Product tags

Related products

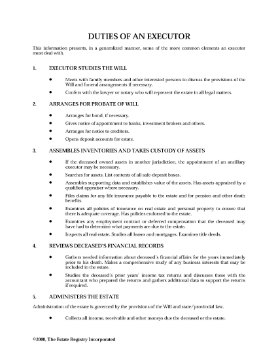

Duties of an Executor

Learn about the Duties of an Executor with this free downloadable summary of the responsibilities of the executor of an estate.

- The executor (sometimes called a personal representative) is responsible for such things as:

- reviewing the will,

- arranging probate,

- taking inventory of the assets,

- preparing the final tax return,

- distribution of the assets to the beneficiaries (heirs).

- 'Duties of an Executor' is a free downloadable PDF checklist and guide.

$0.00

Receipt and Release by Beneficiary of Estate

Estate executors, when you distribute property to the beneficiaries as set out in the Will of the deceased, have each of them sign this Receipt and Release form.

- The beneficiary acknowledges receipt of the estate property.

- The beneficiary releases the executor from any liability in connection with the beneficiary's interest in the estate.

- The beneficiary indemnifies the executor against any claims with respect to the distribution.

- This is a reusable form which you can use each time you make a distribution of estate assets to a beneficiary.

- The form can be used in any jurisdiction which does not have a statutory form.

$2.49

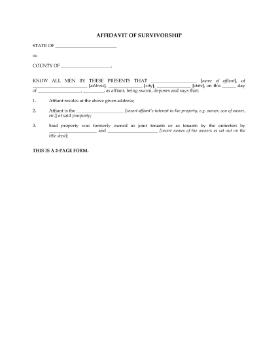

Affidavit of Survivorship | USA

Use this USA Affidavit of Survivorship to transfer title of real property to a surviving joint tenant after the other joint tenant has died.

- The affidavit must be sworn and filed in the appropriate County office to transfer the title into the name of the surviving owner.

- The Affidavit sets out the details of the deceased's passing and the value of the estate.

- The surviving joint tenant also declares whether or not there is any federal or state inheritance tax liability on the property.

- You must provide a copy of the death certificate when you register the affidavit.

- This legal form can be used in any U.S. state which does not have a prescribed form.

- There's no need to place the property in probate. Just sign this USA Survivorship Affidavit in front of a notary, record it with the land records office, and the title deed will be reissued in the name of the surviving joint tenant.

$2.29

Estate Planning Analysis Worksheet

Do you know what the short-term and long-term financial impact would be for the survivor if you or your spouse or partner were to die?

- Use this Estate Planning Analysis Worksheet to help you determine:

- the immediate cash requirements of the surviving spouse / partner,

- ongoing monthly income needs, and

- available assets.

- This Estate Planning Analysis Worksheet should be completed by both you and your spouse or partner.

- It is provided in MS Word format and can be easily downloaded and filled in, either on the computer or by hand.

$0.00