trustees to establish the trust,

- a Trustees Register.

- Available in MS Word format.

- The Trust Deed template can be used in most provinces and territories of Canada. Some jurisdictions, such as Quebec, may require a French translation.

$49.99

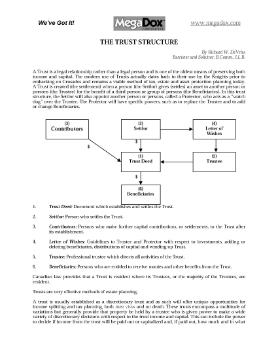

The Trust Structure in Canada

Learn about the trust structure in Canada in this free expert guide.

The guide provides an overview of the structure of a trust, the advantages of a tax structure as a vehicle for income splitting and tax planning for residents of Canada, and the characteristics of specific types of discretionary trusts, such as:

- spousal (family) trusts;

- trusts for minor children;

- trusts for adult children;

- trusts for long-term maintenance of a handicapped child;

- spendthrift trusts.

The Trust Structure in Canada is information for Canadian residents and is copyright by the author.

$0.00

Trust Declaration by Nominee Trustee | Canada

Prepare a Trust Declaration by a nominee trustee who is the registered owner of shares with this template form for Canadian corporations.

- The nominee trustee declares that the shares are held in trust for a beneficiary.

- The trustee will exercise the voting rights of the shares as the beneficiary directs.

- The trustee will deal with the shares as nominee only and in accordance with the beneficiary's instructions.

- Available in MS Word format and fully editable.

- Intended to be used only in Canada.

$6.49 $4.99

Family Trust Final Distribution and Windup Package | Canada

Prepare the resolutions and documents to make a final distribution of trust assets to the beneficiaries and wind up a family trust with this package of forms for Canada.

- The package contains the following forms:

- Letter from the responsible law firm to the trustees;

- Resolution of the trustees distributing all of the trust property and assets to the beneficiaries;

- Receipt for trust property, to be signed by each beneficiary upon receipt of their share of the trust property;

- Final reporting letter from the law firm to the trustees enclosing the signed documents;

- Resolution of the corporation in which the family trust holds shares, authorizing the share transfers from the family trust to the beneficiaries;

- Resolution of the trustees paying out the balance of a loan and cancelling a promissory note securing the loan.

- The forms are provided in one package, as a downloadable and customizable Microsoft Word file.

- Governed by Canadian tax laws and intended to be used only within Canada.

$21.99

British Columbia Land Trust Agreement

Set up a land trust to preserve certain lands for conservation, agricultural or recreational purposes with this Land Trust Agreement for British Columbia.

- The trustee will have the powers necessary to lease, sell, mortgage or otherwise deal with the land but shall only exercise these powers at the direction of the beneficiaries.

- The trustee is required to maintain a current list of all beneficiaries and to furnish the beneficiaries with an annual statement of Trust income and expenses.

- The trustee will have no personal liability for any obligation of the Trust.

- The agreement provides for the resignation and replacement of the Trustee.

- The beneficiaries are individually responsible for reporting their respective share of the profits and earnings from the Trust.

- The trustee is instructed to terminate the trust and distribute the Trust property prior to the legally permitted time period for the existence of the Trust under applicable laws.

$19.99

Forms to Replace Trustee | Canada

Appoint a replacement trustee for a trust with this package of forms for Canada.

- The package contains the following:

- Appointment and Replacement of Trustee form.

- Consent to Act as Trustee.

- Resignation of Departing Trustee.

- Trustee Resolutions to be signed by the original trustee(s), appointing the new trustee.

- This forms package is a downloadable digital product. All forms are contained in one file.

- Intended to be used only in Canada.

$12.49